A PATCHWORK OF TRADFI AND DEFI PRIMITIVES CALLED PENDLE

This article is an independent educational overview of Pendle Finance’s “patchwork” design

INTRODUCTION

In the decentralized world, if you are a builder, there are two main ways to build your own product.

Adopt the existing idea from the early protocols and expand on them

Create a brand-new product that no one has ever made before

Usually, the first approach is more common among new protocols seeking to bring fresh solutions to DeFi. And Pendle is no exception.

Pendle can be seen as a colorful patchwork, stitched together from successful ideas of existing models.

In this article, we will take a closer look at how Pendle inherits these core concepts and evolves them into its own unique design.

KEY TAKEAWAYS

Section 1: Pendle yield stripping - A patch from Traditional Finance

Section 2: Pendle yield trading - A patch from Yield Protocol

Section 3: Pendle’s AMM - A patch from Notional

Section 4: Pendle governance (vePENDLE) - A patch from Curve Finance

Section 1: Yield Stripping - A patch from Traditional Finance

1/ Original Core Idea: Bond Stripping in Traditional Finance

In traditional finance, government or corporate bonds are two of the most common financial products, typically paying coupons or interest periodically, like twice a year. They are also called coupon bonds.

However, coupon bonds alone are not sufficient to satisfy all investor needs. Some investors prefer receiving a fixed, predetermined amount at maturity, while others simply want to diversify their portfolios to reduce concentration risk. Traditional coupon-paying structures cannot fully address these preferences.

To meet these demands, in 1982, the U.S. Treasury officially introduced strip bonds, known as STRIPS (Separate Trading of Registered Interest and Principal of Securities).

Strip bond, also known as a zero-coupon bond, is a bond that does not pay annual interest like a regular bond. Instead, investors buy it at a discount below its par value, and at maturity, they receive the full par value, and the difference is the profit or interest. Another fact is each STRIPS has its own identifier (or CUSIP number) and can be traded independently on the secondary market.

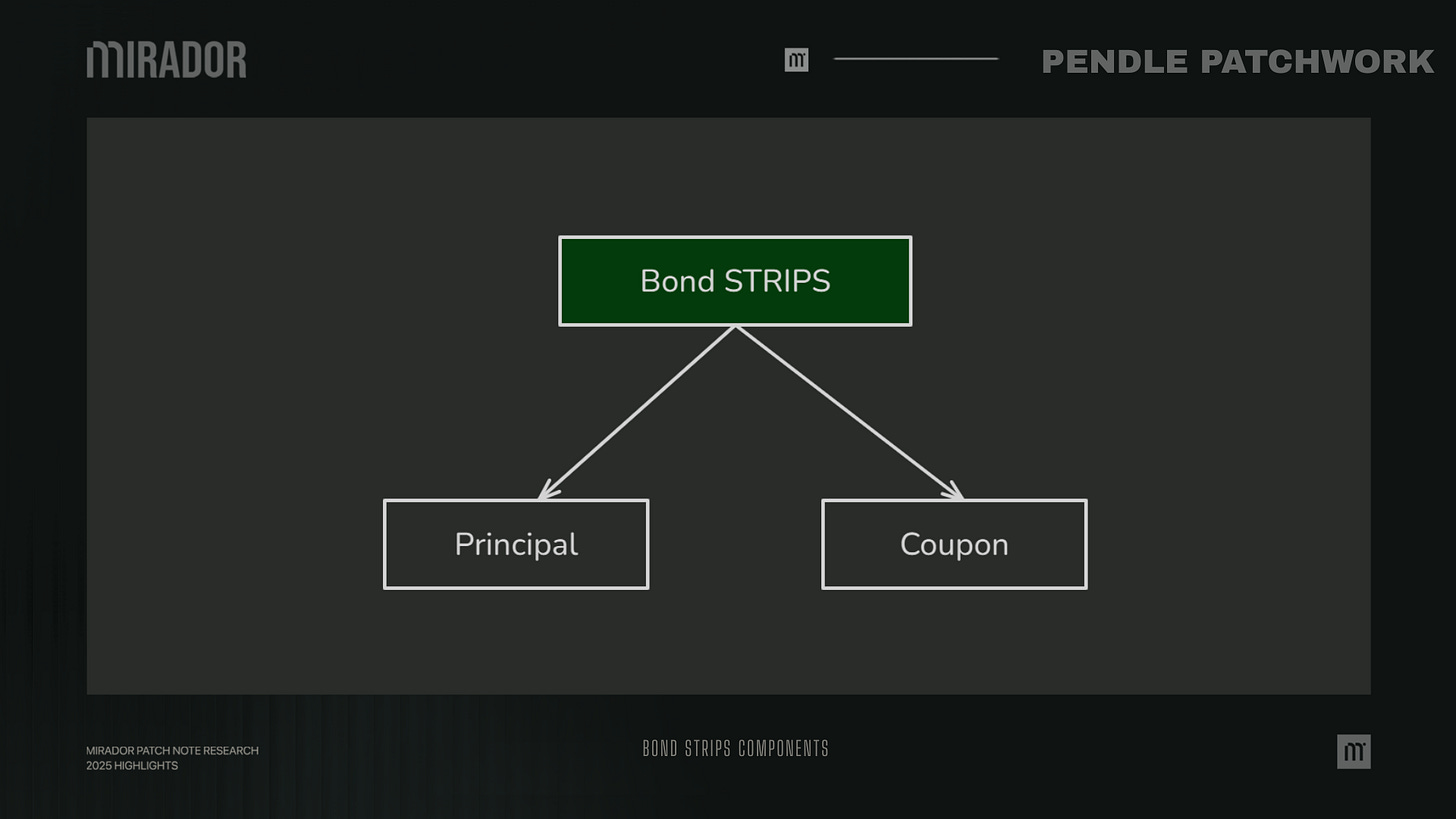

Normally, a coupon bond consists of two cash flows:

Periodic coupon (interest) payments

Principal repayment at maturity

However, these two components can be separated and sold as independent securities, creating two types of STRIPS:

Interest/Coupon STRIPS: each representing a single future coupon payment

Principal STRIPS: representing the final principal payment at maturity

Bond STRIPS components

Basically, STRIPS doesn’t generate new or higher yields than traditional bonds. Yet, such securities would widen the availability of bonds to smaller investors and aid their financial plan, especially interest STRIPS can be traded among investors, enhancing the liquidity.

Interest STRIPS is suitable for short-term investors. They can opt for stripped coupons with near-term maturities like 1-2 years instead of the long 10 years. And vice versa, principal STRIPS is a better option for long-term investors because the holding period is longer, the price is discounted more deeply, thereby the potential profit is greater (although the duration risk can be higher).

2/ TradFi Application In Pendle Finance

Pendle Finance is widely known to be inspired by the previously-mentioned traditional financial basis. Instead of stripping bonds, Pendle strips yield through a mechanism called “yield stripping”. The core of Pendle Finance is quite simple: any yield-bearing asset can be tokenized and separated into two distinct financial products, called:

PT (principal token): earn fixed yield - like principal STRIPS

YT (yield token): earn long yield - like coupon STRIPS

Yield Stripping - Source: Pendle docs

When you deposit your asset, like ETH into Pendle to earn yield, Pendle would tokenize this asset to become SY token (Standardized Yield token). In essence, SY token is the same as your underlying asset (in this case, SY-ETH). Then Pendle would strip 1 SY-ETH into 1 PT-ETH and 1 YT-ETH.

Similar to principal STRIPS, PT is bought with a discount from the start and can be redeemed 1:1 at maturity. YT can be bought to receive the yield of the underlying asset until the maturity date, and can be claimed before maturity.

Pendle allows users to trade PT/YT tokens alone. If you are risk-averse, you can buy PTs only to earn fixed yield. And if you are risk-taking, you can choose YTs to expect a higher profit.

That’s how Pendle brings the TradFi basis into the DeFi world. But not only inheriting, Pendle Finance also makes it grow by developing new products or trading strategies for users.

Section 2: Yield Trading - A patch from Yield Protocol

Pendle is now one of the leading DeFi yield protocols, with its TVL accounting for more than half of the yield market.

However, little do people know that Pendle is not the first protocol to enable the yield trading mechanism.

1/ Yield Protocol

Before Pendle, Yield Protocol was the pioneer lending protocol in yield trading. Launched in 2020, it introduced fixed-rate borrowing and lending with fixed maturities to DeFi.

However, Yield Protocol only supports fixed-rate yields, like zero-coupon bonds. To achieve this, Yield uses a class of ERC-20 tokens called fyTokens (fixed yield tokens) that can be redeemed for an underlying asset 1:1 after a predetermined maturity date.

At its core, fyTokens do not generate interest over time. Instead, they’re traded at a discount to their redemption value (like a zero-coupon bond explained above), yielding a profit at maturity when redeemed at its full face value. The interest rate comes from the gap between the discounted price and the asset’s value at maturity.

Example:

Suppose you buy 1 fyDAI with the maturity of one year for 0.95 DAI. Your yield is fixed because you have a fixed amount of investment (0.95 DAI) and a known amount of future return (1 DAI, a year from now). Buying fyDAI means lending, and the fixed future return will be paid by the borrowers who sell fyDAI.

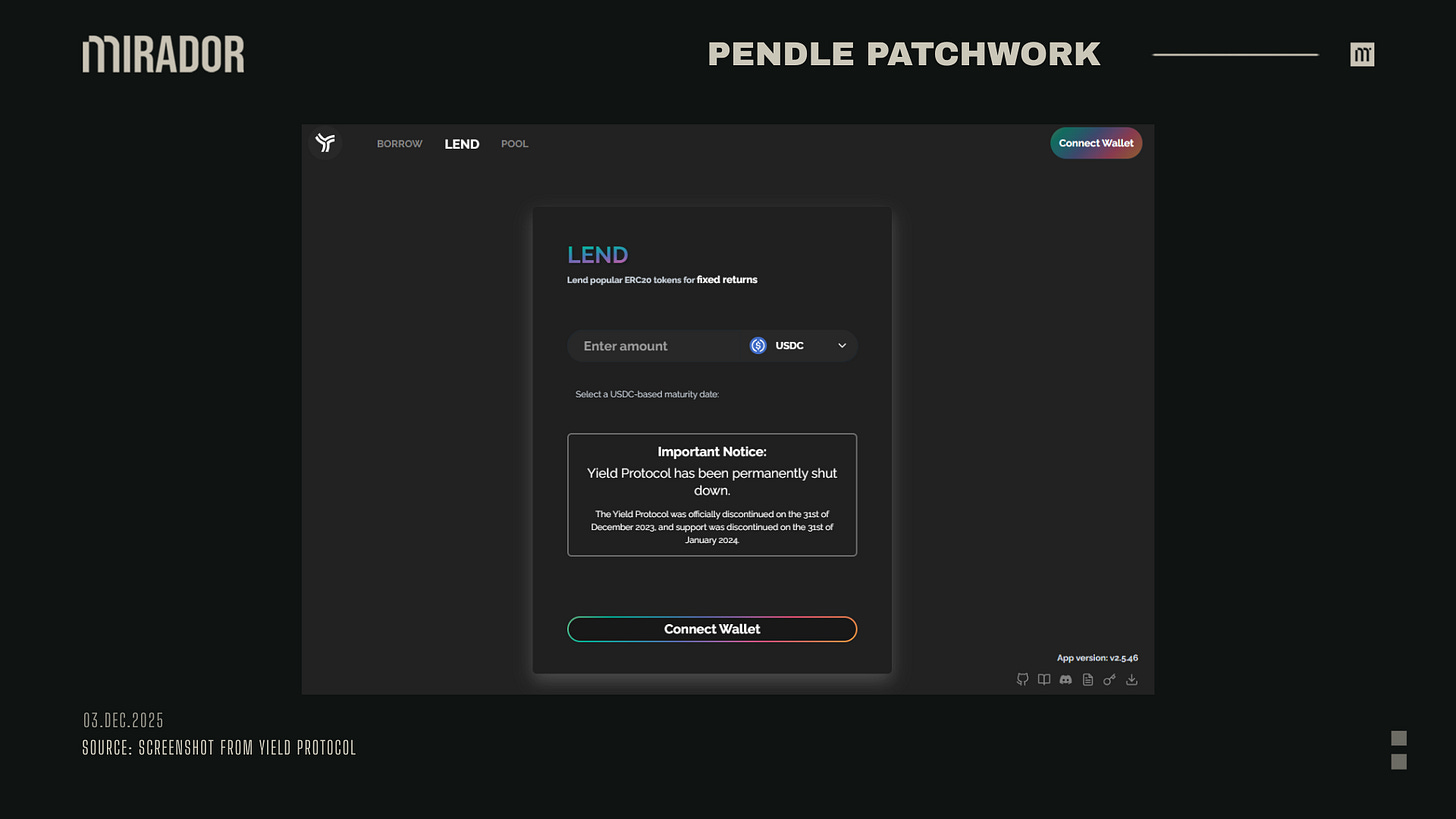

Yield Protocol shut down

Unfortunately, Yield Protocol has been permanently shut down since December 31st, 2023 due to low market demand and rising regulatory challenges. What’s even worse is that on April 30th, 2024, Yield experienced the balance disparity exploit due to the bug in its protocol logic. The damage was about $181,000.

2/ Pendle Yield Trading

Despite the collapse of Yield Protocol, the core idea of this platform is still worthwhile for Pendle to inherit. Adopting this fixed-rate lending model, Pendle developed its own business model, including trading in both fixed-rate and floating-rate yield.

On Pendle, users can trade not only fixed but also dynamic yield. Because some prefer fixed income while others prefer floating one, Pendle allows users to buy/sell PT and YT as they prefer.

What are PT and YT?

For better understanding, here is how PT and YT are defined:

1 PT (Principal Token) gives you the right to redeem 1 unit of the accounting asset (e.g. 1 ETH, 1 DAI, 1 USDe, etc) upon maturity. The value of your PT will increase day by day and can be redeemed 1:1 to the underlying asset at maturity (like fyTokens in Yield Protocol).

1 YT (Yield Token) gives you the right to receive the yield of 1 unit of the accounting asset (e.g. 1 ETH, 1 DAI, 1 USDe, etc) until maturity. Your YT will gradually decrease to 0 and the total yield can be accrued when it’s due, or can be claimed before maturity.

Example:

1 PT-sUSDe (USDe-Ethena market) → Will be redeemable for 1 USDe worth of sUSDe

1 YT-sUSDe (USDe-Ethena market) → Receive the yield of 1 USDe worth of sUSDe

YT is what fundamentally differentiate Pendle Finance from the former Yield Protocol. With YT, users on Pendle can go long yield by buying YT or go short yield by selling YT, effectively enabling yield speculation and creating one of the largest on-chain yield trading markets in DeFi.

Section 3: AMM Model - A patch from Notional Finance

Pendle inherits the AMM model from Notional Finance, a DeFi fixed-rate lending and leveraged yield protocol, because of its high capital efficiency, then adapts it for better yield trading experience.

In fact, the core of these two models is the same. You can scroll down to see why.

1/ Notional AMM basics

Notional is a fixed-rate lending DeFi protocol, where users can:

Lock a fixed interest rate on their assets (lending)

Borrow at a fixed interest rate (borrowing)

Or trade interest (yield trading) as a commodity

To do this on-chain, Notional needs a specialized AMM to automatically price transactions between the current value (cash) and the future value (fCash) over time.

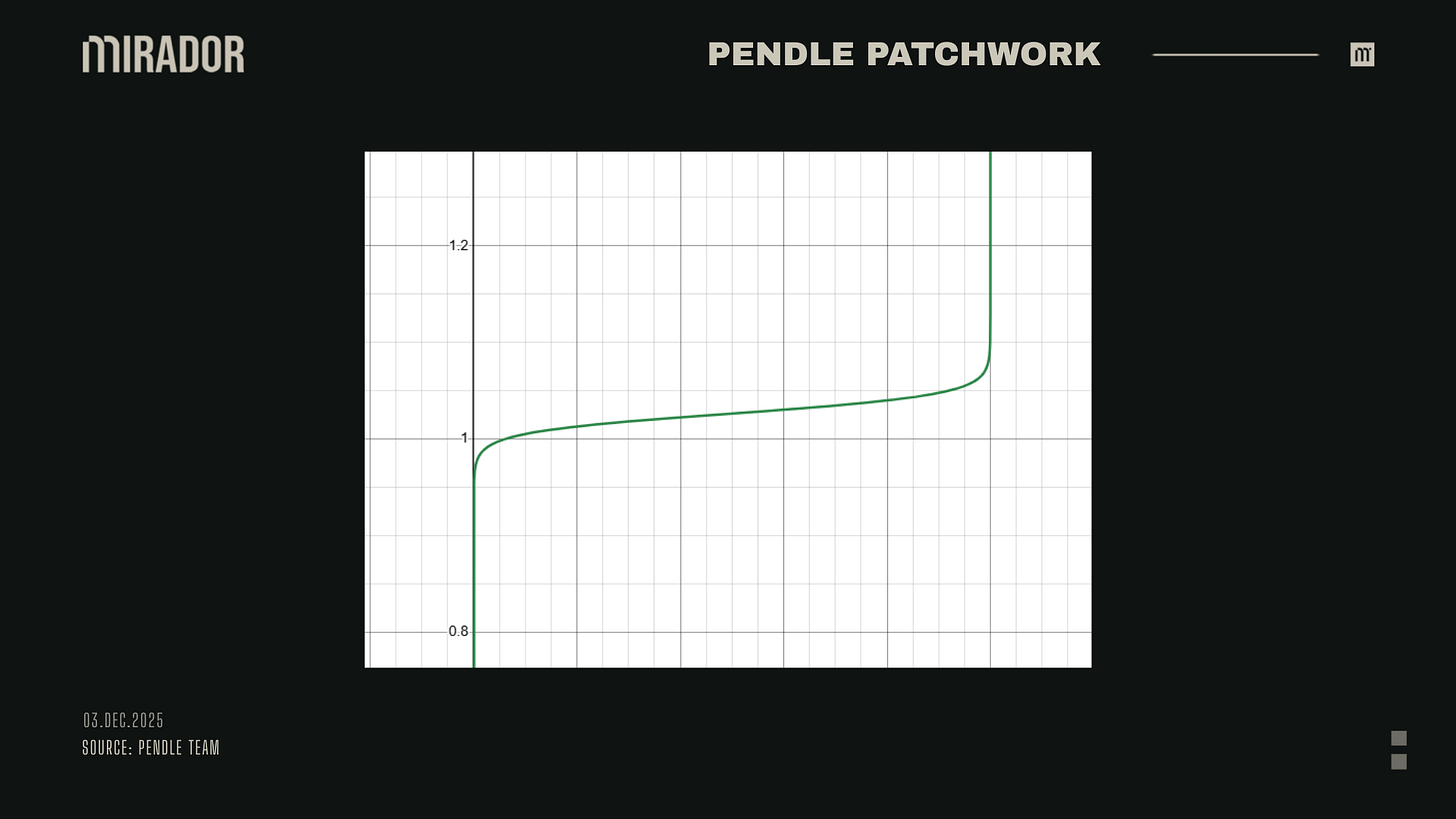

Below is the AMM curve of Notional Finance, a logit curve.

Notional AMM logit curve

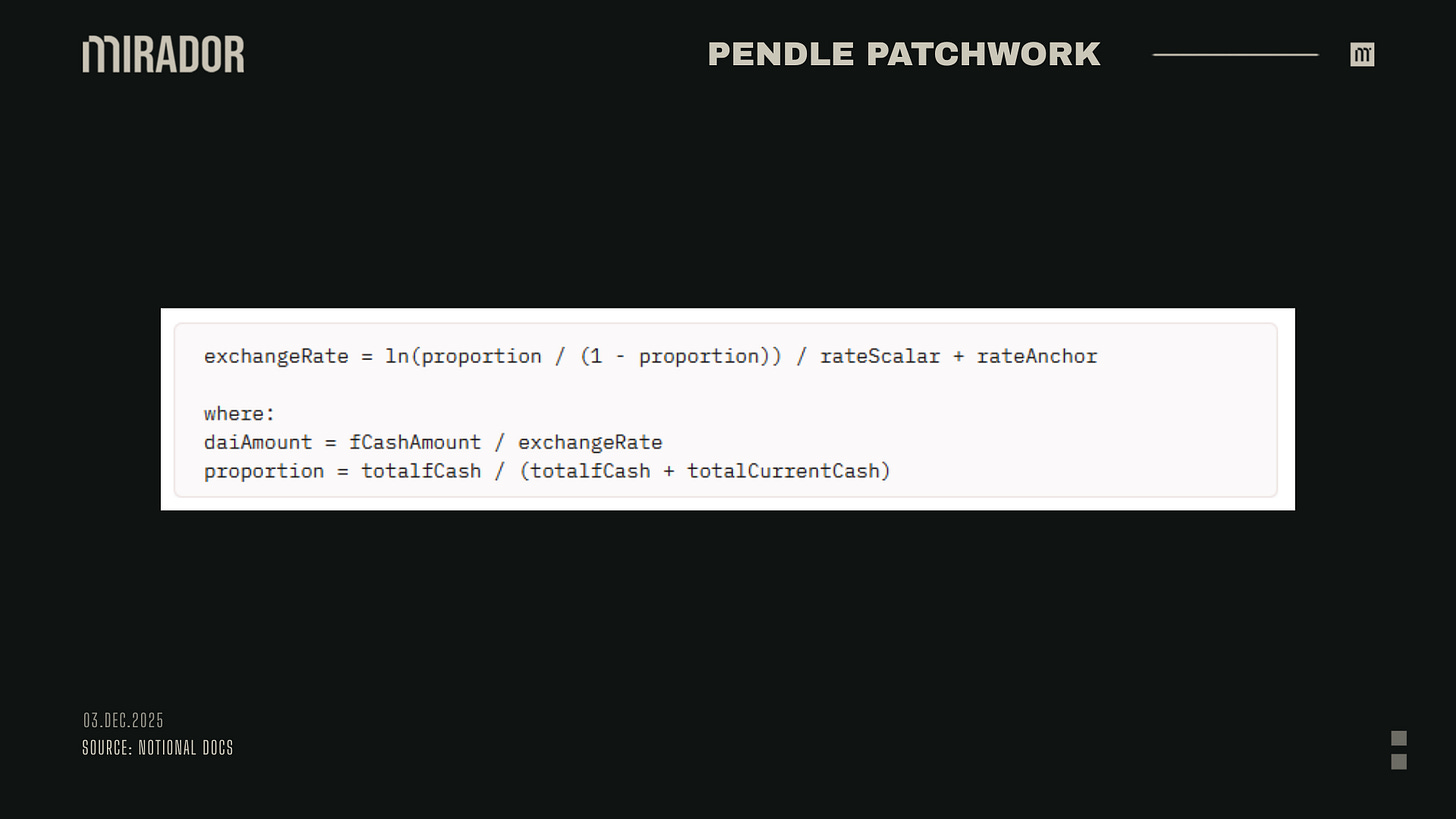

Notional’s pricing formula:

Notional pricing formula

Where:

exchangeRate: the spot rate at which fCash is exchanged for current cash

rateAnchor and rateScalar are governance parameters that determine the offset from zero and the slope of the curve, respectively.

proportion: the proportion of fCash in the market

2/ Pendle AMM basics

Pendle AMM is also a logit curve (S-shaped curve).

Pendle V2 AMM logit curve

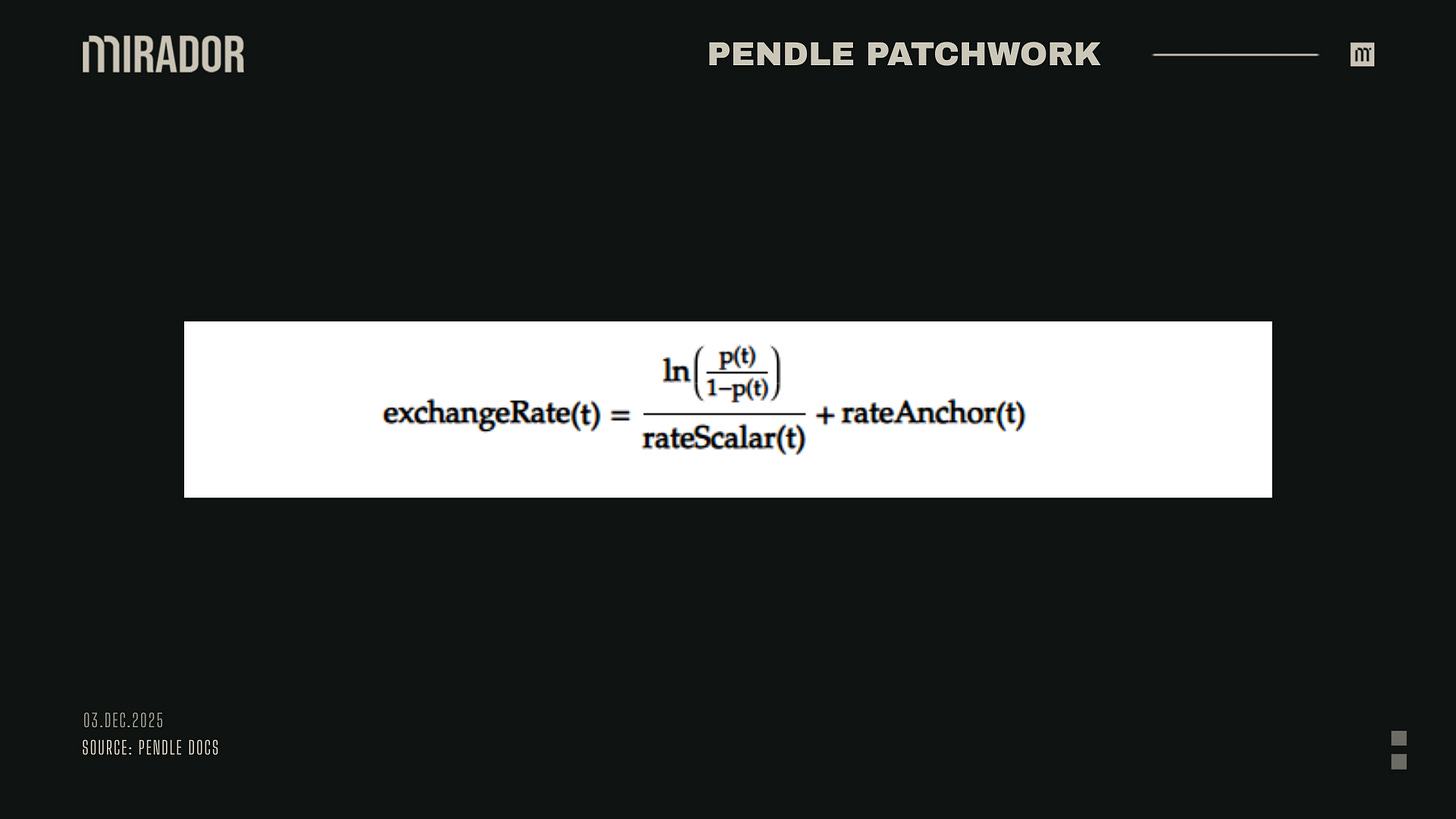

Here is the final exchange rate equation (or pricing formula) for the Pendle AMM, which totally looks like Notional’s.

Pendle V2 pricing formula

Where:

exchangeRate(t): the spot exchange rate of asset in PT (in case of no fee) at time t (exchangeRate(t) 1 since 1 PT can be redeemed 1:1 at the maturity)

p(t): the proportion of PT in the market at time t

rateScalar(t): a parameter used to adjust the capital efficiency (also known as the slope coefficient of the price curve, which adjusts for interest rate sensitivity)

rateAnchor(t): a parameter used to adjust the interest rate around which the trading will be the most capital efficient (also known as the anchor point of the curve, reflecting the interest rate around which it is “most stable”)

Is there any difference between Pendle’s AMM and Notional’s?

At its core, the pricing formula of these two models is mostly the same. The difference is in the calculated object. In Notional, the main object is fCash, and in Pendle, the object is PT. However, this is obvious and not worth mentioning because the operating model of the two protocols is different.

Above all, the hidden distinction lies in the changing of variables for easier complementation.

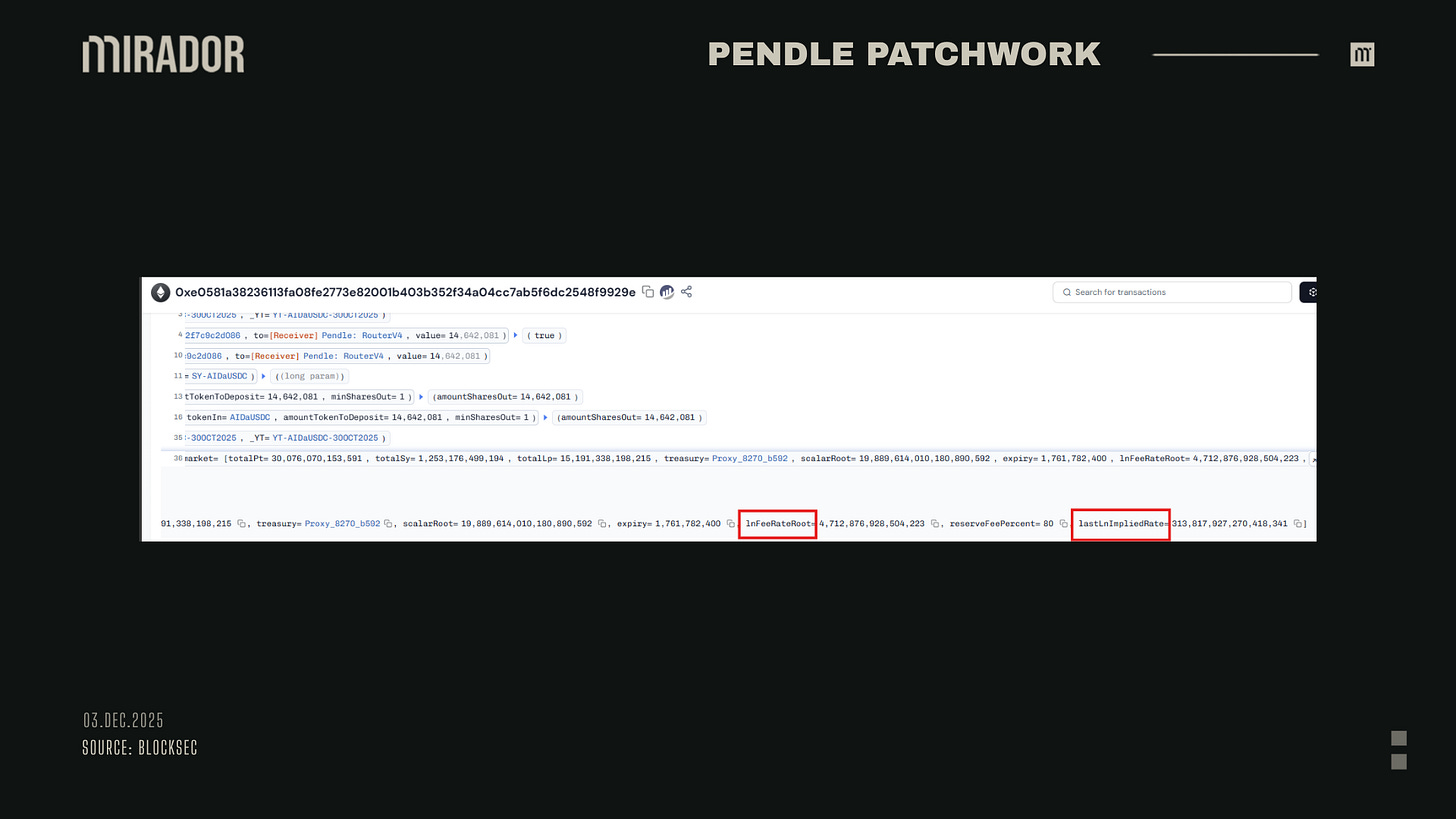

Because natural logarithms and exponents are easier to compute, Pendle introduced some changes in how these parameters are calculated on-chain, based on two factors:

lnFeeRateRoot: Base logarithmic fee rate (protocol fee)

ln(lastImpliedRate): logarithm of the implied APY of the most recent trade.

You can see these two parameters in the real-time transaction below.

On-chain computing of Pendle AMM - BlockSec

Section 4: Pendle Governance - A patch from Curve Finance

Every protocol needs its own governance to keep the system stable, fair and sustainable, and Pendle is not different.

Pendle governance is inspired by the early model Curve Finance. It’s a self-balancing governance & incentive model that attracts liquidity, keeps token value stable, and distributes rewards in the right place and in a decentralized manner.

1/ veCRV

veToken (vote-escrowed tokens) is pioneered by Curve Finance, which is widely known for its most distinctive locking mechanism, where users can lock their $CRV (Curve’s governance and utility tokens) for up to 4 years to receive veCRV (vote-escrowed CRV).

This longer-term commitment comes with two major benefits:

Governance power in Curve’s decision-making

A share of the fees generated across Curve products

This lock-up mechanism is purposefully designed to align the interests of token holders with the platform’s long-term growth. Theoretically, the longer they lock $CRV, the more veCRV they would receive, the greater their influence and the share of rewards would be.

For a deeper dive into the veCRV model, feel free to check out this article.

2/ vePENDLE

Curve has veCRV, and Pendle has vePENDLE, also known as Vote-escrowed PENDLE. Pendle’s incentive mechanism, consisting of 2 main components:

PENDLE token: an ERC-20 token of Pendle protocol, minted and used for governance and utility, encouraging liquidity provision to markets

vePENDLE: received when locking PENDLE to gain protocol revenue. Holding vePENDLE allows you to:

Vote to allocate $PENDLE incentives into a liquidity pool

Vote to receive Voter’s APY (80% of the swap fees of the voted pool)

Receive base APY (interests collected from YT and matured PT rewards)

Boost LP rewards (up to 2.5x - similar to Curve)

Below is how Pendle revenue is distributed.

Pendle revenue flow - Source: Pendle docs

First, users lock PENDLE to receive vePENDLE (maximum 2 years, whereas veCRV is 4 years)

vePENDLE holders vote to channel PENDLE incentives to the Pendle pools (whose liquidity is added by LP providers). The more votes a pool gets, the more PENDLE incentives it gains.

LP providers will earn LP rewards generated by Pendle pools.

There are 5 types of rewards for LPs: Pendle incentives, LP Reward APY, SY Interest APY, PT fixed APY and swap fees (which will be distributed 80% total swap fees of the pool to vePENDLE holders, and based on their vePENDLE weight)

On top of swap fees, another benefit that vePENDLE holders can earn is from protocol revenue, containing 2 main sources:

YT Fees: 5% fee (currently) from yield received by YT holders.

Mature PT Yield: Yield from unredeemed PT at maturity.

These two are also regarded as the real yield, which is the difference from veCRV, where veCRV holders gain revenue mainly from swap fee and stablecoin transaction fee.

Pendle Wars

As with Curve, a battle emerged around Pendle, called Pendle wars.

“Pendle Wars” is a term used to describe the competition between platforms/DeFi projects in the Pendle ecosystem for governance power and influence through vePENDLE.

Since vePENDLE holders have the right to vote on how incentives are allocated to liquidity pools, many projects or partners desire to own as much as vePENDLE as possible to control the power. In order to do that, they will try to “bribe” $PENDLE holders through many strategies.

(bribe - an umbrella term in DeFi, refers to rewards offered to governance token holders (like $PENDLE or $CRV) in exchange for their votes on proposals)

One of the most common methods is to entice $PENDLE holders to stake their tokens in their protocols in exchange for attractive staking rewards (and other benefits depending on each protocol) instead of locking $PENDLE directly on Pendle protocol.

This mechanism is the same as in Curve Finance, where it’s called Curve Wars.

You can see the main participants as well as their veToken-holding power in each war on these two protocols in the picture below.

Curve Wars vs Pendle Wars - Source: defiwars

However, can these platforms bribe as much as they want?

Well, theoretically they can do that to get as much vePENDLE as possible. But in fact, even when they hold a huge amount of vePENDLE and vote all of that amount to their pools, the actual incentives that their pool can receive is limited by the incentive cap, which helps differentiate Pendle from Curve.

Pendle’s Incentive Cap

Incentive cap limits the incentives a liquidity pool can gain in an epoch (a week), based on its actual performance (swap fee). This is to prevent “junk pools” or low-performance pools from siphoning off too much reward just from bribes, which can cause incentives to be distributed in the wrong place.

The core is: if the amount of votes a pool receives causes the incentives to surpass the specified cap, only the capped rewards will be distributed in that epoch. The excess is not lost, but retained by the protocol, and votes continue to earn swap fees and vePENDLE yields as usual.

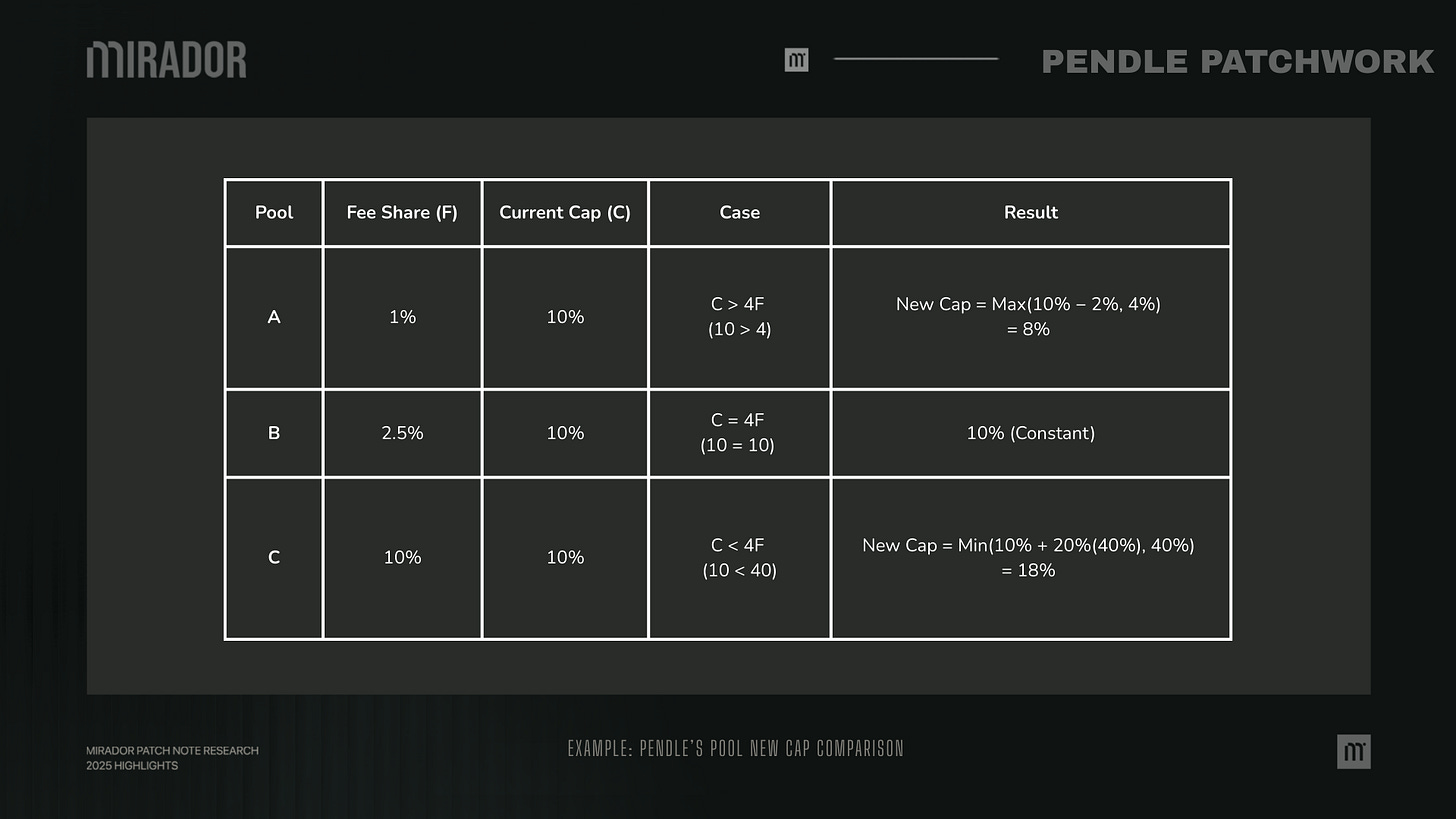

Every week, pool caps are finalized and adjusted based on this formula:

Current Cap (C) - the current maximum incentive cap of the pool (default 5% cap in their first epoch, later it’s adjusted dynamically each week based on its performance, with a max cap of 20%).

Fee Share % (F) - the pool’s proportion of total swap fees generated across Pendle over the last 7 days.

Example:

So, in the next week:

Pool A which performed not too well last week will be reduced reward cap from 10% to 8%

Pool B stays constant

Pool C gets a higher incentive cap at 18% owing to its great amount of swap fees (higher performance)

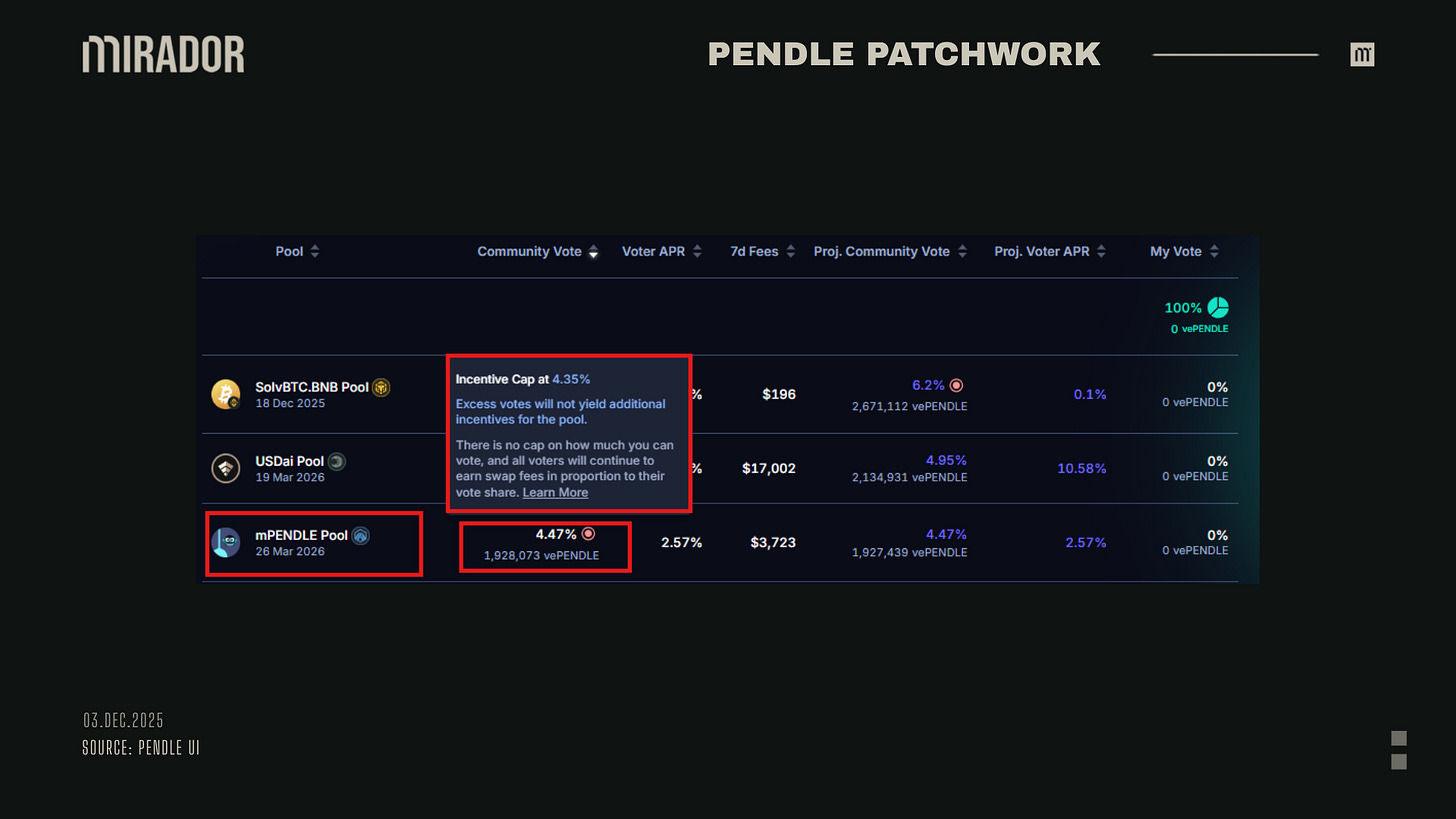

mPENDLE pool votes

As you can see in the picture above, the total community vote for mPENDLE pool (Penpie, also known as the largest vePENDLE holder in Pendle Wars) is currently 4.47%, exceeding its incentive cap of 4.35%. The excess votes won’t yield additional incentives for the pool.

This is what Pendle has improved better than Curve Finance – the pioneering veToken model. Therefore, vePENDLE can be regarded as veToken 2.0.

Conclusion

To sum up, Pendle is the combination of many existing models. Its yield stripping model is from bond stripping in traditional finance, yield trading model is inspired by Yield Protocol, AMM mechanism is adopted from Notional, and vePENDLE is inherited and promoted from veCRV - CurveDAO.

Pendle is proven not to be a copycat but like a patchwork quilt, weaving together ideas that once stood apart to create something stronger, more colorful, and truly its own.

Disclaimer

This article is an independent educational overview of Pendle Finance’s “patchwork” design, exploring how its various components - yield stripping, yield trading, AMM mechanisms, and governance through vePENDLE - come together to form a cohesive and innovative DeFi protocol. Our goal is to help readers, even beginners, understand the core design principles and how each part contributes to Pendle’s unique model, and from there, form their own view on why combining these ideas creates a stronger, more versatile system.

Everything is presented in a step-by-step and approachable way, so that readers with a basic understanding of DeFi can follow along without prior experience with Pendle.

By understanding how Pendle weaves together concepts from traditional finance, Yield Protocol, Notional, and CurveDAO, you will gain a foundation to explore its broader ecosystem - from yield tokenization and fixed yields to AMM interactions and governance strategies built on top of its infrastructure.

follow us on X:

https://x.com/MiradorNews

https://x.com/0x_vikt0r