The Real Forces Behind China’s $1 Trillion Annual Trade

How China Built a $1 Trillion Trade Surplus in the Middle of a Trade War?

The Real Forces Behind China’s $1 Trillion Annual Trade

China just crossed one of the biggest milestones in global trade history: a USD 1.08 trillion trade surplus in the first 11 months of 2025, beating the entire 2024 figure and breaking the trillion-dollar line for the first time ever.

This happened in the middle of a trade war, with exports to the U.S. collapsing –28.6% YoY in November.

So the real question isn’t what China achieved, but how it happened.

Here are the real forces behind the scene.

1. China rerouted global trade faster than U.S. tariffs could bite

Shipments to the U.S. fell hard: eight straight months of double-digit drops. But China compensated with almost surgical speed:

EU: +14.8%

ASEAN: +8.2%

Africa / South Asia: double-digit growth

Total exports (Nov 2025): +5.9% vs. forecast +3.8%

BRI-linked factories outside China helped bypass Trump tariffs, while trade pacts with EU/ASEAN kept demand flowing. Export growth ended up contributing one-third of GDP expansion in 2025.

It was the result of rapid market reallocation.

2. Weak imports amplified the surplus

From January to November 2025, China’s external performance followed a clear pattern: exports kept rising, imports stayed weak, and the surplus widened month after month.

Exports: ~USD 3.62 trillion (+5.4% YoY)

Imports: ~USD 2.54 trillion (–0.6% YoY)

Trade Surplus: USD 1.08 trillion (+21.7% YoY)

Domestic demand stayed soft. The property slump dragged down raw-material imports (timber –15.5%, steel –11.7%), and “Made in China 2025” reduced reliance on foreign intermediate goods.

Lower imports means wider surplus. Simple mechanics but massive impact.

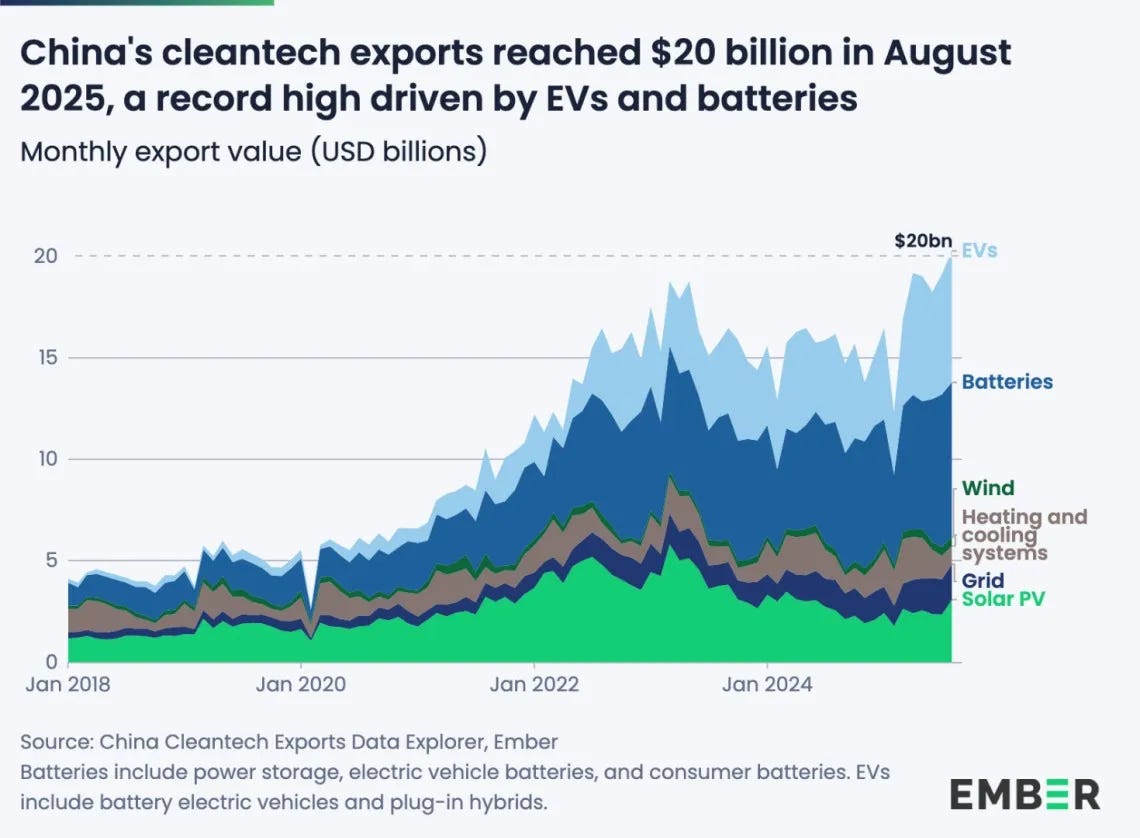

3. China’s industrial upgrade is hitting full stride

Competitive pricing is one thing. Competitive pricing plus upgraded tech is another.

2025 saw:

EV exports: +16.7%

Batteries / clean-energy components: +20%+

Robotics & high-tech manufacturing: +25%

Competitors in Indonesia & South Africa cutting output due to China’s cost advantage

Add global demand recovery + front-loading before tariffs, making export momentum stay strong even under pressure.

China is now competing on both scale and technological depth.

4. Policy Support: Targeted, Timed, and Surprisingly Effective

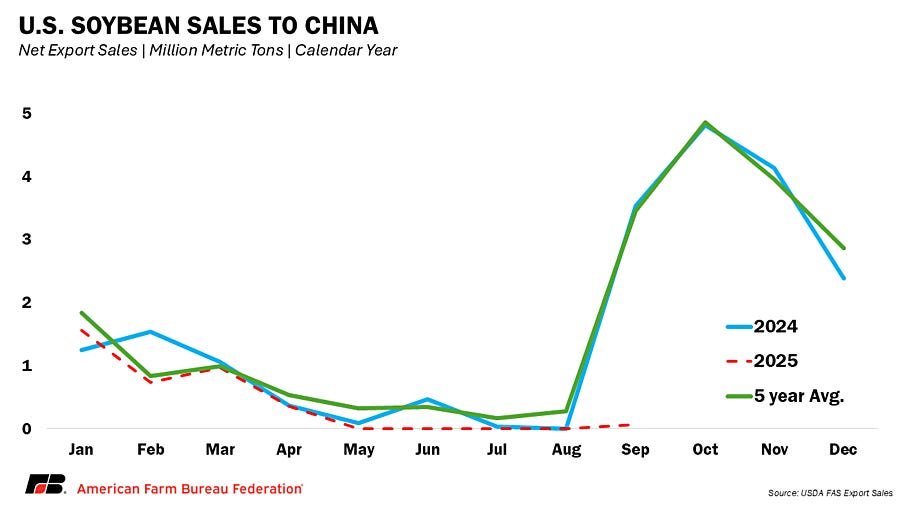

Despite U.S. tariffs rising to 34%, China kept its bilateral surplus elevated largely by cutting U.S. imports, especially soybeans.

The temporary Trump–Xi “cooling agreement” in October eased short-term pressure, but the real momentum came from domestic measures:

Targeted tech subsidies (over 400 billion RMB for AI and semiconductors)

Export incentives that lifted shipments to the EU and ASEAN by 14.8% and 8.2% in November

Faster customs processing that cut clearance times from 48 to 24 hours

Capacity expansion in strategic sectors like EVs, batteries, and renewables.

As a result, Q2 2025 GDP grew 5.2%, showing the trade war did not knock Beijing’s growth engine off its track.

Final

This milestone was never an economic miracle, it was the product of years of adjustment, discipline, and quiet recalibration.

But as 2025 draws to a close and 2026 arrives with sharper headwinds, the real test is whether the world lets it happen again?