HYPERLIQUID UNDER PRESSURE: BACKSTOP DYNAMICS AND THE ROLE OF ADL

This research is to analyze Hyperliquid’s liquidation architecture - including market, backstop liquidation and ADL - as well as the structural trade-offs associated with these mechanisms.

INTRODUCTION

Recently, Hyperliquid’s liquidation system has become a focal point of discussion across the crypto ecosystem. A series of high-profile liquidation events - together with heated debates about fairness, decentralization, and platform solvency - has drawn attention to how the exchange’s risk engine behaves under real stress.

As Hyperliquid has scaled into one of DeFi’s largest perps venues, this exchange has faced increasing complex pressures over its liquidation mechanism, particularly related to the role and risk profile of its HLP vault - a core liquidity and backstop component of the system.

In this article , we examine Hyperliquid’s liquidation architecture, the dynamics of backstop liquidations and Auto-Deleveraging (ADL), and the broader trade-offs that emerge when building a high-performance on-chain perps exchange.

KEY TAKEAWAYS

This article will analyze the liquidation mechanism of Hyperliquid in detail through the following main sections:

Overview: Understanding about the liquidation order of Hyperliquid in a general view

Deep-dive: Understanding every liquidation mechanism of Hyperliquid, together with several major on-going risks surrounding the HLP vault (backstop dynamics) and the insight into the ADL

OVERVIEW: HYPERLIQUID’S LIQUIDATION ORDER

Trading on any exchanges also comes with risks, one of which is liquidation risk.

Briefly speaking, opening a long or short position always requires users to deposit a certain amount of margin as collateral. If the price goes against the position too much, the equity or account value will drop lower than the maintenance margin. At this time, their position is eligible for liquidation. The system needs to close the trader’s position before their account goes negative and leaves bad debt.

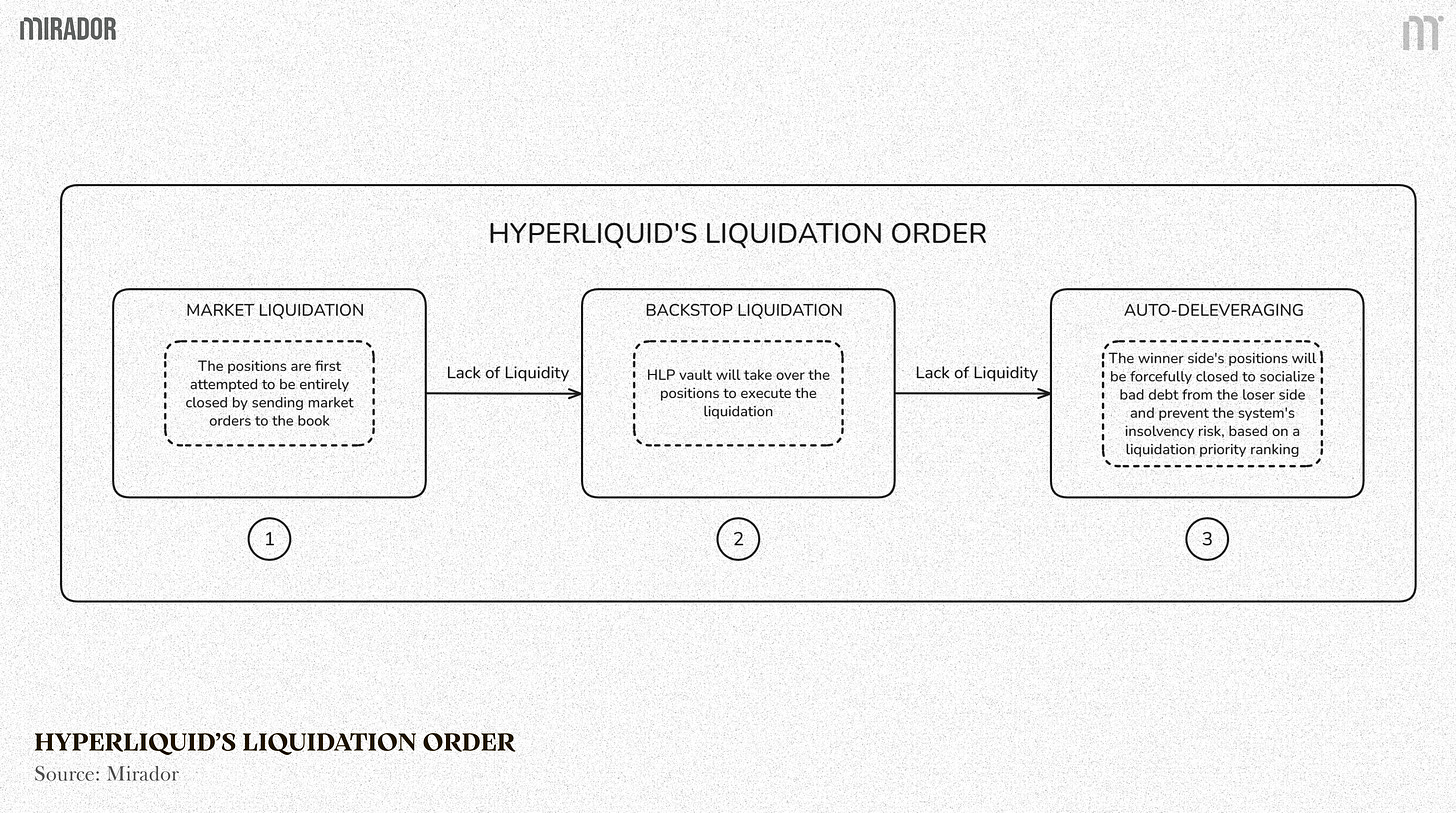

Below is the liquidation order of Hyperliquid. You can look at the picture below for an overview, we will dive into this later.

DEEP-DIVE: HYPERLIQUID’S LIQUIDATION MECHANISM

1. Market Liquidation

Generally, market liquidation is the most basic solution to liquidate a position. In general, the system sells or buys back a portion of the liquidated position directly into the order book. On Hyperliquid, when a long is liquidated, that size is sold into the book and filled by the best bid, effectively transferring the position to a new trader with fresh margin.

Yet, the problem occurs when the liquidity on the order book system is not enough to close full of the position value, especially in the case of new/illiquid tokens. That’s when HLP vault comes in to activate backstop liquidation.

2. Backstop Liquidation And Some Controversies Surrounding It

Before delving into this liquidation mechanism, let’s first learn some basic information about HLP vault.

2.1. What Is HLP Vault?

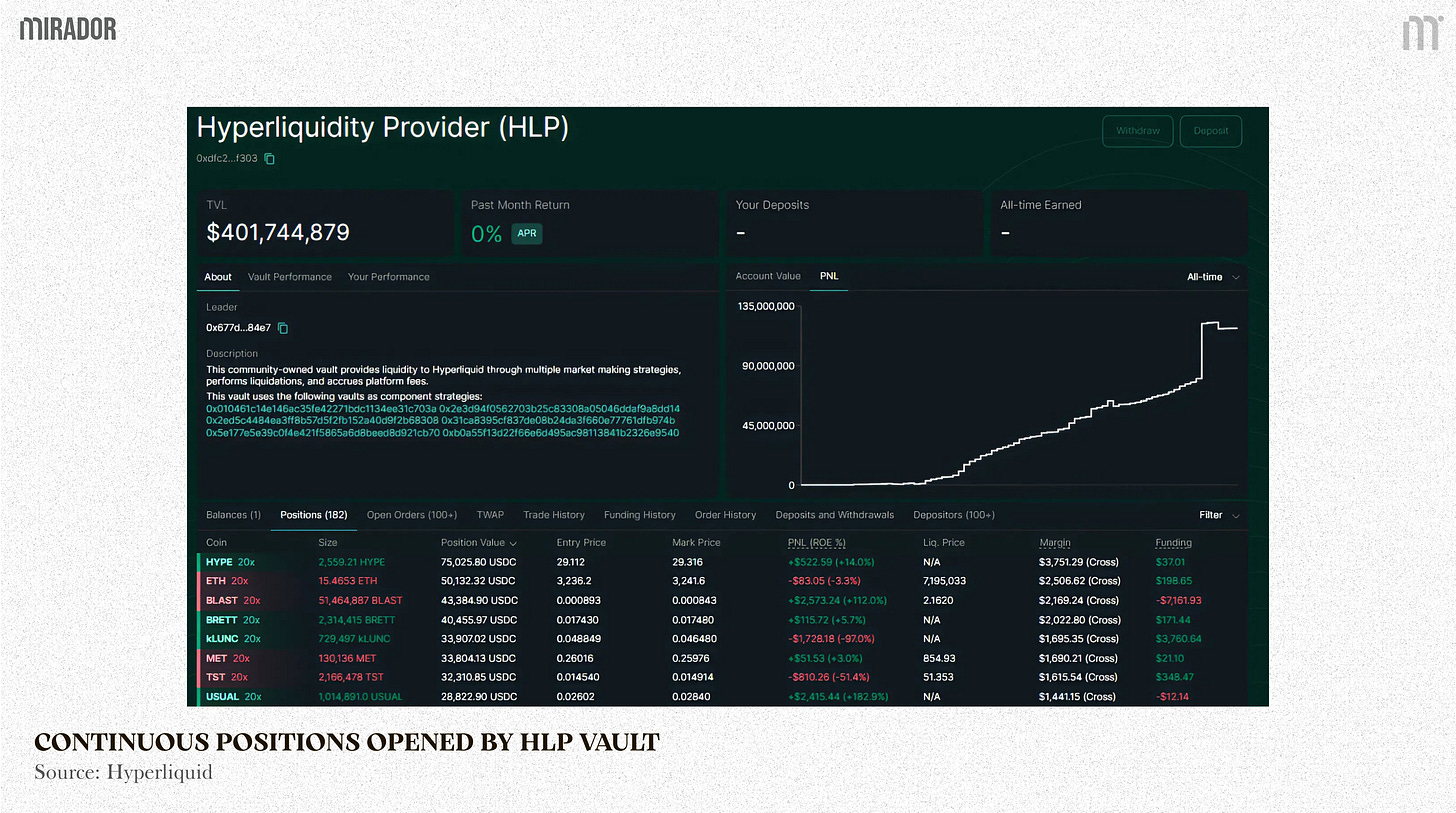

HLP, or Hyperliquidity Provider, is a vault managed by Hyperliquid protocol, allowing the community to contribute their own assets to the vault. This vault is mainly used to support liquidity for the market, proceed market-making strategies, execute liquidation and receive protocol fees as revenue.

Depositing tokens like USDC into the HLP vault makes you become a liquidity provider (LP), as the name of the vault suggests. For LPs, they can gain profits or even loss depending on the vault performance.

2.2. What Does The HLP Vault Do Exactly?

A) Market Making

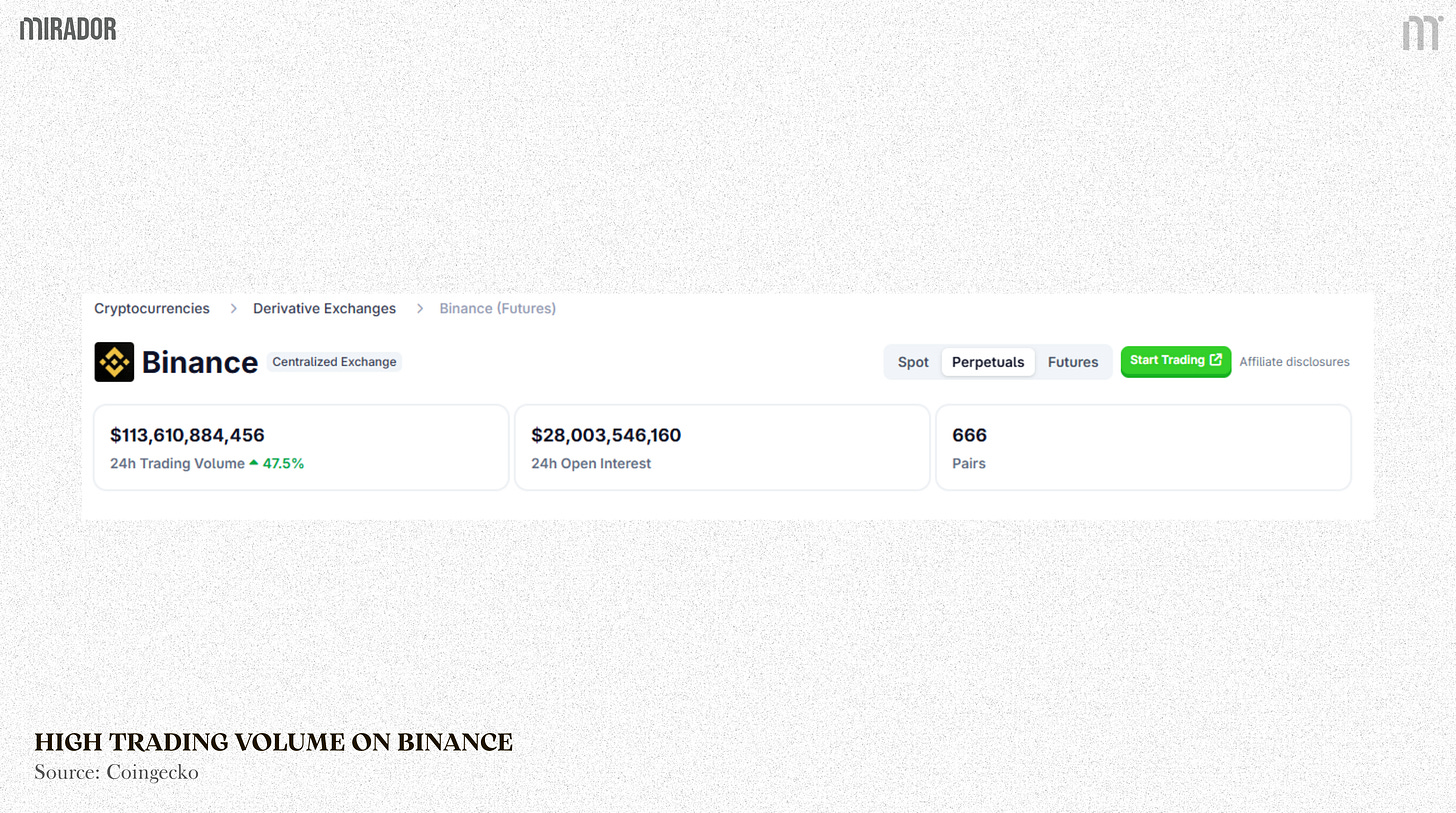

Binance, the leading centralized exchange for crypto assets, processes more than $80B in daily trading volume. So the liquidity on this CEX is very deep, making it easier for users to trade and match orders.

Much of this liquidity is supported by professional market-making firms that continuously quote both sides of the order book, resulting in tight spreads and high execution reliability. This is the key reason why top CEXs like Binance remain the default venues for most traders. For new order-book DEX like Hyperliquid, liquidity is always a priority issue that needs to be addressed to create smooth trading and less price volatility.

However, with transparency to be the guiding principle, Hyperliquid can’t rely on internal or privileged market makers in the same way CEXs do.

So, the solution is to make it public and permissionless!

The first and foremost role of HLP vault is to be a collective market maker (or liquidity backstop) where anyone can provide liquidity to secure a balanced market.

When users deposit USDC into HLP, they authorize the system to use these assets to support market operations. In case the liquidity demand on the order book system is not enough for users to match orders, the HLP will then step in to execute the remaining portion at the mark price, ensuring continuity of execution and reducing slippage during thin-liquidity moments.

For example, when plenty of traders open perpetual long BTC positions at the same time but few traders open short positions on the order book. This causes the liquidity not enough for all the long positions to be matched. So, to handle this, HLP will open equivalent short positions, like a real trader.

Therefore, at its core, HLP is no different than a trader, but runs more frequently than normal users. And depositing money into this vault is like performing a copytrade strategy, where LPs don’t need to trade by themselves and share profits or even loss together with the vault.

B) Backstop Liquidation

As mentioned above, when the order book lacks sufficient liquidity to satisfy market liquidation demands, the backstop liquidation mechanism will be enforced.

When the liquidated order can’t be fully matched, causing the account equity to drop below 2/3 of the maintenance margin, HLP vault will join to take over that position. When being backstop liquidated, the maintenance margin of traders, which is used as a safety net to ensure a profitable value for the vault, won’t be returned.

Example:

Say a trader on Hyperliquid opened a large short position on BTC, expecting the future price to drop down. After a certain time, the price of BTC suddenly pumped, causing his position to be liquidated. As usual, the matching engine of Hyperliquid will send a market liquidation order onto the order book for other traders to match and close this liquidated order. However, due to the poor market liquidity of the DEX, only half of this position value was matched, the remaining will be backstop liquidated. The remaining margin would be transferred to the HLP vault to take on. This vault can:

Keep the short position, wait for the BTC price to turn down and make a profit

Close immediately to avoid prolonged risks

Profit or loss totally depends on the vault’s strategy.

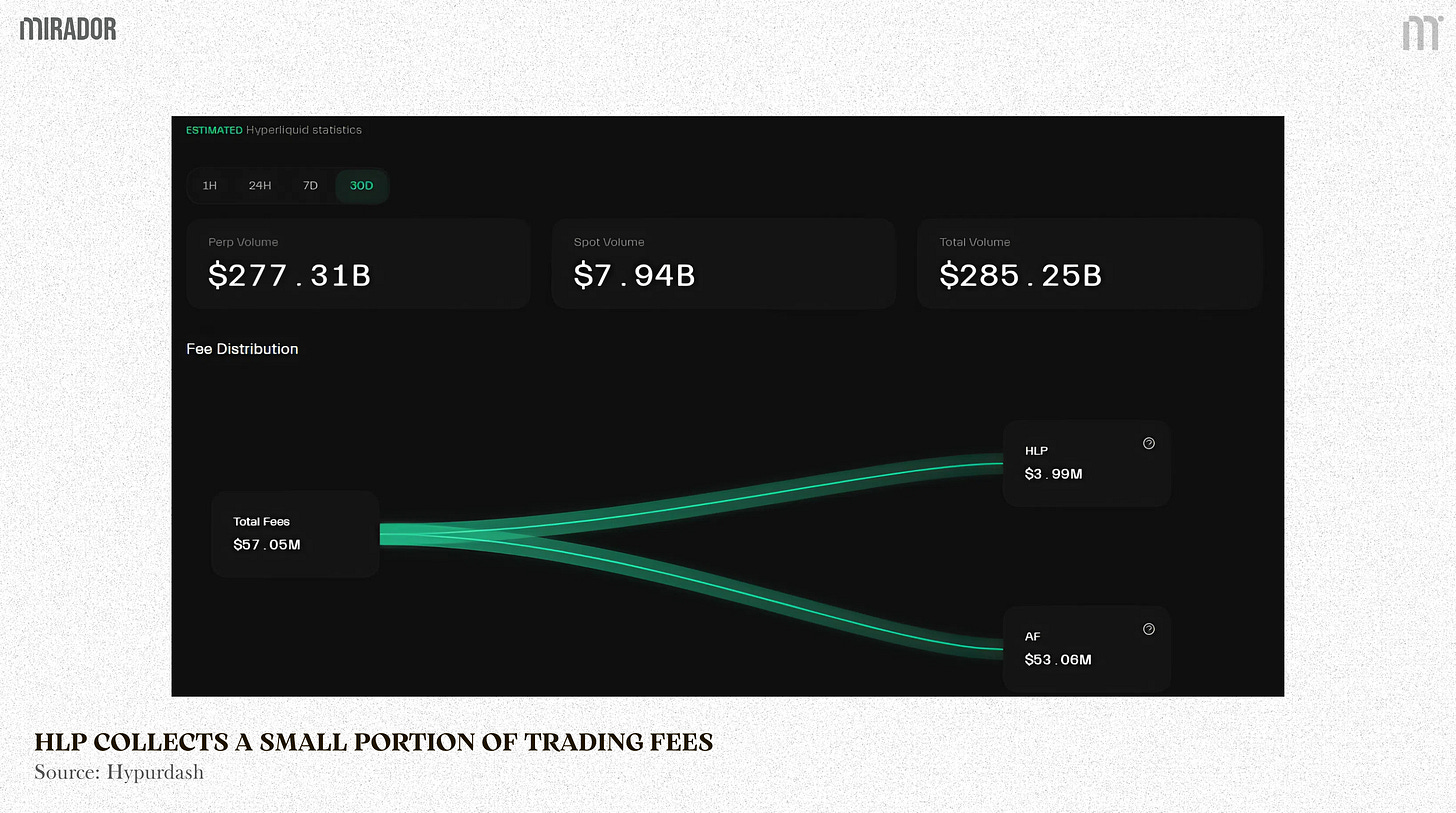

C) Accrue Platform Fees

Besides gaining profits from liquidation and market making strategies, HLP vault is also permitted to receive a portion of trading fees on the platform. This is an advantage over CEXs where fees mainly benefit their team, corporation or insiders.

As a community-driven vault, HLP is configured to receive a small amount of trading fees of Hyperliquid, about 7% as seen in the picture above.

So, the HLP vault also acts like a passive yield source for LPs.

That’s the theory, but what about the reality?

Does this HLP vault really benefit both sides: the users and the protocol itself?

The answer is YES and NO.

YES, because the HLP vault was born to generate passive income for LPs as mentioned above. It also serves as an automatic market making tool and earns profits (and loss, too).

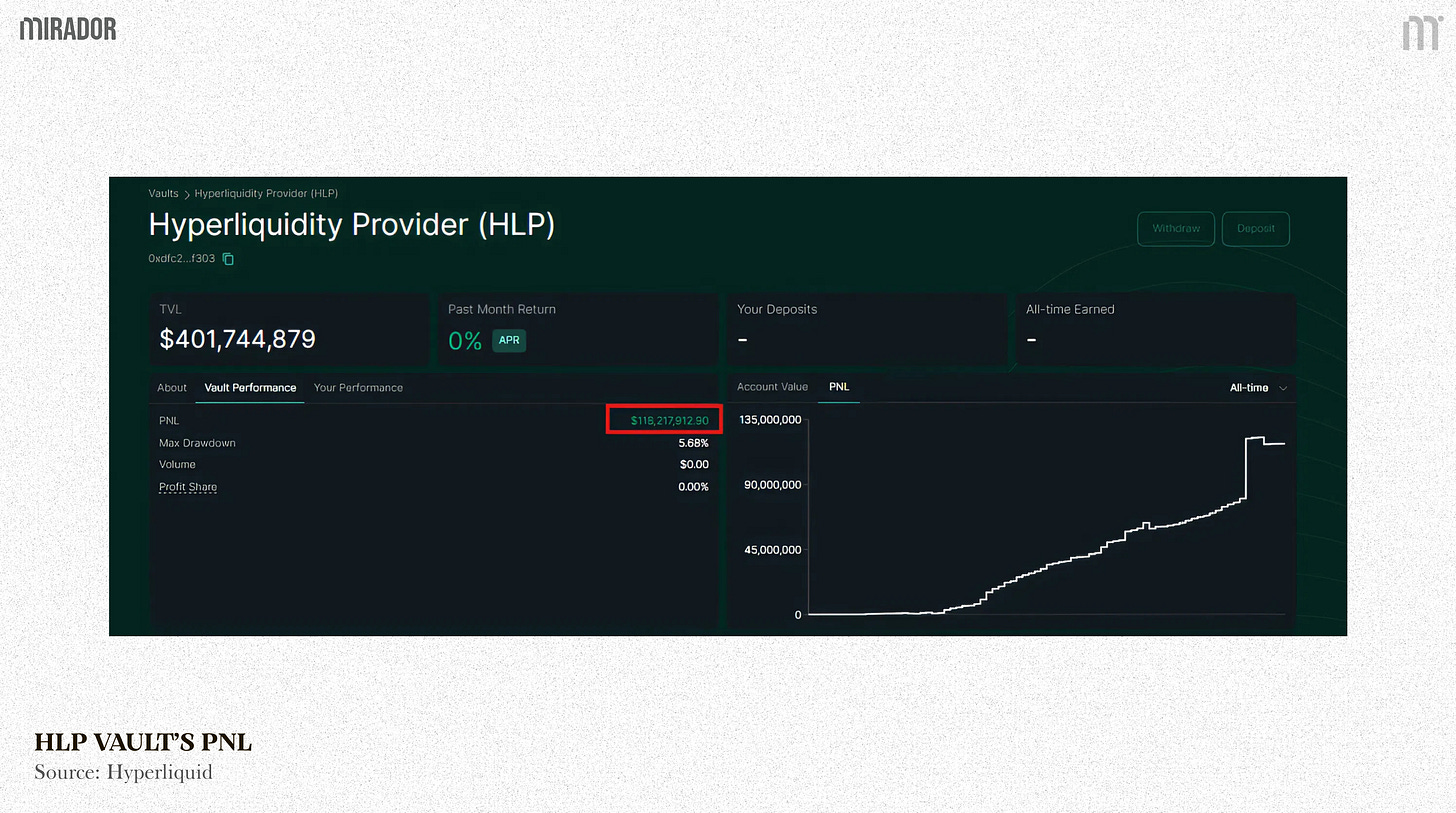

As reflected in the picture above, from May 11, 2023 to present, the vault has recorded over $118M in net profit, highlighting its consistently strong returns.

And above all, the HLP vault was born to protect the protocol itself from insolvency and systemic imbalance via a backstop liquidation mechanism as explained above.

And NO, because the reality is not so rosy. Backstop liquidation is inherently applied to shield Hyperliquid from insolvency, but in fact, under extreme conditions, this very mechanism can also be a source of solvency risk.

2.3. The Ongoing Risks Surrounding HLP Vault And Its Backstop Dynamics

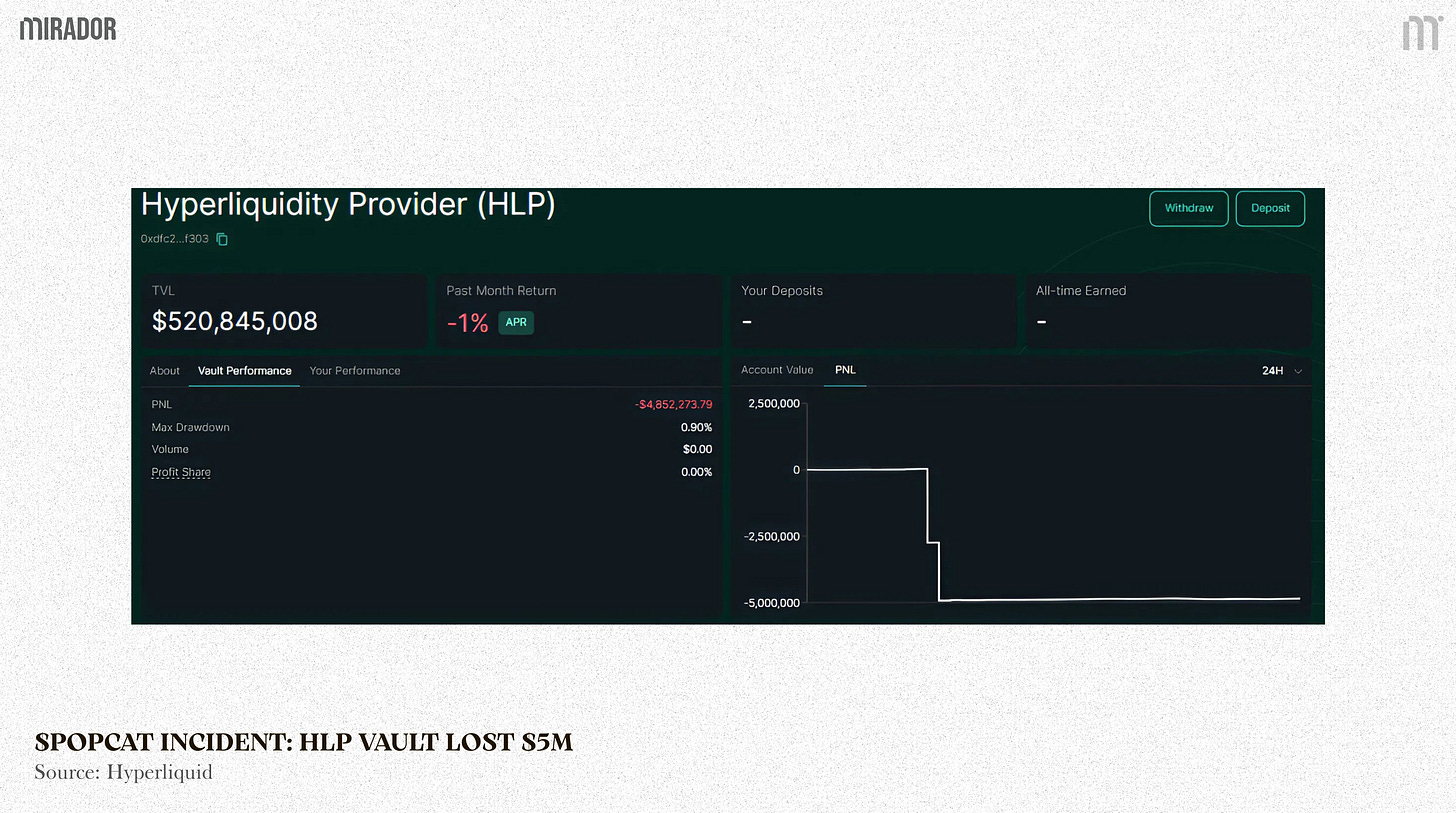

In 2025, Hyperliquid faced 3 major incidents related to the HLP vault, causing this protocol vault to encounter significant losses.

A) $ETH Incident

The incident happened on March 12, 2025 when a whale wallet opened a long ETH position on Hyperliquid with the margin of over $4M and max leverage (~50x), resulting in the total position value of over $200M. After the ETH price surged, this whale suddenly withdrew a large amount of margin, causing the whole position eligible for liquidation.

However, with such a big volume, the order book’s liquidity was not enough for market liquidation. As such, the backstop liquidation was activated by the HLP vault. The long position together with the remaining margin was transferred to this vault.

Since the takeover price of that position was so unfavorable, HLP suffered a loss of about $4 million over the past 24h. Whereas, the whale successfully walked away with the profit gain of $1.8M.

After this incident, Hyperliquid had to admit the vault’s loss (actually LPs’ loss) and decided to reduce the max leverage for BTC and ETH from 50x each to 40x and 25x, respectively in order to raise the value of maintenance margin, especially for large orders and prevent a repeat.

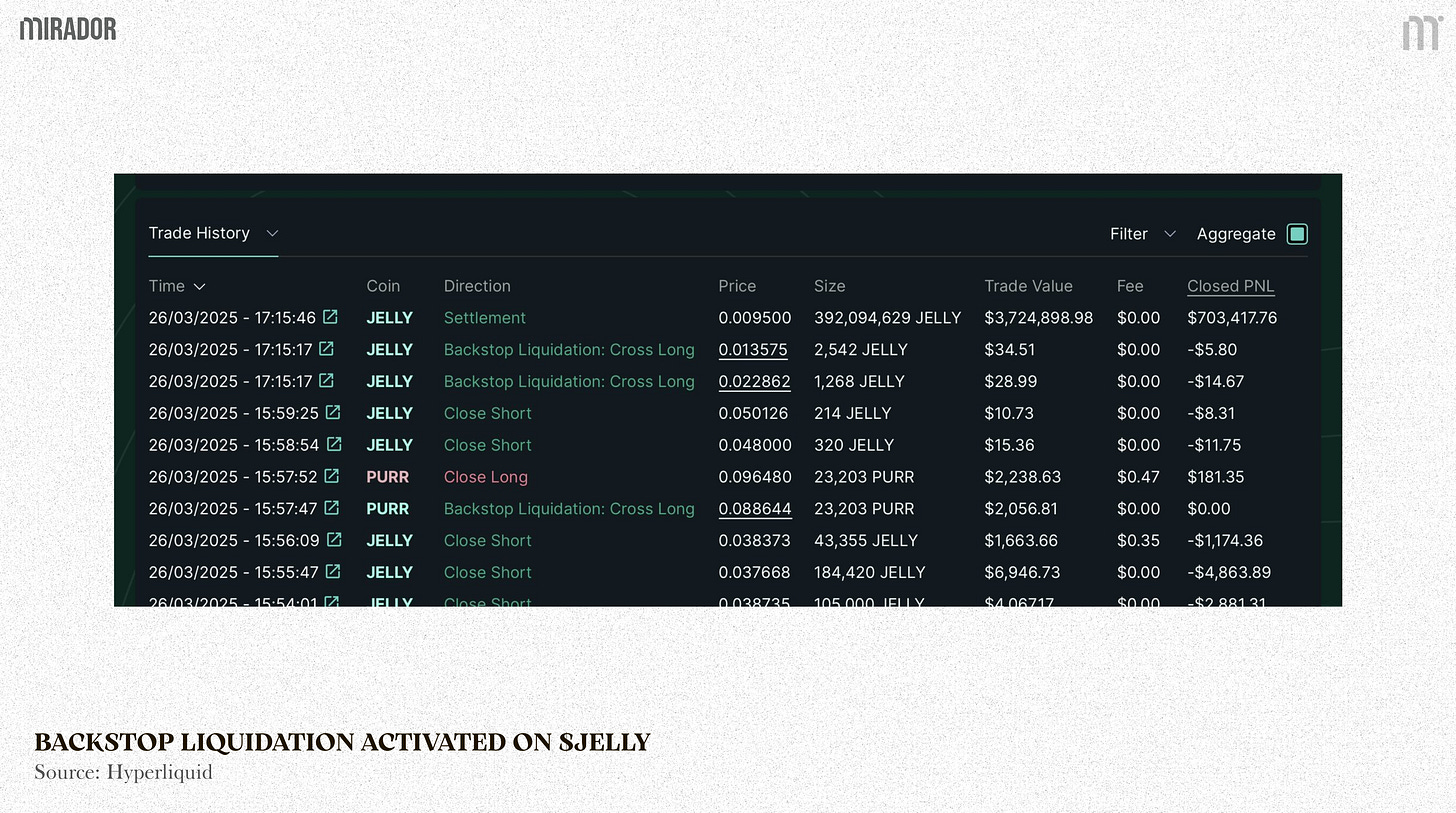

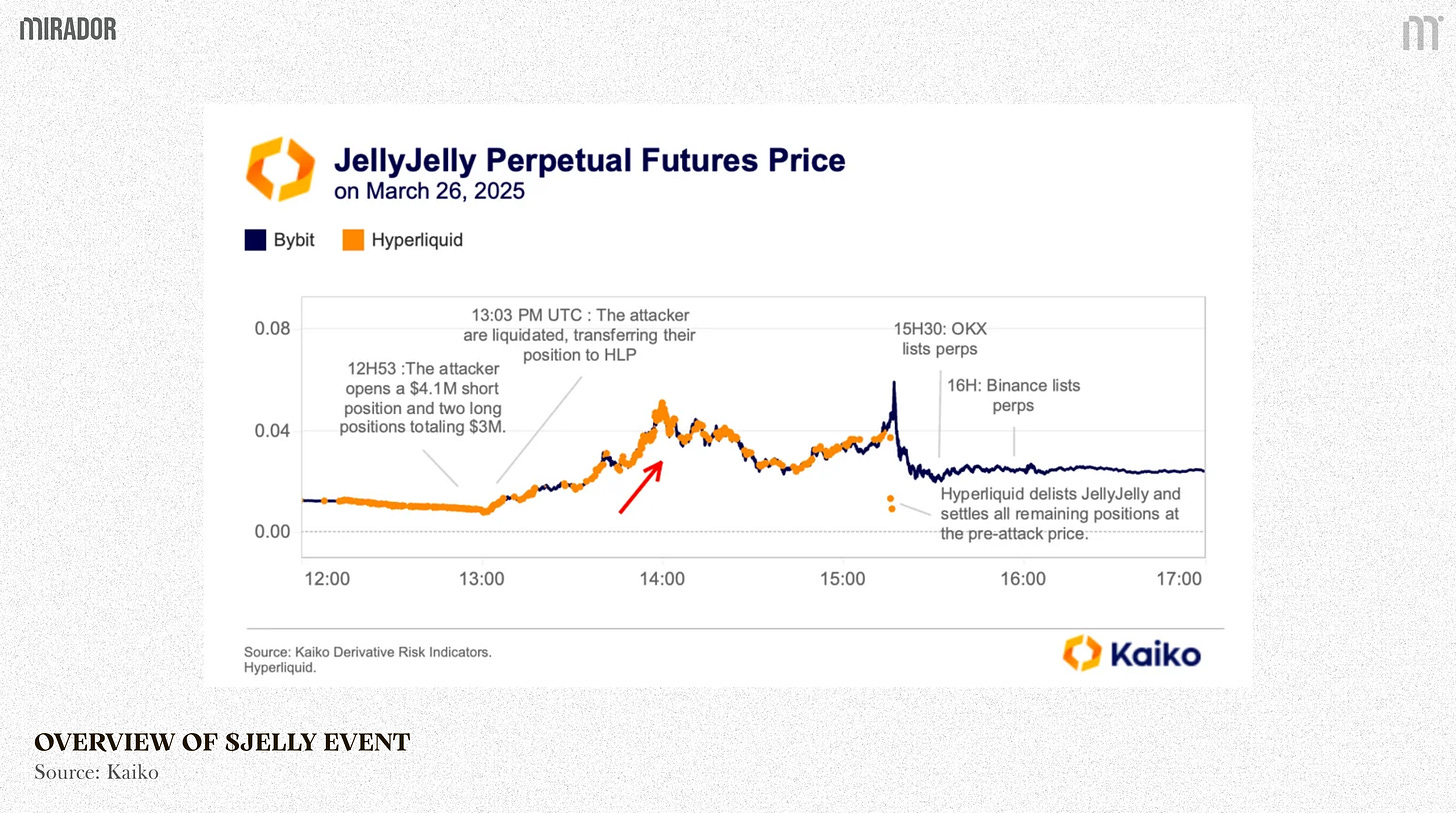

B) $JELLY Incident

However, it wasn’t long before a similar incident occurred again. This time was related to $JELLY token, a Solana-based illiquid token on Hyperliquid with only $15M market cap.

On March 26, 2025, a whale opened large positions in Jelly-My-Jelly token on Hyperliquid perps, including one short position of ~$4M and two long positions of ~$3M.

First, after the big short position, many retail traders also opted for short positions on $JELLY believed that its price would plummet.

Following the scenario as in the first case, the whale withdrew the margin of short position, triggering the liquidation by market. Then, as the market liquidation couldn’t be matched, the burden was moved to the HLP vault to take on.

After that, this whale opened two new long $JELLY positions. After a while, the news that OKX and Binance listed $JELLY on perps was widely publicized, causing the price to increase from ~$0.00806 to ~$0.0517 (~500%) in only 1 hour.

The HLP vault was recorded a huge impermanent loss of over $12M after the short squeeze. However, what surpised onlookers was that Hyperliquid decided to delist $JELLY and adjust the price oracle to escape all the losses through the voting process of validators. This act raised the question of the decentralization nature of this DEX.

And after all, the HLP vault suffered almost no loss, except from the mass withdrawal from the LPs later.

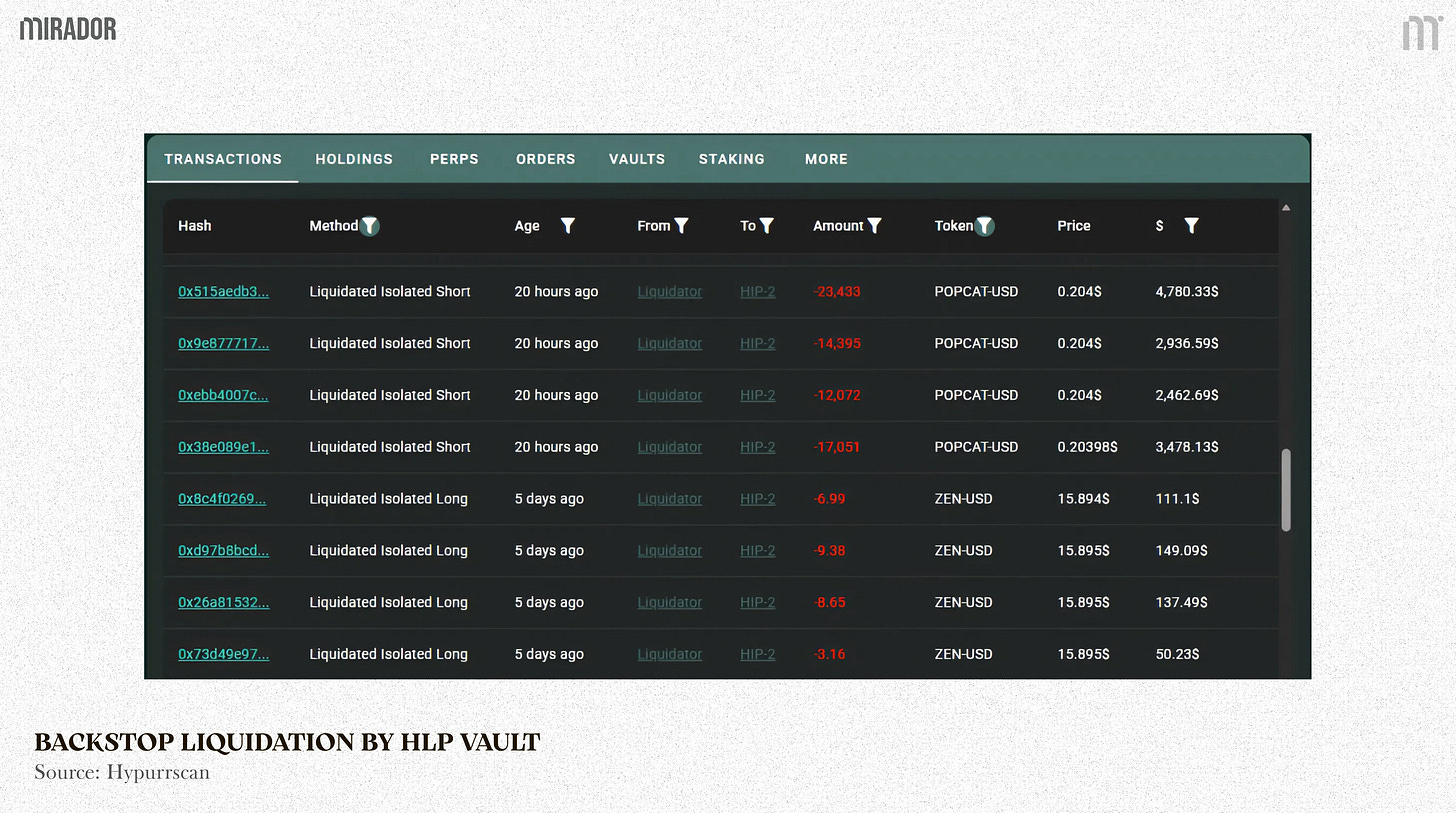

C) POPCAT Incident

There’s a saying: Once is chance, twice is coincidence, three times is a pattern.

After two consecutive incidents, Hyperliquid was expected to be able to restore and improve the loophole in their liquidation mechanism, but no, another incident just happened recently, with a similar scenario.

Similar to $JELLY case, this time was the same but in the opposite direction - long position on $POPCAT.

With an aim of market manipulation, on November 13th, 2025, an anonymous trader withdrew $3M USDC from OKX, then opened long $JELLY positions across 19 wallets on Hyperliquid, building ~$30M leveraged position value.

In order to pump this token, he attempted to set a strong buy wall ($30M worth) at $0.21, creating a FOMO for other traders to follow the move.

After successfully trapping these small fishes, he suddenly canceled all the buy orders, leading to the big drop in $POPCAT price and mass liquidations on the market. As a rule, due to the liquidity imbalance, the HLP vault now had to join in and take over these long positions, resulting in an additional ~$5M loss.

After all, the trader lost his $3M collateral, and the protocol team had to intervene manually to stabilize market and close remaining exposure.

(?) A key question is:

Why were these whales willing to take extremely large and asymmetric positions, despite the high likelihood of significant losses?

While there has been speculation within the community regarding potential strategic motives or coordinated actions, there is currently no verifiable evidence supporting these claims.

Instead of attributing these events to specific actors or intentions, a more rigorous interpretation is that the incidents revealed a repeatable market pattern: sharp directional moves → increased FOMO flow → concentrated pressure on HLP’s inventory. Under these conditions, the vault becomes exposed to short-term directional imbalance, which can result in substantial drawdowns.

Thus, this is the critical risk that the HLP vault is facing. Despite all its advantages, these real-time incidents have exposed that this perps DEX is far from truly decentralized as it claims to be, and it is gradually losing the community trust.

What if the HLP vault couldn’t meet the liquidation demand?

The last resort is to activate: Auto-Deleveraging

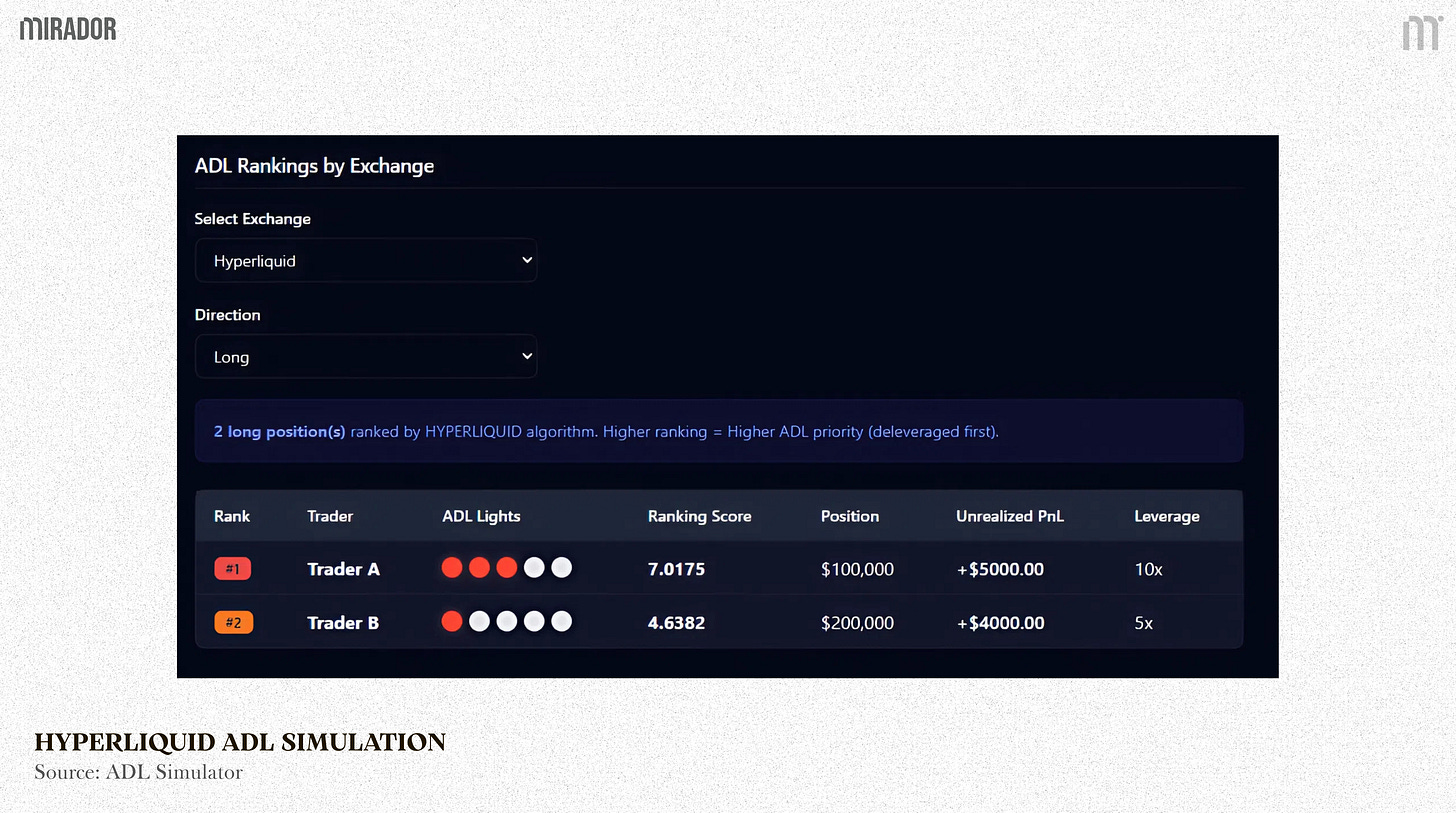

3. Auto-Deleveraging And The Trade-Off

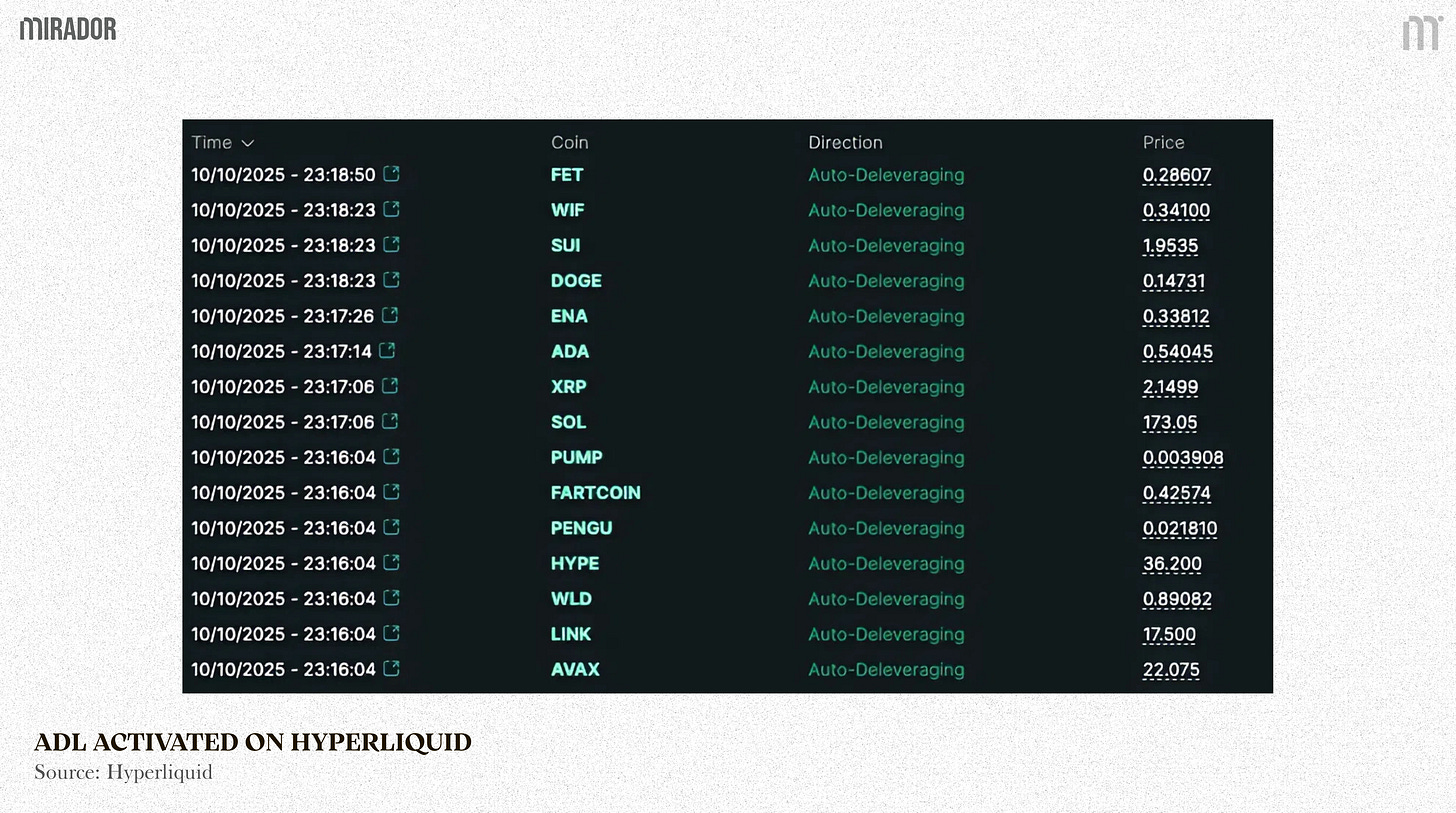

Auto-Deleveraging (ADL), is the final safety mechanism to keep the system solvent and prevent bad debt in case market and backdrop liquidation are not workable. And the ADL has nothing to do with the HLP vault or backstop liquidations.

The core idea of ADL: pick certain traders to “push off the table”.

Their opening positions are ranked by the following criteria to qualify for the ADL:

making the biggest unrealized profits

using the highest leverage

the biggest size

It means that even though you are sitting on huge unrealized profits, if the ADL is conducted, a part of your positions might be forcibly closed so the platform can protect all the users and itself from insolvency.

As can be seen in the picture above, Trader A with higher unrealized PnL and leverage would be ranked above Trader B in the ADL scenario.

Why is ADL legal?

Because the nature of perps is a zero-sum game, the profits of winners are derived from the loss of losers. In perps, if the long/short person dies, and no one replaces them, then you - the winner - can’t keep winning either since there’s no one left losing money to pay you.

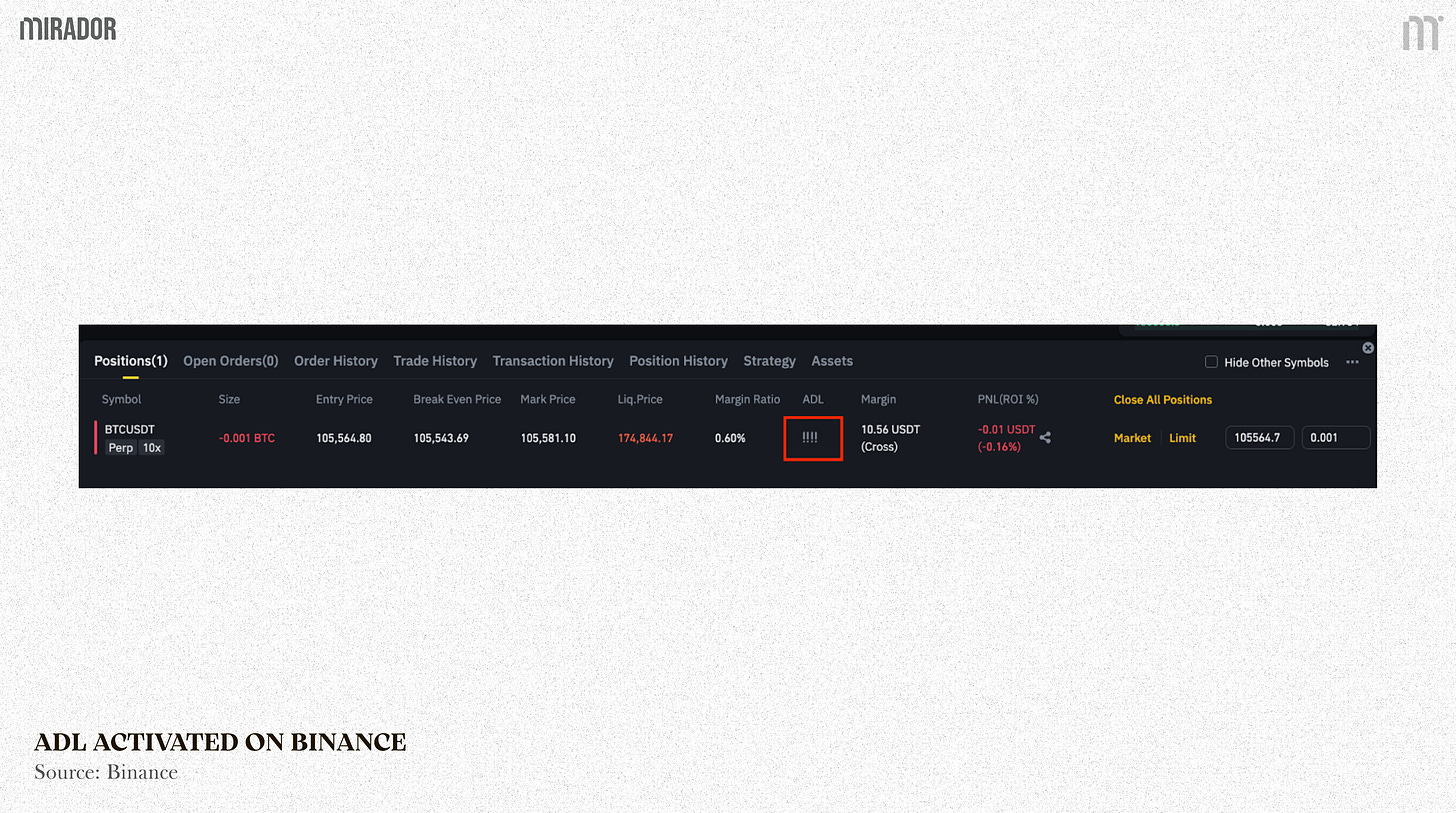

As such, forcing the winning side to close part of their position is the last choice of the platform. Amid the major crypto market crash on October 10th, 2025 (when BTC fell from $122k to $100k), the ADL was reluctantly activated to leave no bad debt on Hyperliquid.

This mechanism is considered unfair to some traders, especially those who are about to take profit but kicked out soon. However, in this case, the criticism of Hyperliquid for forcing profitable trading positions is also unfair to the platform itself, as ADL is not only applied on Hyperliquid but also on Binance and is available on other CEX/DEXs like BitMEX, Aster...

Moreover, ADL is expected to occur only in extreme scenarios - far less frequently than standard liquidation mechanisms such as market liquidations or backstop liquidations, most traders seldom experience it.

Should Hyperliquid be responsible for the ADL on 10/10?

In this 10/10 incident, what makes Binance receive less criticism is its relief campaign to appease users. After that darkest day of crypto history, Binance has announced a $300M compensation plan to support traders who suffered forced liquidations, which would be distributed through token vouchers.

On the other hand, in the event that ADL occurred, what distinguishes Hyperliquid is its emphasis on decentralization and transparency. All ADL executions and liquidated positions can be tracked directly on-chain (as shown in the picture above), allowing users and researchers to independently verify when, how, and why positions were closed. This level of auditability meaningfully differentiates Hyperliquid from centralized platforms, where ADL processes are typically opaque and handled through internal risk engines.

In short, ADL activation is basically an unavoidable trade-off to maintain the system’s solvency and the trader’s profit integrity.

CONCLUSION

In summary, some major liquidation incidents in 2025 showed that Hyperliquid’s liquidation stack operates as designed in most cases but still reveals limitations when the market experiences extreme volatility, particularly the issue of the platform’s own decentralization.

Backstop and ADL are not unique to Hyperliquid but are inherent trade-offs in all derivative platforms aimed at protecting solvency. What Hyperliquid does better is transparency: the entire liquidation and ADL flow is verifiable on-chain. The remaining question is how the platform will optimize these mechanisms to reduce tail risk and enhance fairness for both LPs and traders in the future.

Disclaimer

This article is written for analytical and educational purposes. Its primary objective is to provide readers with a clearer understanding of Hyperliquid’s liquidation architecture - including market liquidations, backstop dynamics, and ADL - and to highlight the structural trade-offs associated with these mechanisms.

The content is intended for readers interested in derivatives market design, on-chain risk systems, DeFi infrastructure, and protocol-level mechanics. Our goal is to help readers gain a more informed, technical, and nuanced perspective of how Hyperliquid’s liquidation pipeline operates under stress, where its strengths and limitations lie, and what risks traders and liquidity providers should consider.

Everything will be broken down in a simple way with clear illustrations so that anyone can follow it.