The Evolution of On-Chain Forex: Key Developments and New Perspectives Heading into Late 2025

From $9T/day FX markets to on-chain settlement: why 2026 may be the turning point for DeFi-native foreign exchange.

In April 2025, global FX markets reached a new milestone, with daily trading volumes hitting ~$9–9.6 trillion, according to the BIS. Importantly, this figure only reflects traditional market hours, not the 24/7 nature of crypto and DeFi markets.

Despite its scale, FX remains a market that is:

Highly fragmented

Largely OTC-driven

Dependent on prime brokers and balance sheets

Constrained by regional trading hours

Now consider a simple thought experiment.

If just 0.1% of global FX flows (~$9 billion/day) were to migrate on-chain:

DeFi spot and derivatives liquidity would expand dramatically

Institutional-grade strategies delta hedging, basis trading, cross-currency arbitrage would become viable on-chain for the first time

On-chain FX would move beyond experimentation and start functioning as real settlement and hedging infrastructure

This shift is particularly relevant as the USD’s role as a universal safe haven weakens, driving demand for real-time FX hedging. With 24/7 settlement, atomic execution, and transparent risk, DeFi is one of the few systems capable of absorbing this demand at scale.

Curve Finance Update: Expanding On-Chain FX Swaps

In 2025, Curve Finance made a notable step forward by introducing FXSwap pools specialized AMMs for spot FX trading between non-USD stablecoins and RWAs.

Curve’s “refuel” mechanism helps keep liquidity tightly centered around market FX rates, reducing slippage and impermanent loss for LPs, while gradually shifting FX activity from CEXs and OTC desks on-chain.

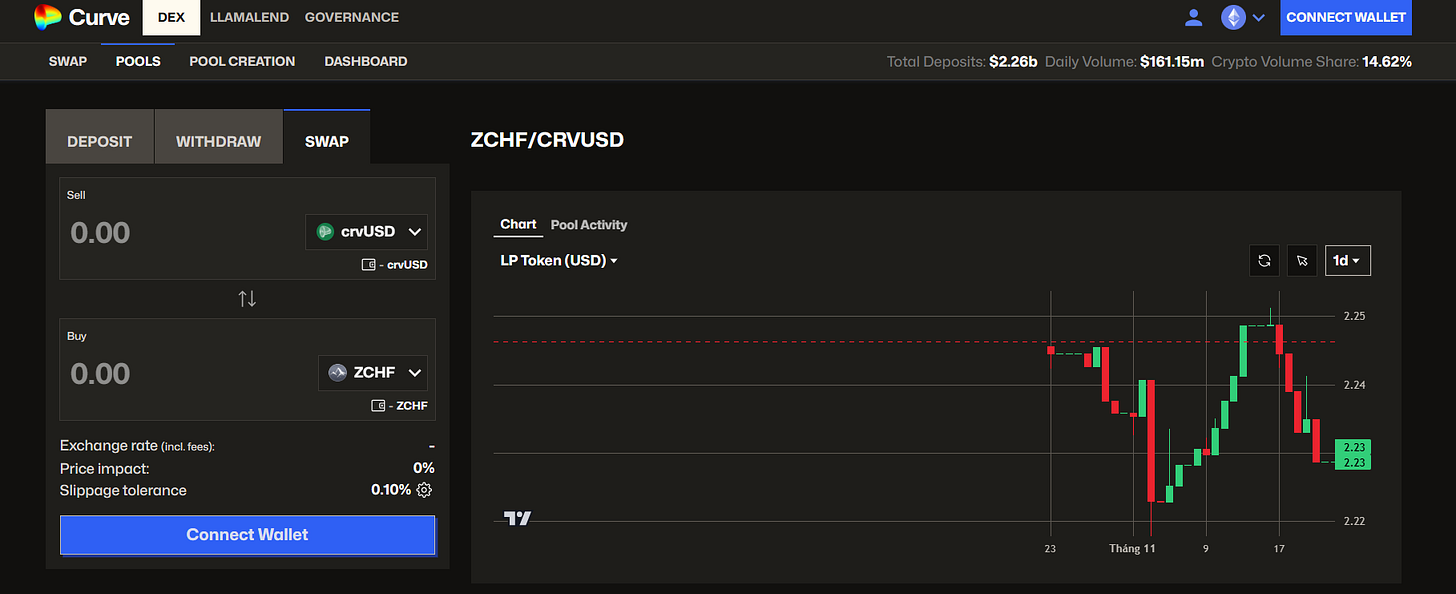

So far, Curve has deployed a single pool ZCHF/CRVUSD, a small Cryptoswap pool for Swiss franc exposure but it represents an early effort to bootstrap on-chain FX liquidity via stablecoins.

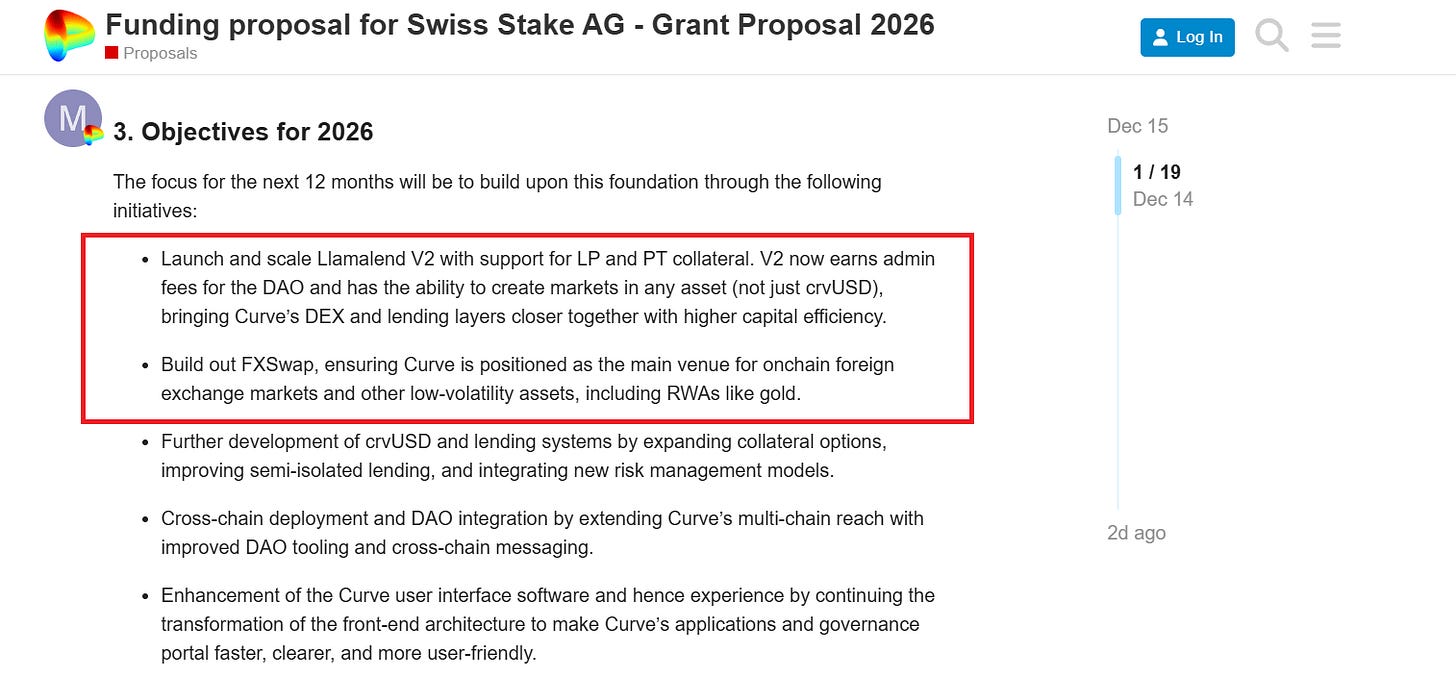

Looking ahead to 2026, Michael Egorov’s Llamalend V2 proposal aims to deeply integrate DEX and lending layers:

Support LP/PT collateral

Generate admin fees for the DAO

Enable markets for virtually any asset, not just crvUSD

This could significantly improve capital efficiency and allow users to borrow against FX positions for basic hedging.

However, Curve still lacks a critical component: native leverage and direct long/short functionality. Without leverage, Curve remains better suited for spot trading and passive hedging, rather than attracting speculative FX traders accustomed to 25x+ leverage in traditional markets.

Perpetuals XYZ on Hyperliquid HIP-3: 24/7 FX Derivatives, but Liquidity Remains the Key Challenge

While Curve focuses on spot FX, Perpetuals XYZ is pushing the derivatives frontier by building on Hyperliquid’s HIP-3 framework to enable FX perpetual futures.

Details: https://docs.perpetuals.xyz/

HIP-3 allows anyone to permissionlessly deploy new markets by staking 500,000 HYPE via auction, with:

Real-time oracle pricing

Up to 50x leverage

CEX-like performance with 24/7 trading

Currently on testnet, Perpetuals XYZ supports major FX pairs like EUR/USD and USD/JPY, helping test liquidity depth and funding dynamics ahead of mainnet.

The open question remains:

Can early liquidity especially for exotic FX pairs be deep enough to prevent excessive slippage and cascading liquidations during periods of high volatility?

The Open Question: Will 2026 Be the Breakout Year for On-Chain FX?

With advancements from both Curve (spot FX) and Perpetuals XYZ (FX derivatives), on-chain FX is beginning to take shape as a hybrid ecosystem spanning trading, lending, and hedging.

But can these protocols overcome:

Legacy FX dependencies

Liquidity bootstrapping challenges

Cross-border regulatory friction

To attract even 0.1% of global FX flows?

Or will the space still need a more radical DeFi-native breakthrough to transform FX into true on-chain financial infrastructure?

One thing is clear: 2026 will be a pivotal year for on-chain FX.