AAVE V4: A FAIRER LENDING MODEL WITH RISK PREMIUM

Breaking down Risk Premium mechanism to explore how AAVE V4 prices Collateral Risk directly into Interest Rates

INTRODUCTION

AAVE V4 introduces Risk Premium as a core component of its lending architecture, fundamentally changing how borrowing costs are determined in a shared-liquidity system.

This article takes a deep dive into AAVE V4’s Risk Premium mechanism, explaining how borrowing costs are adjusted under the hood and uncovering the less visible flows and accounting logic that are not immediately apparent from the user interface.

KEY TAKEAWAYS

This article focuses on the mechanics behind Risk Premium in AAVE V4, breaking down how it is calculated, how it evolves over time, and how it turns into actual interest accrual. The main flow will be:

Section 1: Collateral risk in previous AAVE models and the motivation Risk Premium in AAVE V4

Section 2: A deep breakdown of the core Risk Premium algorithm, covering its key components, logical steps, and how position-level risk changes final borrowing costs.

SECTION 1: PREVIOUS AAVE AND COLLATERAL RISKS

1/ AAVE previous lending models: High-level design

a) Collateral rehypothecation (Collateral Reusing)

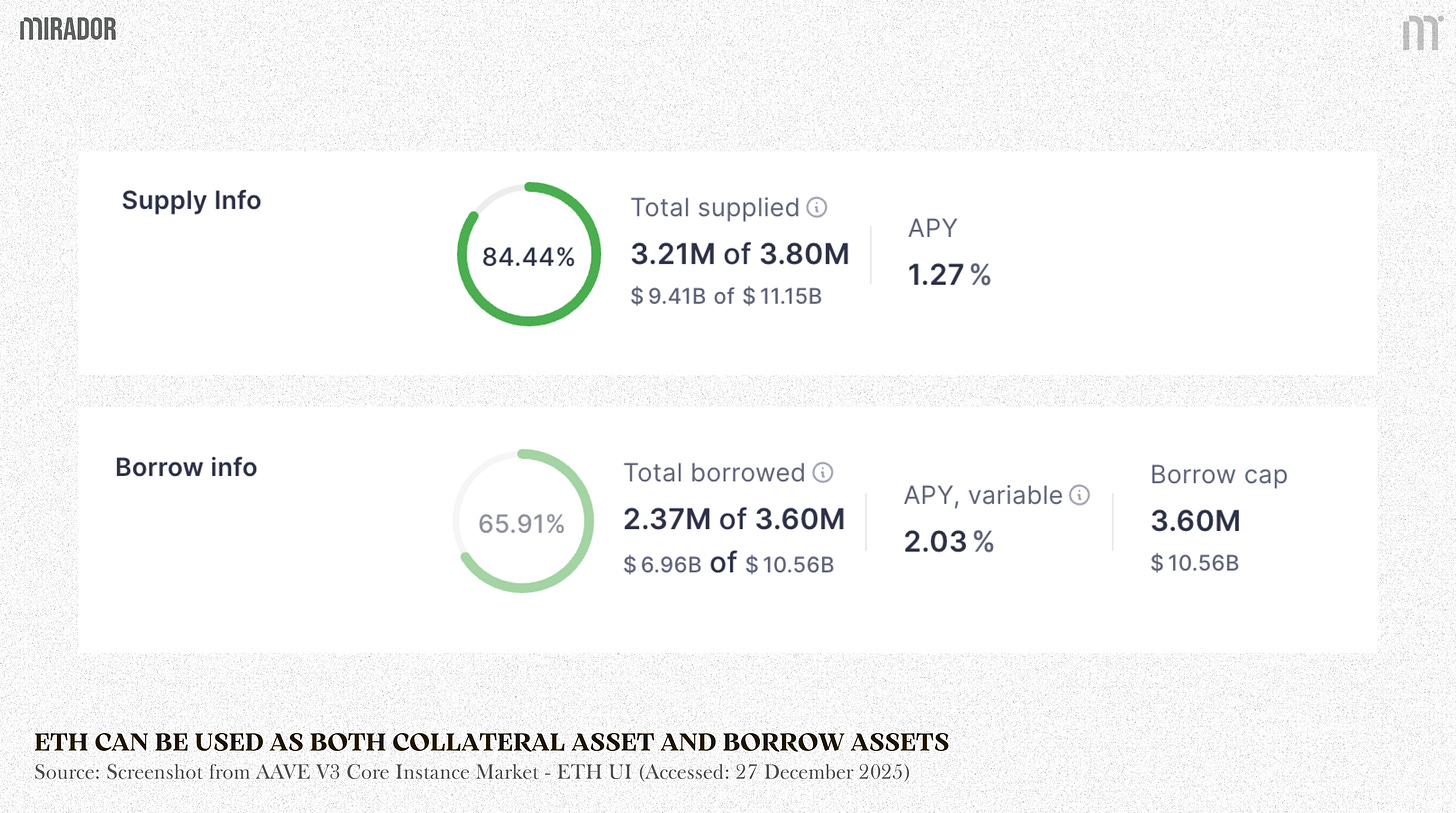

Previous versions of AAVE use the collateral rehypothecation model to improve capital efficiency, which means: instead of locking collateral in escrow, assets deposited as collateral can also be lent out to other borrowers at the same time. This allows the same unit of capital to support both borrowing and lending activities.

When collateral is held in escrow, it means the borrower’s collateral assets are locked in a smart contract and are not used for anything else during the loan period.

This setup is convenient since the collateral is always available for liquidation or pay back and withdraw. However, escrowing collateral is inefficient in terms of capital usage. While the collateral is locked, it does not generate any yield or serve any productive purpose, meaning borrowers earn no return on the assets they have pledged.

The most effective form of collateral rehypothecation is one that maximizes capital efficiency for both users and the protocol: the protocol can reuse user collateral as lending liquidity, while users are not capital-locked and still retain full economic ownership of their assets.

This design is enabled on AAVE by collateral tokenization, where deposited collateral is converted into aToken - a yield-bearing rebasing tokens that represent both the underlying asset and its accrued interest.

When users deposit assets into AAVE, the protocol mints corresponding aTokens at a 1:1 ratio. The underlying assets are used for lending, generating yield from borrowers’ interest; while user can claim their yield, redeem them at any time for the underlying asset at a 1:1 ratio, use them as collateral to borrow, transfer them to other wallets,...

The yield from borrowing is distributed automatically by increasing users’ aToken balances over time, while the aToken price remains pegged to the original asset.

For example: You deposit $100 WBTC into AAVE, then protocol mints $100 aWBTC and sends them to your wallet.

At this point, you have:

Your balance: $100 aWBTC

Each $1 aWBTC is redeemable for $1 WBTC

Over time, borrowers pay interest to the pool. Instead of increasing the price of aWBTC, AAVE distributes this yield by increasing your aWBTC balance. And after some time, your balance becomes $105 aWBTC.

When you decide to withdraw: AAVE burns your $105 aWBTC and you receive $105 WBTC in return. This means the extra $5 WBTC comes from interest earned while your assets were supplied to the protocol.

b) Collateral Clusters

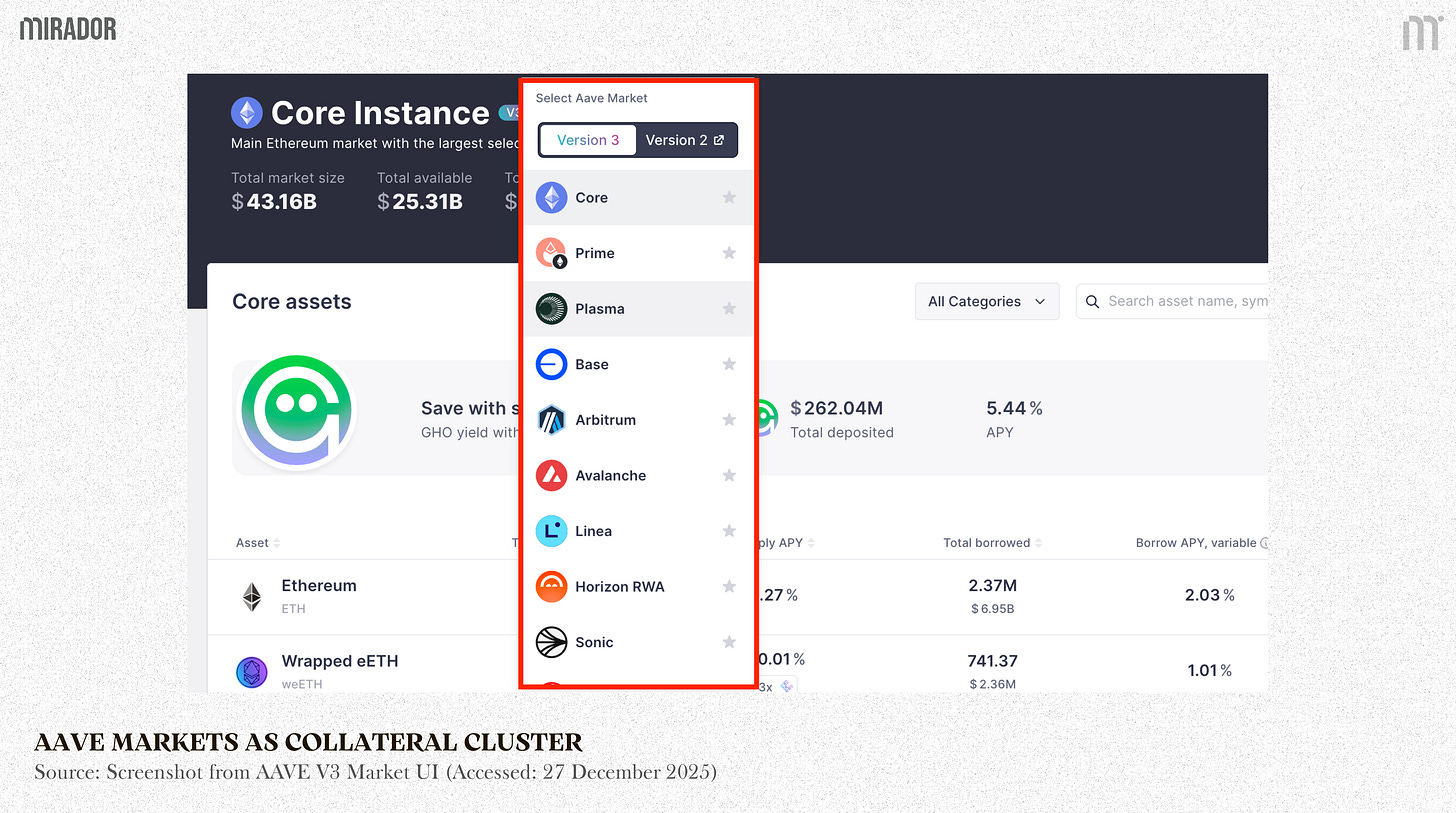

Because Aave allows collateral to actively be reused as liquidity for other borrowers, the protocol groups multiple assets into a single shared lending market, forming what is theoretically known as a “collateral cluster”. And in Aave, each market functions as a collateral cluster. A market defines a group of assets that share the same liquidity pool, interest rate logic, and liquidation system, all of which can be used as collateral and borrowed against one another.

However, rehypothecation also means that assets are economically connected. If one collateral asset becomes risky, its impact can propagate through the shared pool. As a result, collateral clusters inherently socialize risk across the market. To manage this trade-off, AAVE restricts clusters to highly liquid, well-tested assets and applies conservative risk parameters to preserve system stability.

2/ Collateral risk problems

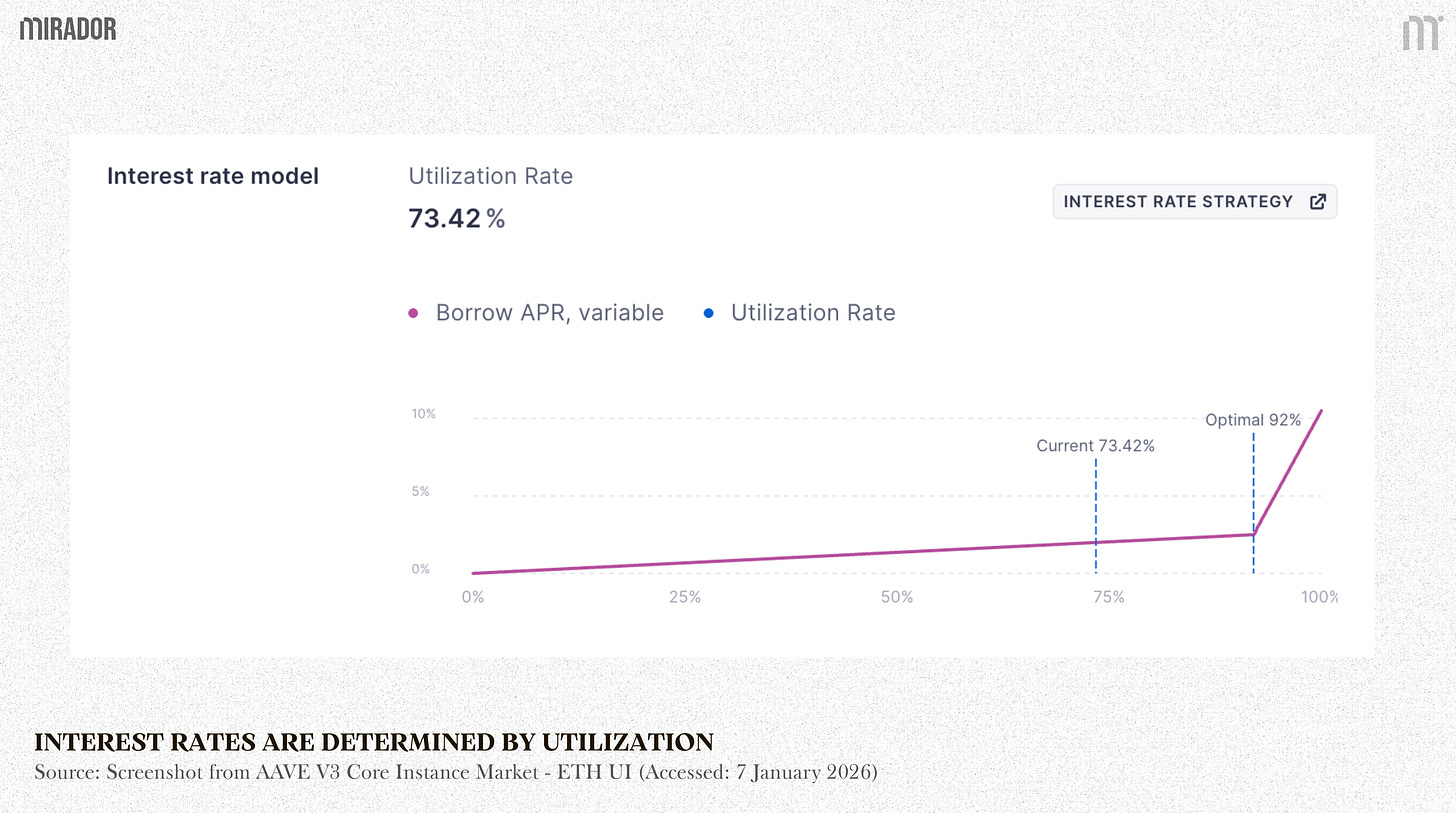

Because each AAVE market functions as a single collateral cluster, all assets within the market share the same pool of liquidity. As a result, borrowing cost (Borrow APY) is based on the supply and demand of the borrowed asset within that shared pool. Or in other words, interest rates are determined by utilization: when demand for a particular asset increases relative to available liquidity, its borrowing rate rises, and vice versa.

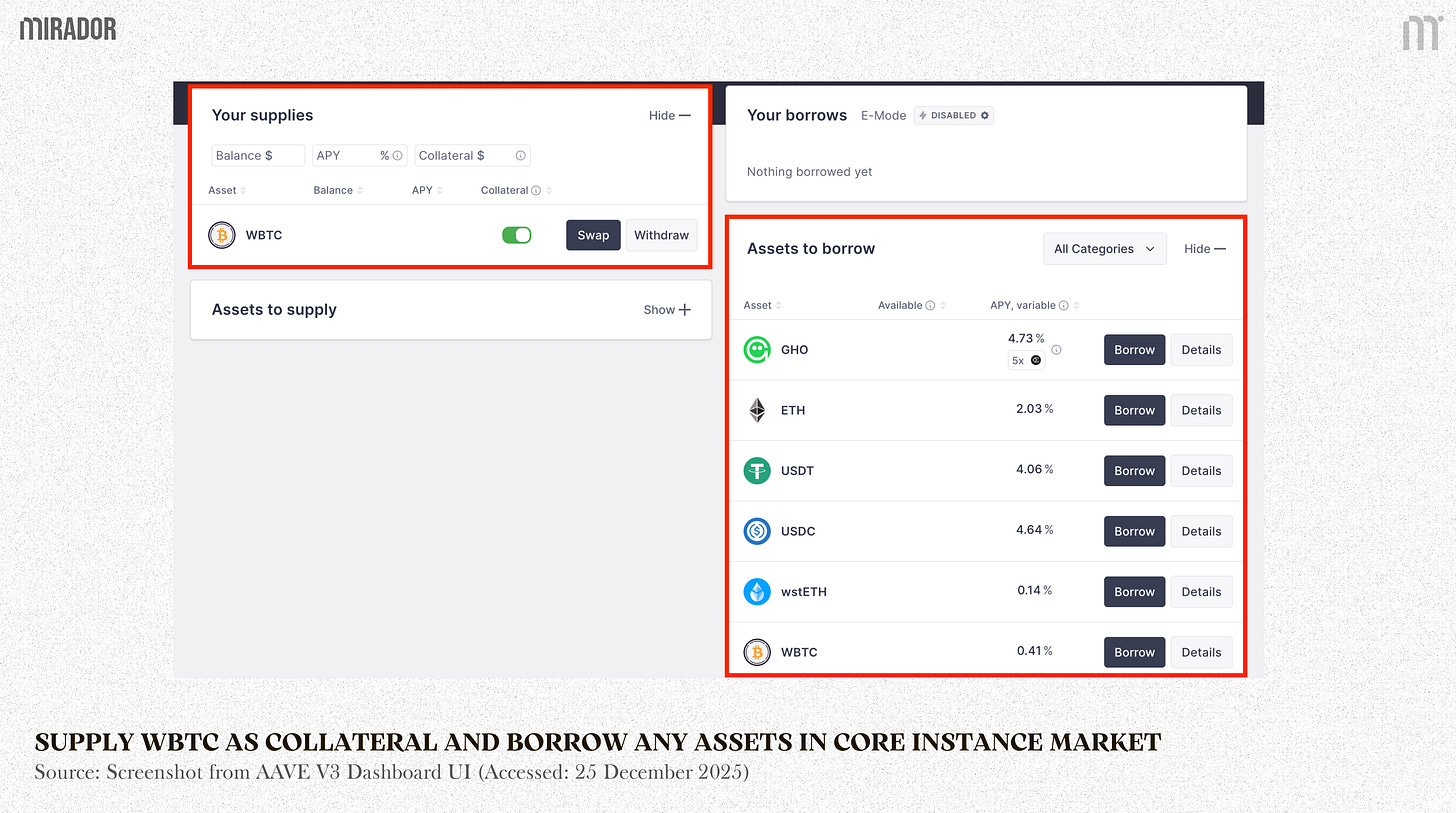

This means that borrowers with very different collateral risk profiles often pay similar interest rates as long as they borrow the same asset.

Collateral Risk Profiles managed by AAVE V3

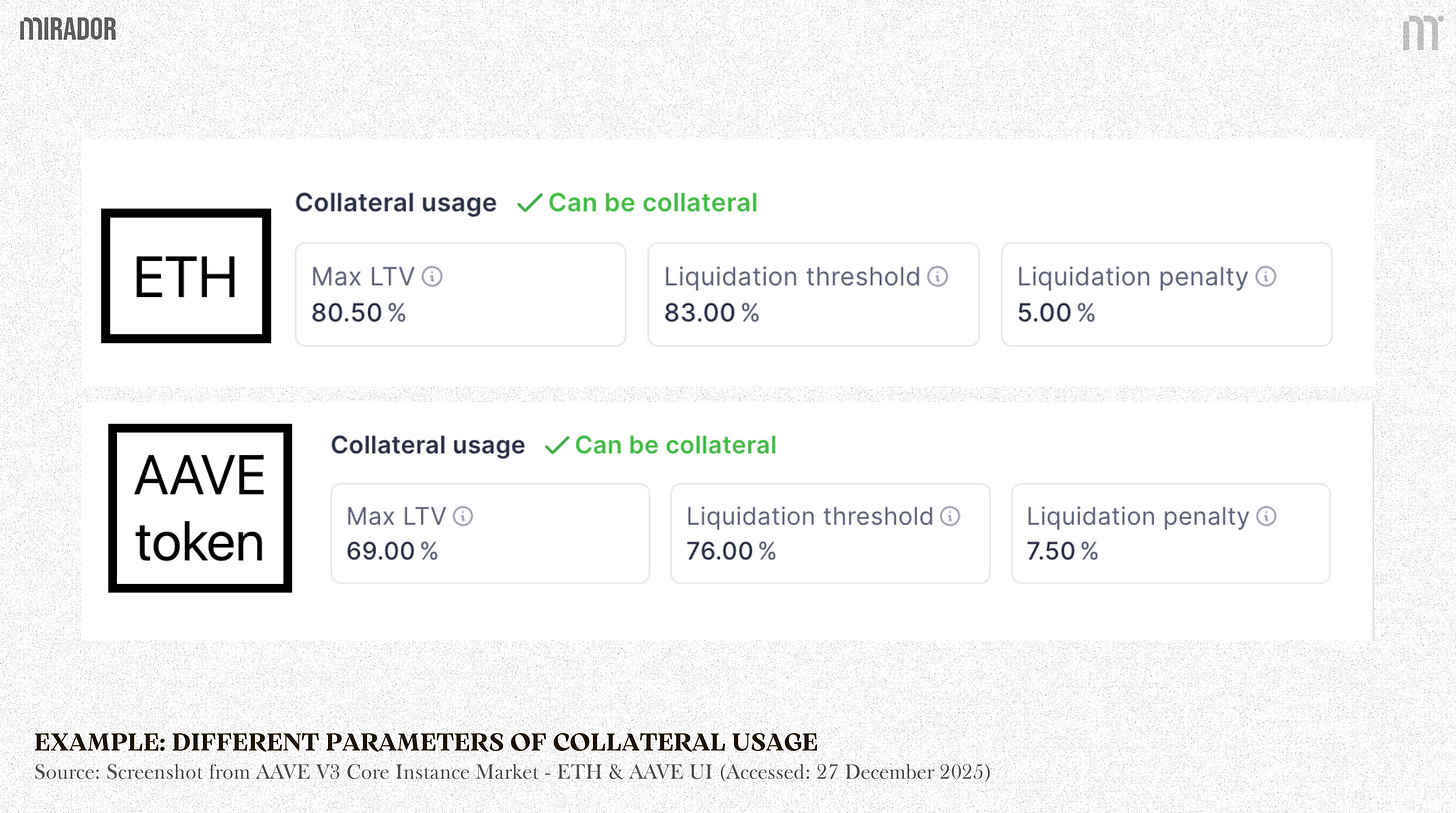

Of course, previous versions of AAVE, like AAVE V3, do not completely ignore this risk. Key parameters such as the maximum loan-to-value (LTV), liquidation threshold, and liquidation penalty are all determined by the collateral asset used to back the loan.

For example: Both Alice and Bob want to borrow WBTC on AAVE V3. While Alice uses ETH - a well-established asset, Bob uses AAVE token - a less proven asset, leads to different parameters like this:

The key is: Even though both Alice and Bob borrow the same amount of WBTC, Alice can borrow more and faces safer liquidation conditions because ETH is a more established and liquid collateral. Bob, using the AAVE token as collateral, is limited by a lower maximum LTV and faces a higher liquidation penalty due to the higher risk profile of his collateral.

But it is not enough to protect system

Although adjusting parameters such as maximum LTV and liquidation penalty based on the collateral asset helps limit downside risk, this mechanism alone is not sufficient to fully protect the system. These parameters only restrict how much a borrower can take and when their position is liquidated, but they do not price the ongoing risk that a borrowing position introduces to the shared liquidity pool.

Borrowers using riskier collateral are allowed to borrow less, but they still pay the same interest rate as safer borrowers as long as they borrow the same asset. As a result, higher-risk positions do not have significant opportunity cost on shared liquidity of a specific market on AAVE, while the cost of their risk is absorbed by the entire pool. This creates a structural mismatch between risk and pricing, leaving the protocol risky despite conservative collateral parameters.

This mismatch may not cause significant issues when assets are carefully curated and segmented into separate markets. However, it becomes a much more serious concern in the context of AAVE V4 development, where the protocol transitions to a hub-and-spoke architecture and concentrates liquidity into a unified liquidity layer.

In such a shared liquidity environment, riskier borrowing positions can no longer be allowed to access the same capital at the same price as safer ones without consequences. To address this, Aave V4 introduces an additional component in its interest rate calculation known as the “Risk Premium”, which dynamically adjusts borrowing costs based on the risk profile of each position’s collateral.

SECTION 2: RISK PREMIUM - OPPORTUNITY COST OF CHOOSING COLLATERAL ASSETS

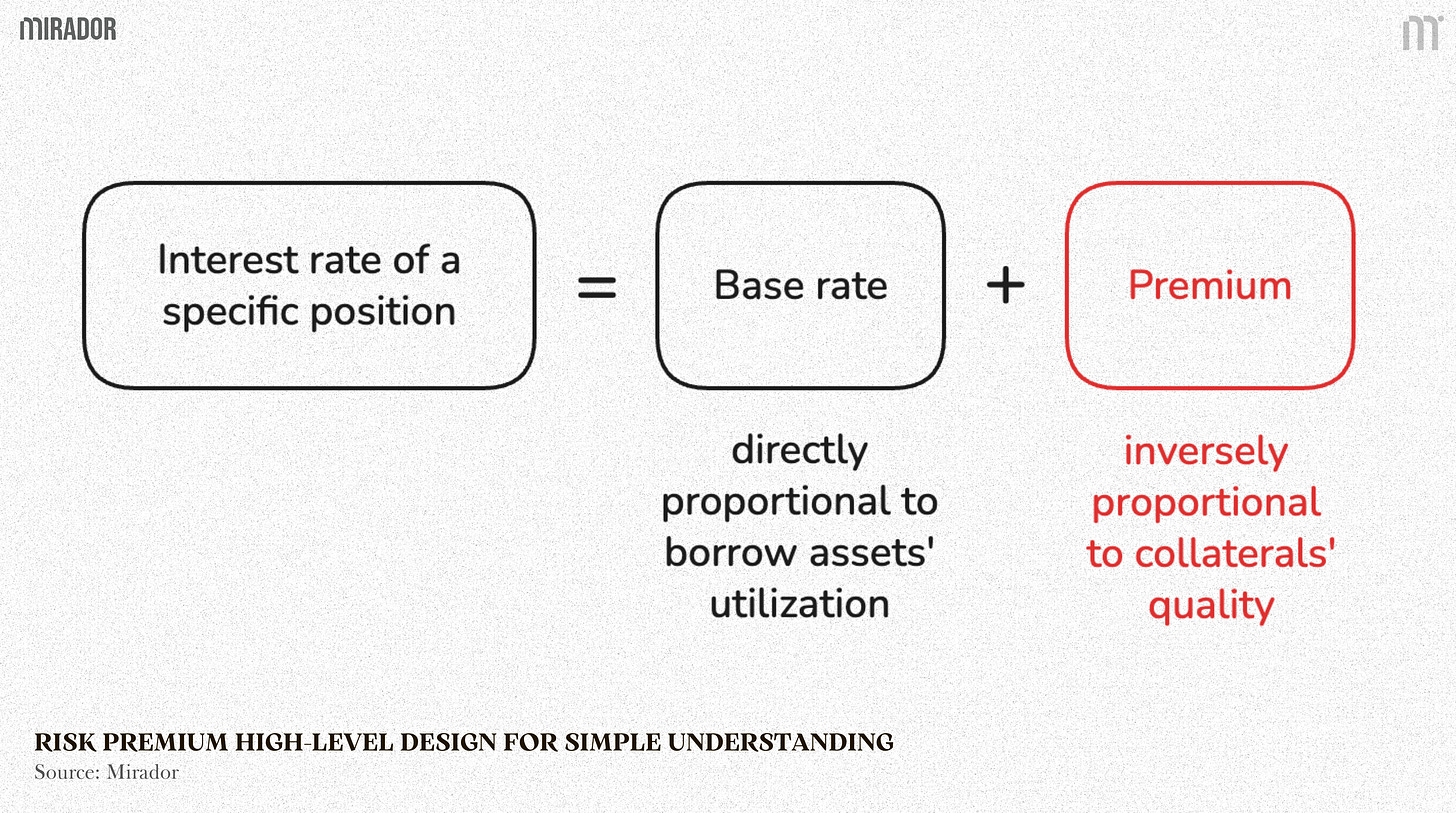

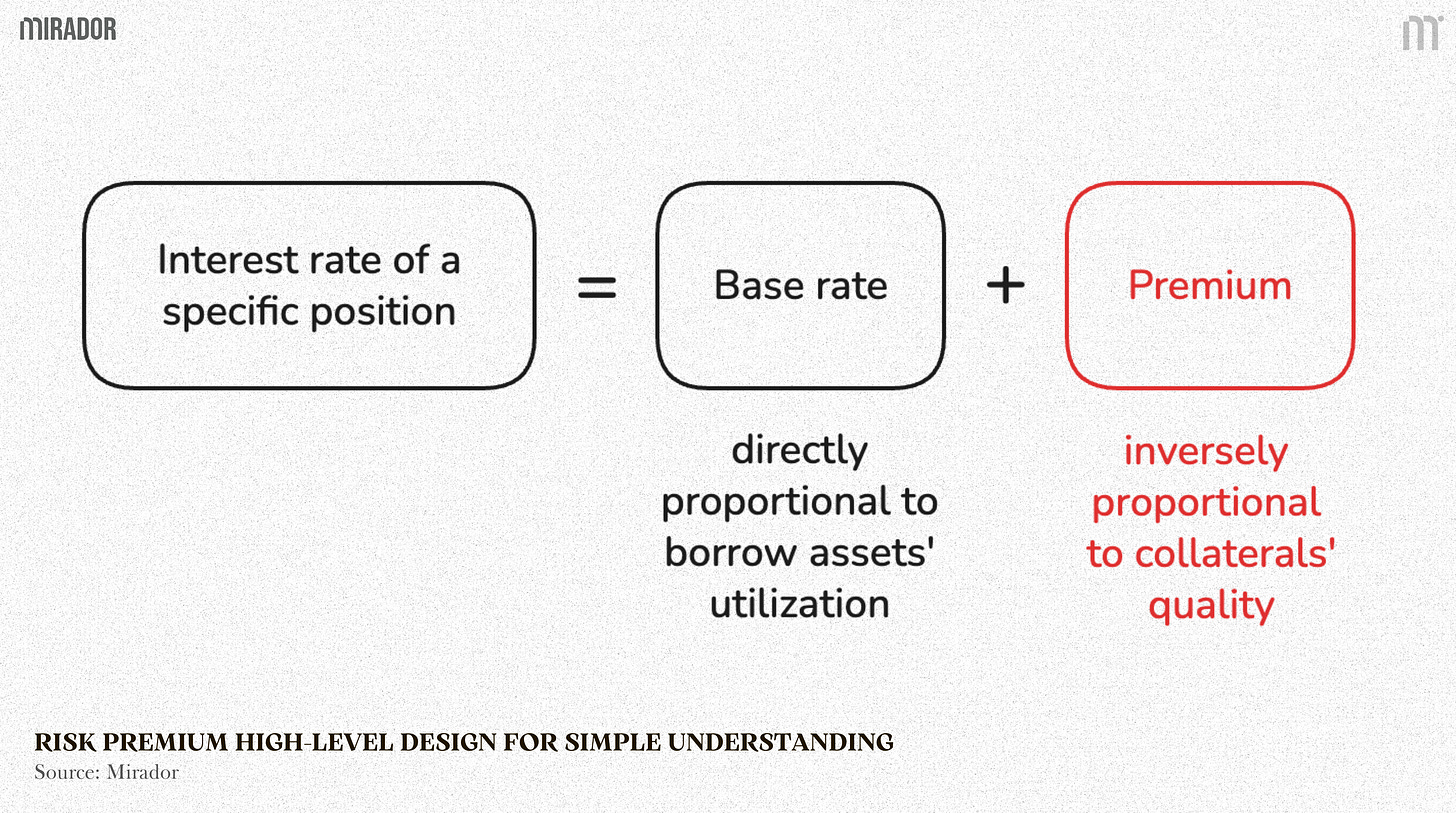

In AAVE V4, borrowing costs are no longer determined solely by the supply and demand of the borrowed asset. Instead, the protocol extends its interest rate model to account for the quality of the collateral backing each position. This marks a fundamental shift from asset-level pricing to position-level risk pricing.

This risk premium is applied on top of the asset’s base borrow rate, ensuring that users who introduce more risk into the system pay more for accessing shared liquidity.

Under this design, a user’s debt interest is directly influenced by the risk profile of the assets used as collateral. Higher-quality, more liquid, and less volatile collateral results in a lower additional borrowing cost, while riskier collateral introduces an extra charge.

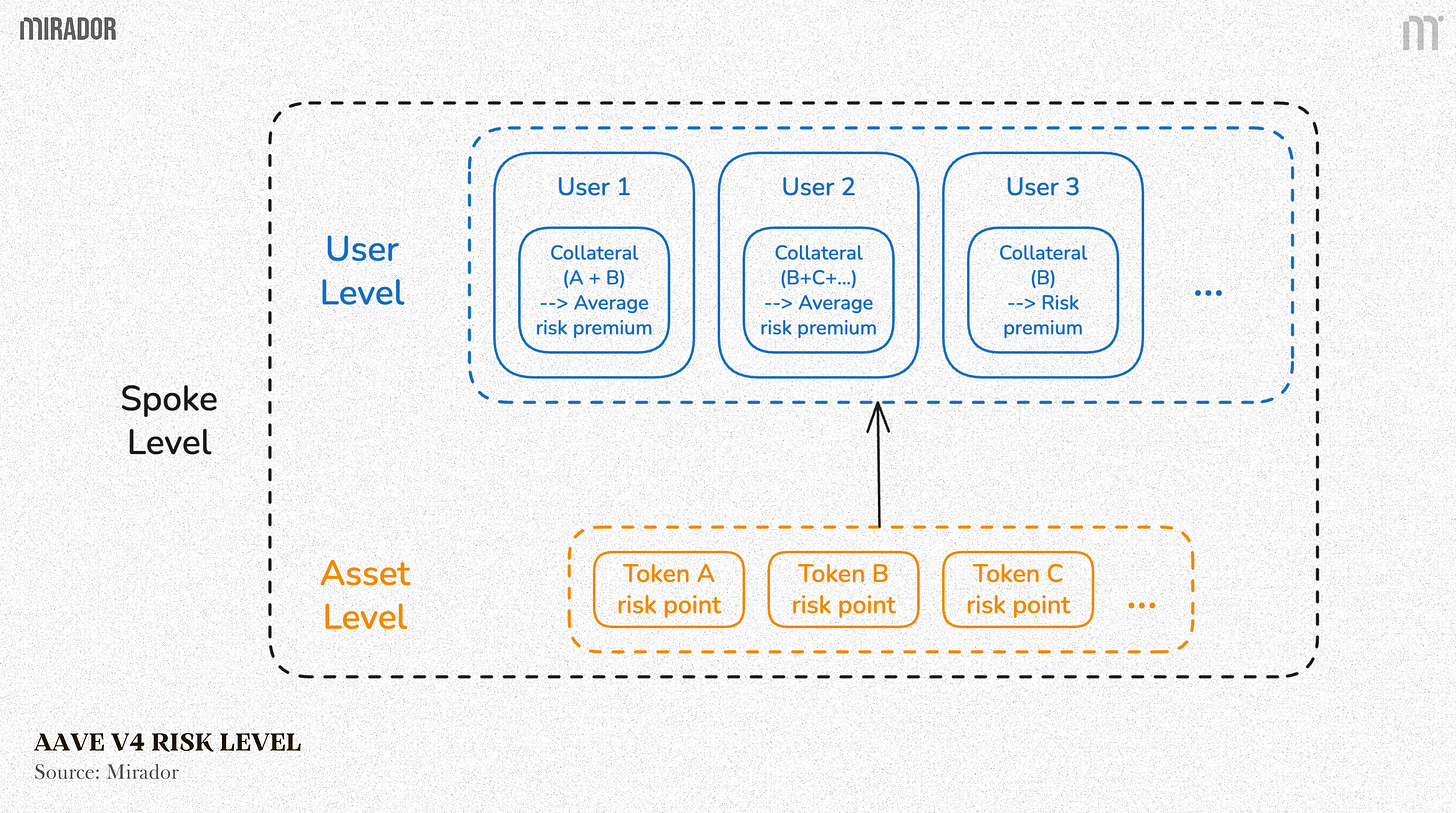

1/ Risk level

Asset-level risk (Collateral Risk Point): When an asset is listed in a Spoke, governance assigns it a Collateral Risk score

User-level risk (User risk premium): Reflecting how risky a user’s borrowing position is. If a user supplies multiple types of collateral, the protocol computes a value-weighted average of the Collateral Risk scores of the assets actually backing the user’s debt.

Spoke-level risk: Each Spoke tracks the average User Risk Premium of its active positions, capturing the overall risk environment within that Spoke.

Because different spokes serve different use cases and user profiles, users’ risk levels can vary even though in AAVE V4, they share the same underlying liquidity hub.

Spoke-level risk is managed by 2 level inside: Asset-level and User-level.

a) Asset-level risk: Collateral risk points (CRi)

Collateral Risk (CR) is the foundational parameter in AAVE V4’s new interest rate design and should be the first concept to understand when analyzing the protocol’s borrowing mechanics. Unlike previous versions, where collateral risk primarily affected liquidation thresholds and loan-to-value limits, AAVE V4 directly incorporates collateral quality into interest rate formation.

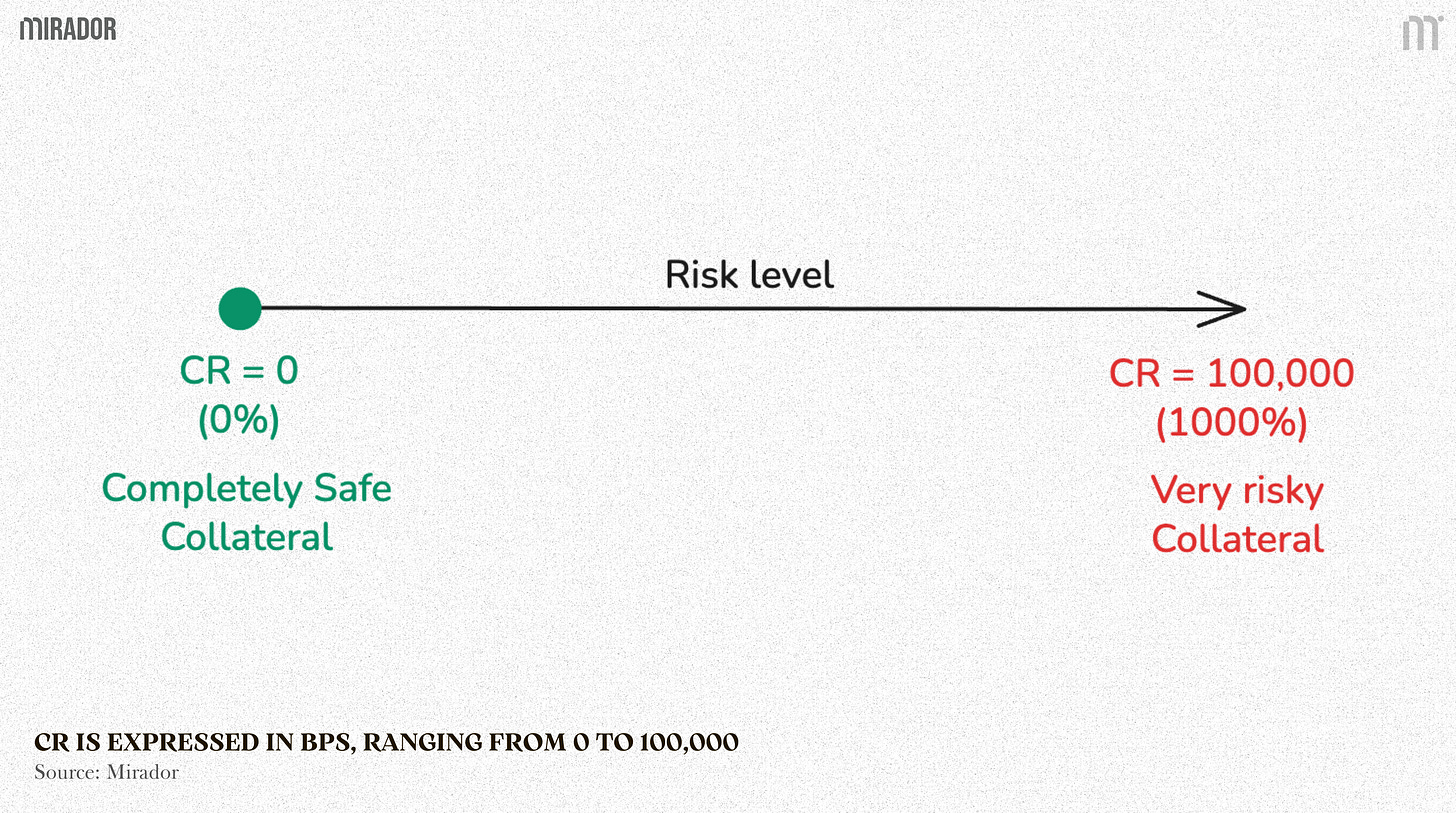

Collateral Risk point (CR) is a risk score assigned to each collateral asset, expressed in basis points (BPS), ranging from 0 to 100,000 (meaning 0% to 1000%).

The closer the value is to 0, the safer the asset is considered; the closer it is to 1000, the higher the risk associated with using that asset as collateral.

CRᵢ is the Collateral Risk point of the asset i.

For example: CRETH = 0 BPS, in contrast, a new asset - XYZ may have CRXYZ = 100 BPS.

This means ETH is considered the safest form of collateral within a given Spoke. Using ETH as collateral therefore introduces no additional collateral risk to the position.

Compared to ETH, XYZ asset is more likely to experience sharp price movements or liquidity stress.

As a result, a position backed entirely by ETH carries nearly no risk premium, whereas using XYZ asset as collateral introduces an additional risk premium that the user must pay.

We will deeply examine how this risk premium is calculated and applied in detail in the following sections.

Importantly, as we have discussed earlier, CRᵢ is not a fixed or universal property of an asset. It is a configurable risk parameter governed at the Spoke level, and its value is set and adjusted by the Governor based on the risk profile and design goals of each Spoke. This means that the same asset can be assigned different Collateral Risk values across different Spokes, depending on how it is intended to be used.

b) User-level risk: User risk premium (RPu)

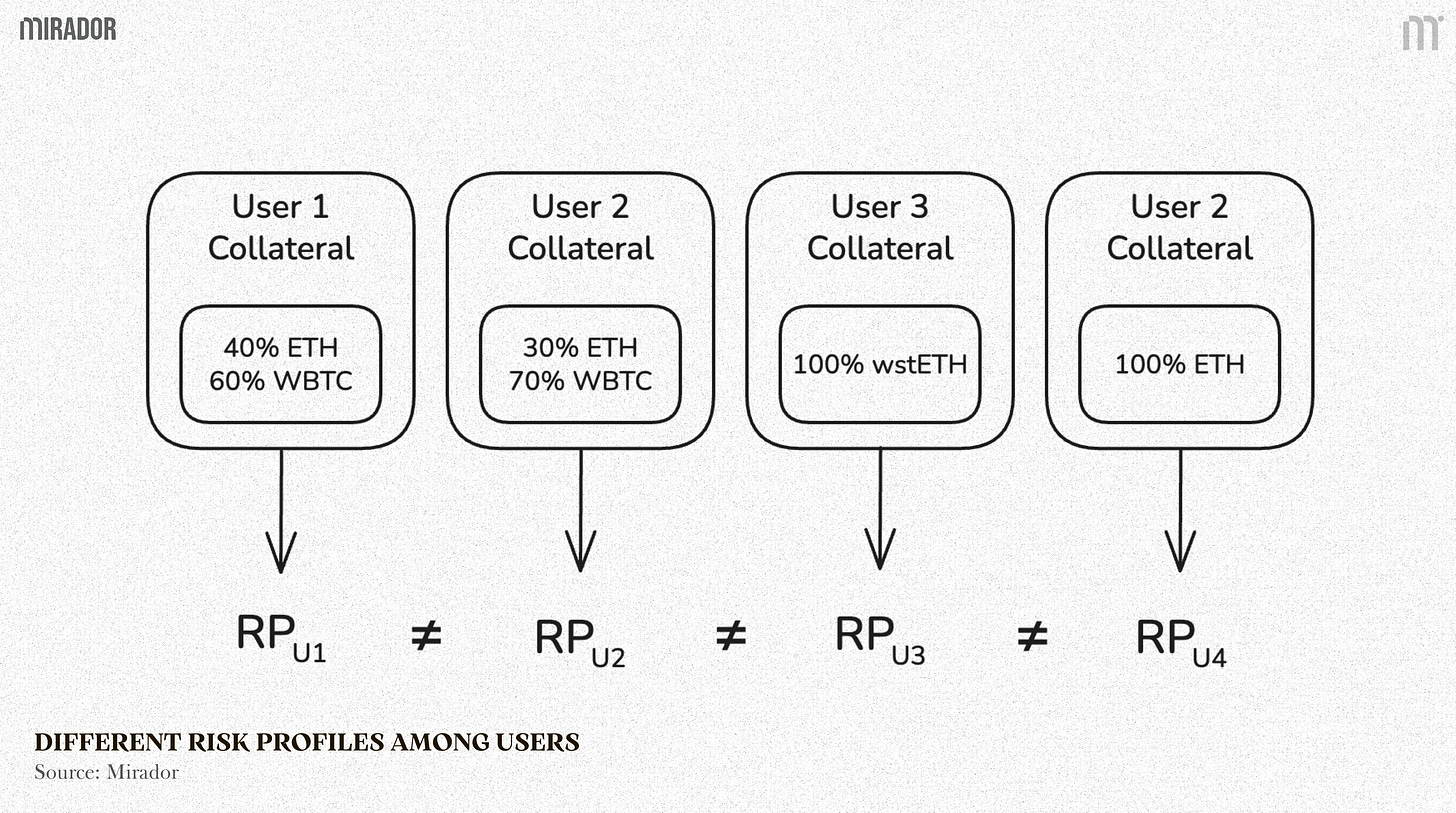

In practice, AAVE V4 allows users to back their debt with a portfolio of different collateral assets, rather than relying on just one asset. The composition of this collateral portfolio can vary significantly from one user to another, both in terms of asset types and relative weights.

In addition, risk profile can also vary over time for the same user’s position. Even if the set of collateral assets remains unchanged, the risk profile of a position is inherently dynamic. Even with an unchanged collateral set, a position’s risk profile can evolve over time due to price movements, debt accrual, and updates to risk parameters.

Therefore, assessing risk cannot stop at the asset level alone. Two users may hold the same collateral assets, but in very different proportions, leading to materially different risk profiles. To capture this position-specific risk, AAVE V4 introduces the concept of User Risk Premium (RPᵤ).

User Risk Premium (RPᵤ) represents the aggregated quality of the collateral backing a user’s borrowing position. It is a dynamic value that depends on several evolving parameters:

Collateral amount (Cᵤ,ᵢ) for asset i: The amount of asset (i) supplied as collateral by user (u). This value can grow over time as collateral may earn yield when being borrowed within the protocol.

Asset price (Pᵢ) for asset i: Asset prices fluctuate continuously, and different assets exhibit different levels of volatility, directly affecting the risk profile of the position.

Collateral Risk (CRᵢ) for asset i: the parameter of asset-level risk that we have discussed in the previous part.

Taken together, these factors allow AAVE V4 to compute a single, position-level risk metric that accurately reflects how risky a user’s borrowing position is and also reflects the changes in one position over time.

While RPᵤ defines what the risk level of a user’s position is, the next section explains how this value is computed in practice by identifying which collateral actually backs the debt and aggregating risk accordingly.

2/ Risk Premium algorithms

The Risk Premium algorithm connects the asset-level risk parameters defined earlier with position-level interest pricing in AAVE V4.

Collateral Risk (CRᵢ) provides the initial risk signal for each asset, but because a single position can be backed by multiple collateral assets, risk must be evaluated at the position level through User Risk Premium (RPᵤ).

At its core, this algorithms’ flow identifies the minimum set of collateral, prioritized from lowest to highest risk, that is strictly required to cover the user’s outstanding debt, and then computes a value-weighted average of their Collateral Risk to capture the position’s marginal liquidation risk.

Step 1 - Sort the collateral assets by risk level: starting with the safest assets (lowest CR) and ending with the riskiest ones (highest CR).

Consider a borrowing position backed by a portfolio of three collateral assets: ETH, WBTC, and wstETH.

Suppose the protocol assigns the following Collateral Risk (CR) scores within a given Spoke:

CRETH = 0 BPS (lowest risk)

CRWBTC = 200 BPS

CRwstETH = 150 BPS

Based on these risk scores, the collateral assets are sorted from lowest to highest risk in the following order:

ETH (CR = 0 BPS)

wstETH (CR = 150 BPS)

WBTC (CR = 200 BPS)

This ordering defines the priority in which collateral is considered when assessing the risk of the position. Lower-risk assets (such as ETH) are assumed to back the debt first, while higher-risk assets (like wstETH and then WBTC) are only taken into account if the safer collateral is insufficient to cover the outstanding debt.

Step 2 - Calculate total debt: Calculate the user’s total debt value (interest included) in base currency (totalDebt).

Once the collateral assets are ordered by their risk level, the next step is to determine how much debt the position needs to be backed.

This is done by calculating the user’s total outstanding debt, including accrued interest, and expressing it in a common base currency. This value, referred to as totalDebt, represents the amount of collateral that must be covered by the ordered collateral assets.

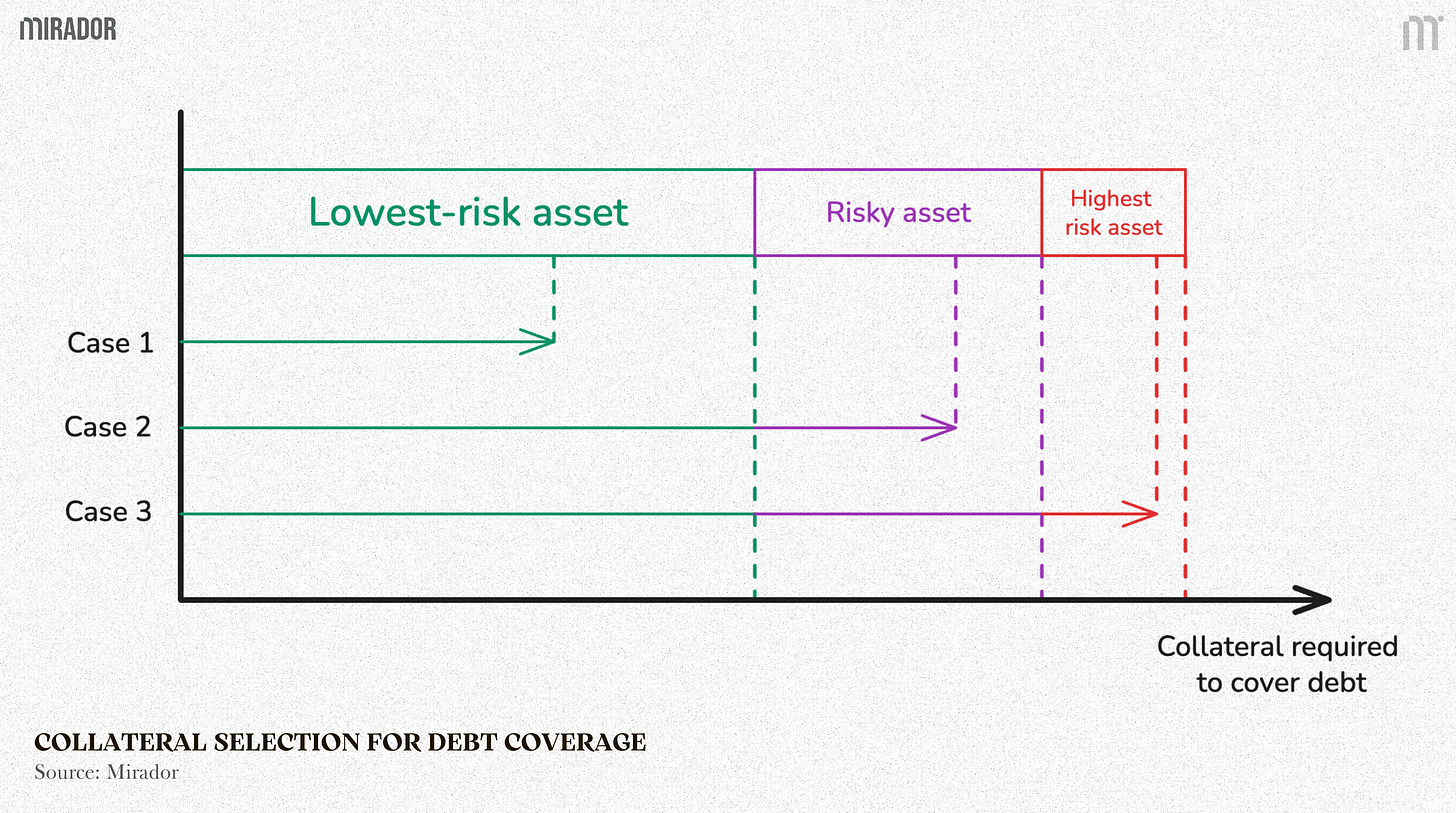

Step 3 - Collateral selection for debt coverage

Starting from the safest collateral, the protocol walks through the ordered list of assets and gradually uses them to cover the user’s total debt.

For each collateral asset, the system checks whether the remaining debt can be fully covered by that asset alone. If it can, only the necessary portion of the asset is taken and the process stops. If it cannot, the entire value of the asset is used, and the algorithm moves on to the next, riskier collateral.

This process continues until the total debt is fully covered, ensuring that only the minimum amount of collateral required, starting from the lowest-risk assets, is considered.

For example: Suppose a user has the following collateral portfolio:

$1,000 ETH (CRETH = 0 BPS)

$800 wstETH (CRwsETH = 150 BPS)

$700 WBTC (CRWBTC = 200 BPS)

Total outstanding debt (including interest) = $1,600

1/ ETH can covers $1,000 of the debt at maximum.

Therefore, remaining debt = $600.

2/ wstETH has enough value to cover the remaining $600.

Therefore, only $600 worth of wstETH is used and the process stops, while $200 wstETH and $700 WBTC in users positions are still untouched.

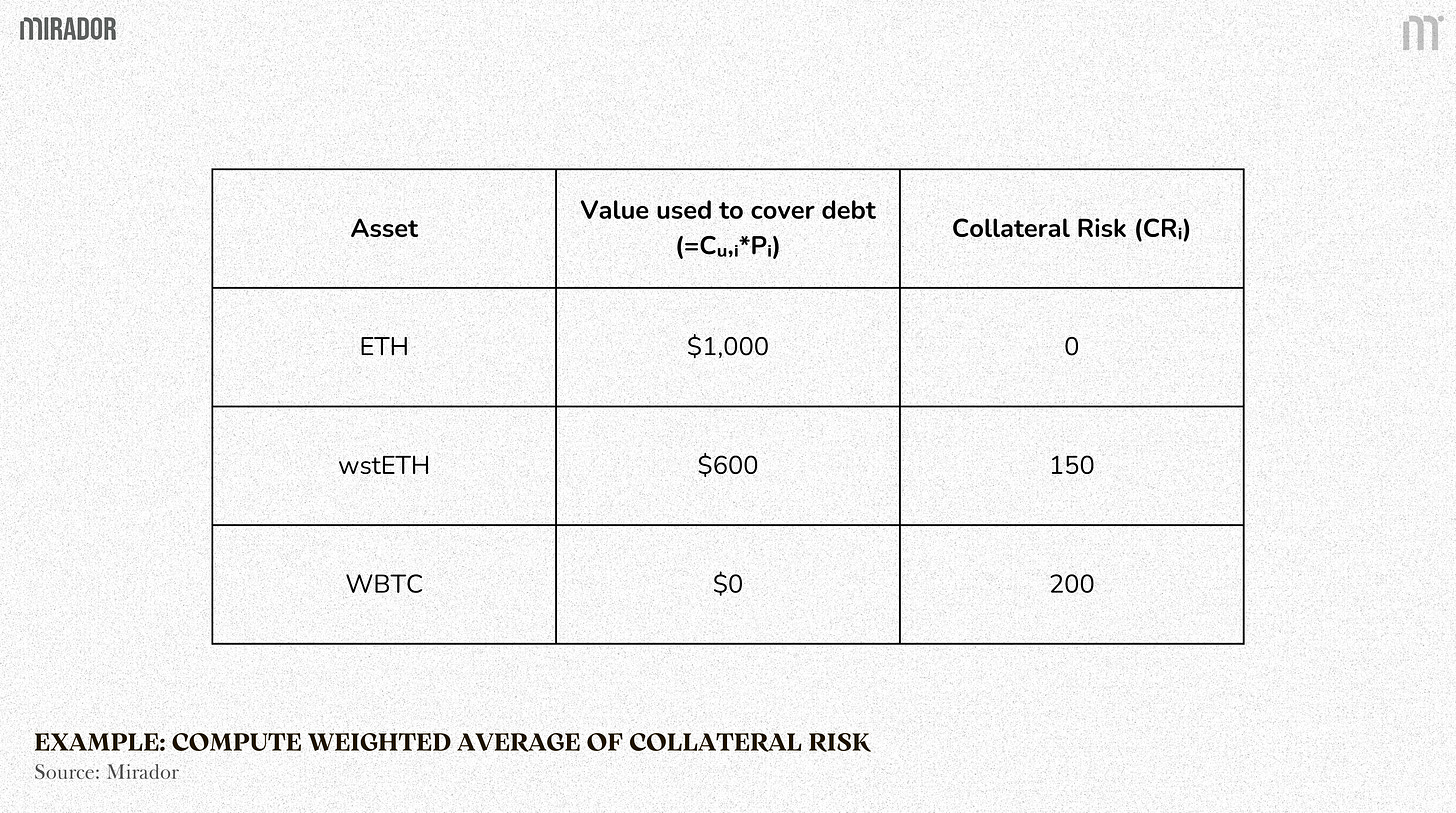

Step 4 - Compute weighted average of Collateral Risk for the included collateral assets and its amounts.

Once the set of collateral assets (and portions of assets) that actually back the debt has been identified, the final step is to aggregate their risk into a single position-level metric.

This is done by computing a value-weighted average of the Collateral Risk scores, using the amounts of collateral that were included in the debt coverage.

The formula to calculate RPᵤ can be written as:

With:

Cᵤ,ᵢ : Collateral amount for asset i

Pᵢ : Asset price for asset i

CRᵢ : Collateral Risk for asset i (BPS)

By weighting Collateral Risk by collateral value, the formula ensures that RPᵤ reflects the effective risk exposure of the position, not merely the presence of risky assets in the user’s portfolio. In other words, a risky asset only increases RPᵤ if it meaningfully participates in securing the debt.

For example (continuing): After performing the Debt Coverage Selection step, the effective set of collateral that actually backs the user’s debt is as follows:

Therefore, only ETH and wstETH are included in the risk calculation, applying the formula, we have:

So that, the Risk Premium in this case is 56.25 BPS.

Although the user supplied three different collateral assets, only ETH and a portion of wstETH are required to secure the debt. As a result, RPᵤ is calculated as a value-weighted average of the Collateral Risk scores of those assets alone.

The higher-risk WBTC does not affect the User Risk Premium at all, because it does not participate in backing the outstanding debt.

However, there are two practical questions remaining unanswered: when RPᵤ is updated, and how it is operationally applied to affect borrowing costs.

When is User Risk Premium (RPᵤ) updated?

In principle, User Risk Premium should continuously reflect the latest state of a user’s position, since it depends on collateral composition, asset prices, and governance-defined risk parameters. In practice, however, continuous updates are not feasible on EVM-based blockchain, as they would require constant on-chain computation and state changes.

Instead, in AAVE V4, RPᵤ is recalculated only when the user executes an action that can change the risk profile of the position. These actions include supplying or withdrawing collateral, borrowing or repaying debt, or explicitly triggering a position update.

If the user remains inactive, RPᵤ is left unchanged, even if prices move or risk parameters are updated in the background. Exceptionally, the Governor retains the ability to forcibly update the User Risk Premium of a given user to match the most recent risk parameters of its collateral assets, even in the absence of user interaction.

This design strikes a balance between risk accuracy and on-chain efficiency, ensuring that RPᵤ is always correct when it matters, without incurring unnecessary computational overhead.

How does User Risk Premium (RPᵤ) operate in practice?

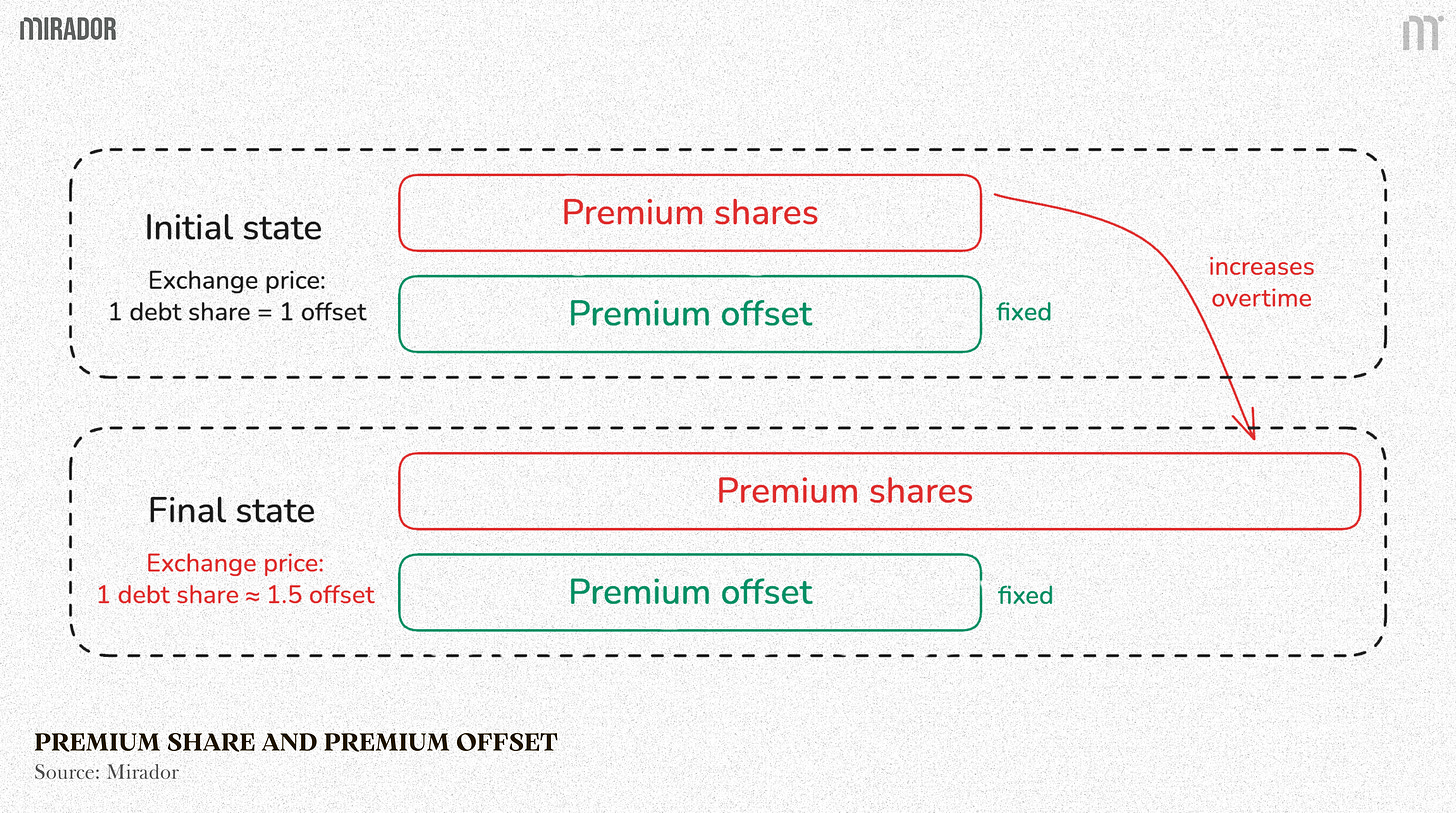

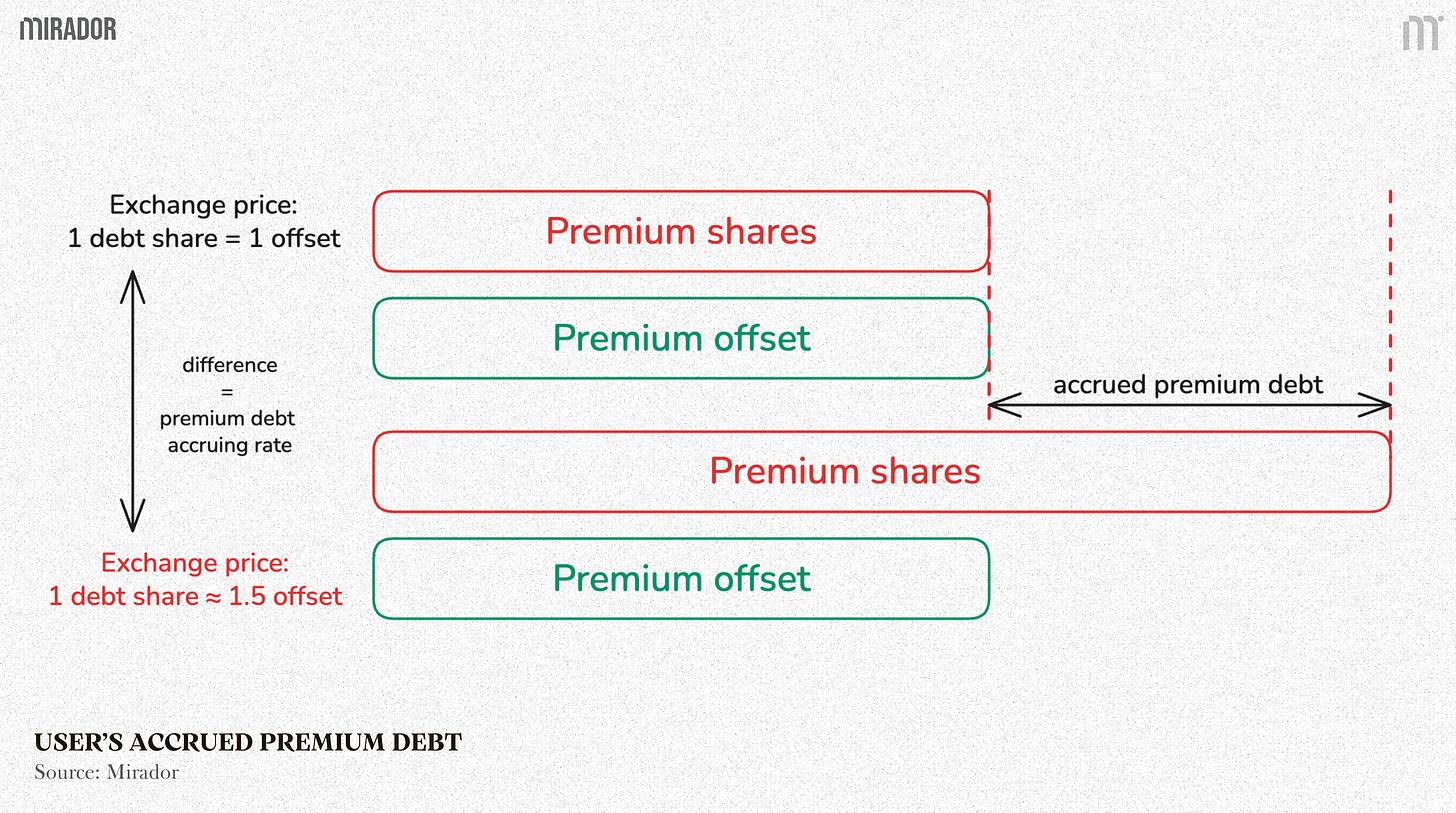

Once RPᵤ is determined, it must be translated into actual borrowing costs without directly modifying the principal debt. AAVE V4 achieves this by introducing virtual debt shares, known as premium shares, together with a corresponding premium offset.

In AAVE V4, premium shares do not represent additional borrowed assets. When a user borrows, they receive exactly the amount shown in the interface, and this amount is recorded as base debt, which is the only real principal in the system.

The purpose of premium shares is purely accounting-based: they exist to measure and accrue the extra interest associated with collateral risk over time.

To ensure that no extra cost is charged upfront, the protocol creates a premium offset at the same time as the premium shares. Initially, the value of the premium shares and the offset are equal, meaning the user owes no risk premium at the moment of borrowing. As time passes, interest accrues on the premium shares while the offset remains fixed. The difference between the two represents the accumulated risk premium that the user gradually pays for using riskier collateral.

This design allows AAVE V4 to price collateral risk dynamically through interest, without increasing the borrowed principal or giving the impression that the user has taken on additional debt.

At any point in time, a user’s accrued premium debt is calculated as the current asset value of their premium shares, minus the premium offset.

When the user performs an action (such as borrowing, repaying, or adjusting collateral), the premium accumulated so far is locked in and moved to a “realized premium” balance. The system then resets both the premium shares and the premium offset, because the user’s Risk Premium may have changed and the premium accounting must be recalibrated to reflect the new risk profile.

The difference between the two represents the accumulated risk premium owed by the user.

Therefore, at its core, the Premium Offset serves as a baseline reference in AAVE V4’s risk-aware interest accounting. Its purpose is to ensure that risk premium accrues only over time, rather than being charged immediately at the moment a position is opened.

3/ Final Interest Rate calculating

As we have mentioned earlier, in AAVE V4, interest on a borrowing position does not come from a single source. Instead, it is split into two components:

Base rate: based on utilization of borrow assets in Hub

Premium rate: reflecting how risky the user’s collateral is.

These two components grow separately in the system, but from the user’s perspective, they are combined into one total debt balance.

a) Base rate

The base rate represents the cost of using liquidity from the Hub.

When a user borrows an asset, the borrowed amount is recorded as Base Debt. This is the real principal the protocol provides on the user’s behalf.

Overtime, Base Debt accrues interest according to the Hub’s base borrow rate. This rate depends on liquidity utilization, not on collateral quality.

b) Premium rate

The premium rate represents the extra interest charged because of collateral risk.

The premium rate is where the Risk Premium algorithm becomes economically meaningful. All of the previous mechanisms exist for a single purpose: to determine how much additional interest a user should pay on top of the base rate.

For example: Suppose the base borrow rate for GHO is 5% (500 BPS).

If you use WETH as collateral, which has a Collateral Risk of 0 BPS, no premium is applied. Your interest accrues purely at the base rate of 5%.

But if you instead use LINK as collateral, and based on the user’s collateral composition and the Risk Premium algorithm discussed earlier, the protocol determines that your position has a Risk Premium of 300 BPS (for example).

Your effective borrow rate is now therefore:

In other words, the user pays a higher interest rate not because more liquidity is borrowed, but because the collateral backing the position is assessed as riskier.

CONCLUSION

Risk Premiums make borrowing in AAVE V4 fairer and clearer. Users who provide safer collateral can borrow at lower interest rates, while riskier positions naturally pay more. This encourages better collateral quality and helps keep the system stable.

At the same time, the protocol can support many different assets and lending styles without forcing everyone into the same risk bucket. By pricing risk more accurately, AAVE V4 improves market efficiency and creates a healthier, more sustainable model for both users and the protocol.

Importantly, this accounting design ensures that users always borrow exactly the amount they intend to, while collateral risk is priced gradually through interest rather than upfront charges. By separating principal debt from risk-based accrual, AAVE V4 avoids hidden costs, improves transparency for borrowers, and aligns borrowing costs more closely with the true risk a position introduces to shared liquidity.

DISCLAIMER

In this article, we focus on analyzing the Risk Premium mechanism in AAVE V4, explaining how collateral risk is incorporated into borrowing costs at the position level. Rather than evaluating performance or making protocol comparisons, our goal is to break down the core design logic and on-chain mechanics behind AAVE V4’s risk-aware interest model.

Throughout the article, we do not avoid discussing technical concepts, smart contract flows, or mathematical formulations that may initially appear complex. However, all models, examples, and calculations are intentionally simplified and explained step by step, with the goal of making AAVE V4’s risk-aware interest model clear, intuitive, and accessible to readers with different levels of DeFi experience.

Ahead of the AAVE V4 launch, we will return with further deep-diving articles exploring other key components of the new architecture.