WHY HYPERLIQUID CHOSE USDC: DESIGN RATIONALE, TRADE-OFFS AND FUTURE PATHS

The reasons behind USDC’s dominance on Hyperliquid DEX, together with associated risk factors and design considerations for reducing reliance on a single stablecoin.

INTRODUCTION

If you’ve ever used Hyperliquid or other decentralized exchanges (DEXs) such as dYdX, GMX, you may notice that most trading pairs are primarily quoted in USDC on these platforms. Hyperliquid also relies heavily on USDC as collateral for both trading and staking as reflected in the metric below.

Why is this the case? Why not USDT, the largest stablecoin in the entire crypto market?

In this article, we will examine the reasons behind this trend, discuss the potential risks that Hyperliquid may face as a result, and whether Hyperliquid can reduce its high dependency on USDC in the future.

KEY TAKEAWAYS

This article will explain in detail why Hyperliquid DEX chose USDC as its primary quote asset and collateral, via the following main sections

Section 1: Explore why Hyperliquid mainly uses USDC as the quote asset and collateral but not USDT – the largest stablecoin in the crypto world

Section 2: The most critical risk that USDC holds, which can pose a threat to Hyperliquid, in reality

Section 3: Examine whether Hyperliquid can reduce its dependency on USDC through the launch of its native stablecoin (USDH)

BEFORE WE BEGIN

1/ Why Hyperliquid Doesn’t Use ETH Or BTC As The Quote Assets?

Definitely because perps require a collateral of high price stability.

ETH, BTC or other non-stable tokens are widely known with a high volatility, which shouldn’t be used as collateral or quote assets. Therefore, perps DEXs prefer safer quote assets, and stablecoin (like USDC or USDT) is the most suitable option.

2/ USDC & USDT Background

USDC (USD Coin) was launched in 2018 by Circle, a US publicly listed company. As widely known, fiat-backed stablecoin like USDC is redeemable 1:1 for US dollars. If you want 1 USDC, you need to give Circle 1 US dollar, then 1 USDC will be minted and given to you, and vice versa. Currently, this is the second-largest stablecoin with the circulating supply of over $70B.

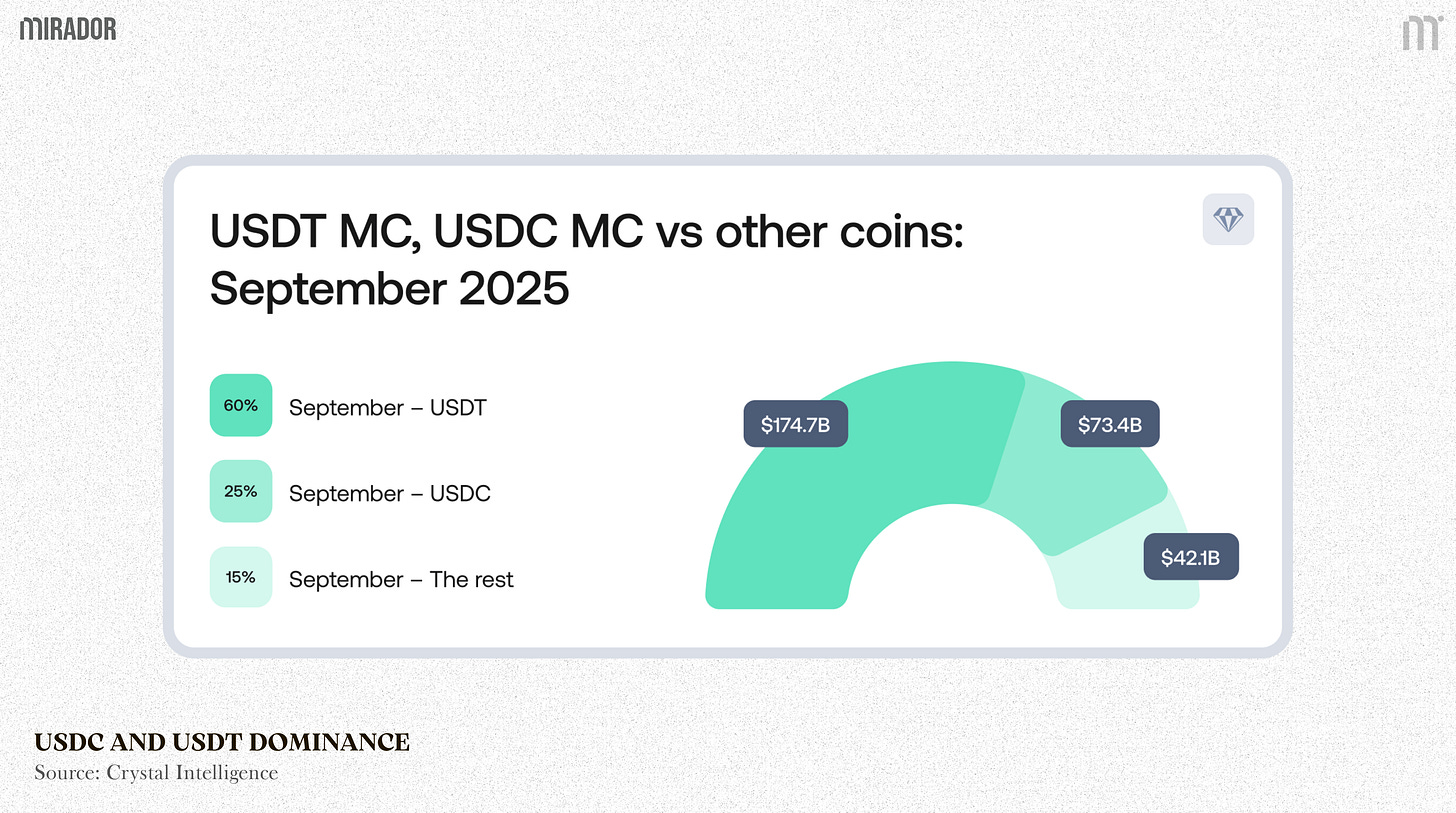

Meanwhile, USDT (Tether USD) was launched in 2014 by Tether, a fin-tech company headquartered in El Salvador. This is the pioneer in the concept of fiat-backed digital currency pegged 1:1 to traditional one (initially the US dollar). USDT is the largest stablecoin with the circulating supply of over $170B, more than twice that of USDC.

SECTION 1: WHY HYPERLIQUID MAINLY USES USDC AS THE QUOTE ASSET AND COLLATERAL BUT NOT USDT?

There are several reasons behind the decision to choose USDC as the quote asset for most trading pairs, as well as collateral on Hyperliquid and other DEXs. And transparency is the first and foremost factor. Why?

A historical failure like Terra-Luna ($TerraUSD depegging event) demonstrate that even sophisticated token mechanics cannot compensate for a lack of transparency in its reserve structures. The missing of $3.5B in its reserves which were supposed to back the cryptocurrency not only seriously affected related investors but has also shaken confidence in the crypto market as a whole.

Therefore, it is important for e-money issuers to prove their transparency and accountability in order to prevent similar incidents in the future.

1/ Transparency (Main)

A collateral or quote asset must be capable of proving itself to be highly, or more precisely, absolutely stable.

The core problem is not that Hyperliquid itself needs a highly stable asset, but that its participants - traders, LPs, and market makers - do. If the quote asset loses its peg, their positions can quickly become eligible for liquidation. As a rational response, LPs would withdraw liquidity, leading to deteriorating orderbook depth and higher slippage. Ultimately, such a scenario could cripple liquidity and confidence, destabilizing the entire platform.

That’s why a fiat-backed stablecoin must be proven with high transparency to secure trust for both the protocols and users. And in this game, USDC appears to do it better.

The transparency is reflected via two major factors: reserve backing and regulatory compliance.

1.1/Reserve Backing

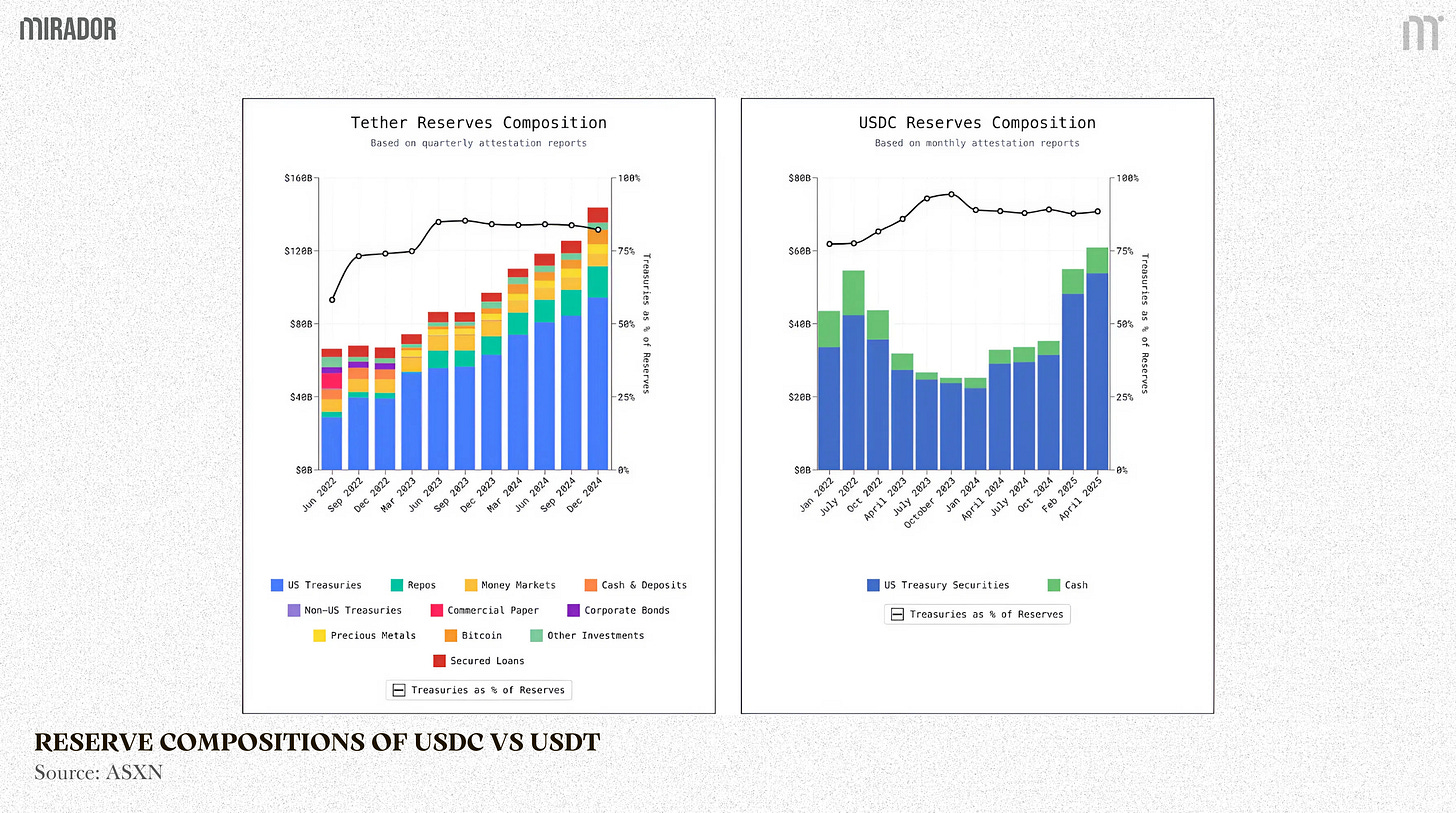

USDC’s reserve structure is simpler and more transparent because it is almost entirely backed by cash and short-term US Treasuries (main) - two of the most liquid and lowest-risk assets available.

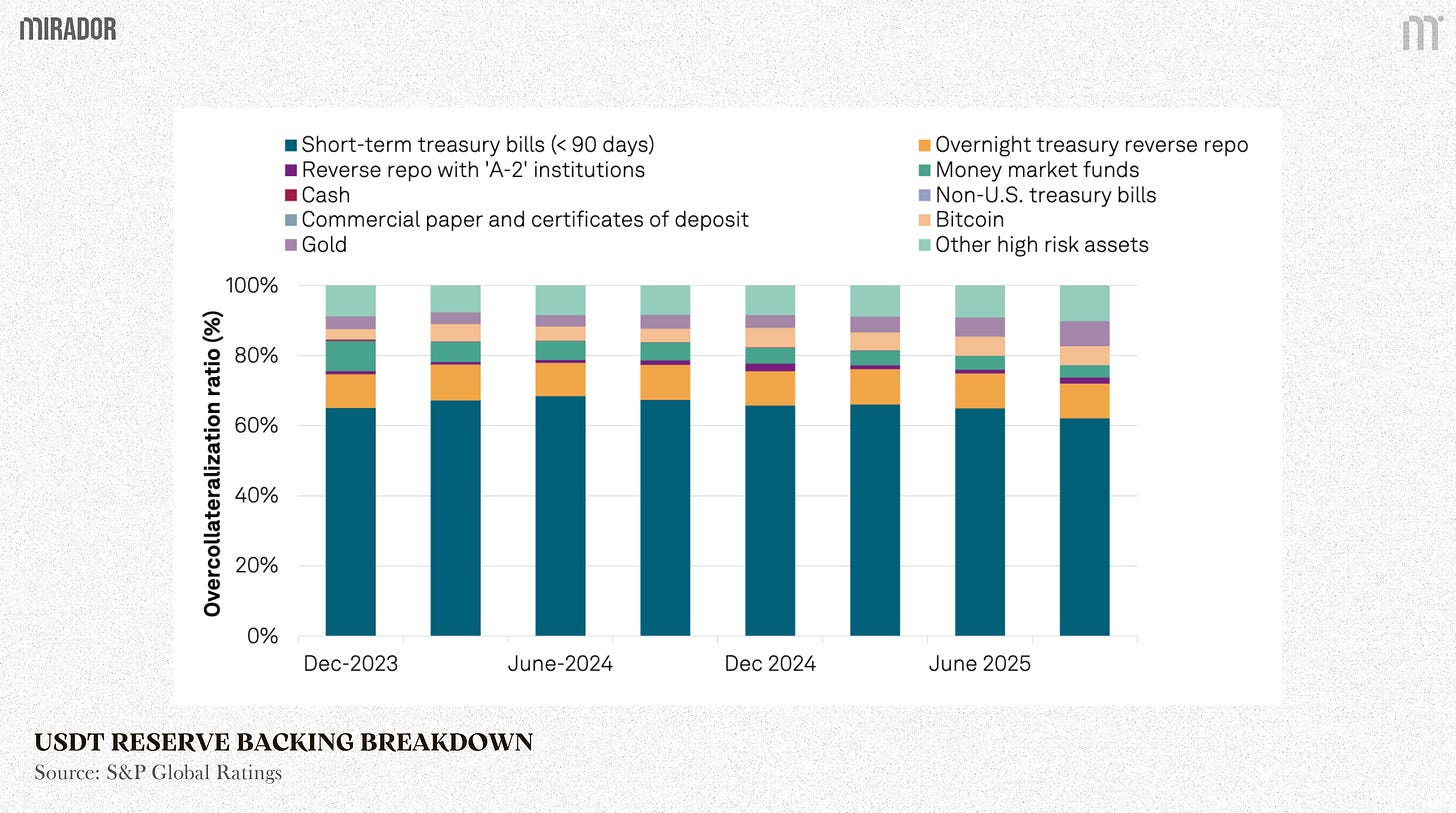

Meanwhile, USDT is backed by more sources, including short-term US Treasuries (main), cash, and other financial products like Bitcoin, corporate bonds, commercial paper, etc as in the picture above. A broader mix does not automatically mean higher risk, but in USDT’s case, the quality, liquidity, and transparency of some asset classes were significantly lower.

According to S&P, Bitcoin accounts for 5.6% of all USDT in circulation, which surpasses the 3.9% reserve implied by Tether’s reported collateral ratio of 103.9%. Because these assets are more volatile than cash or treasuries, a sharp decline could potentially undermine their collateral value.

Therefore, the market perceives USDT as having higher risk not because it has more types of collateral, but because parts of its collateral are less transparent, less liquid, and more volatile compared to USDC’s reserves.

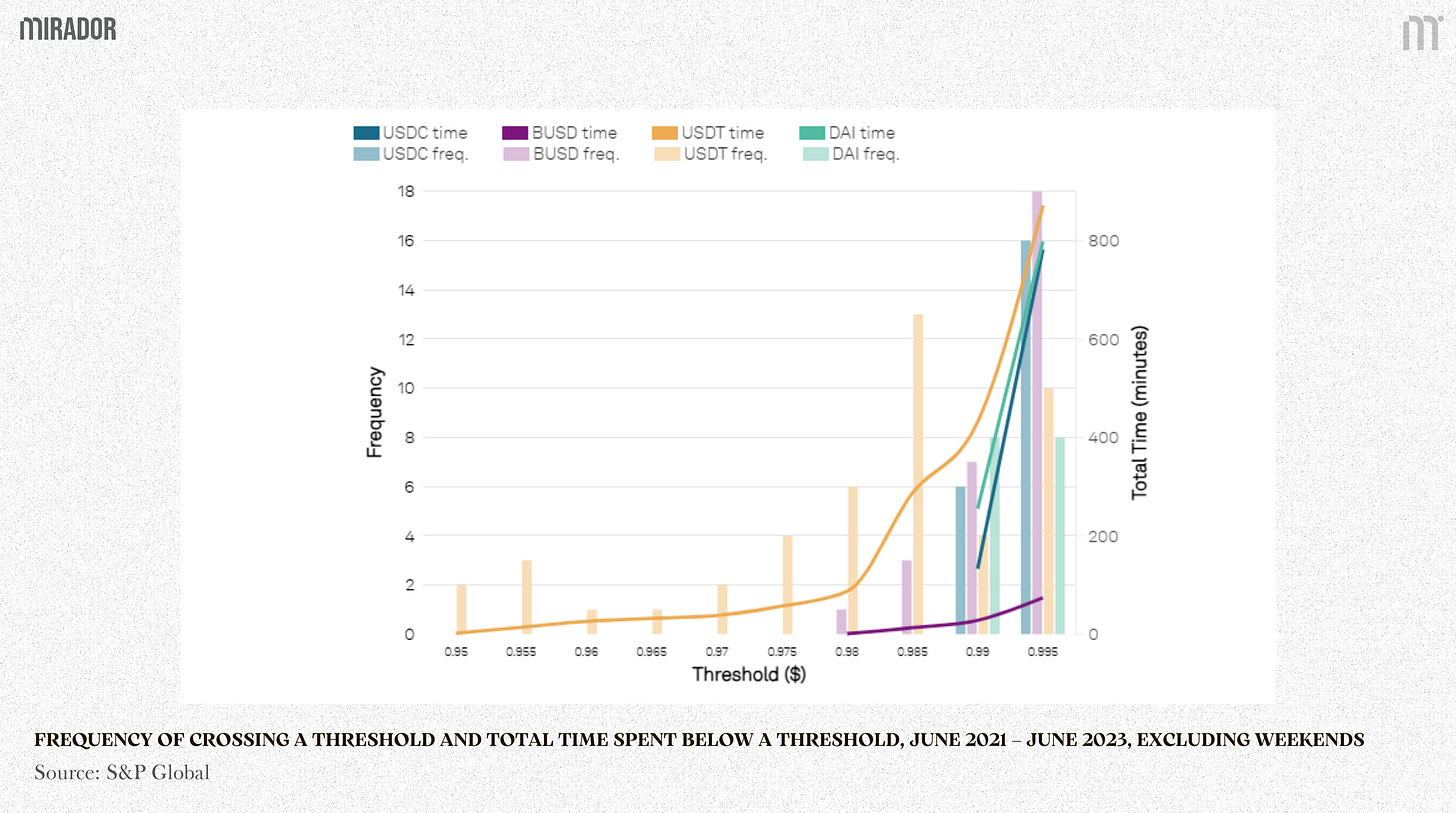

Also, as shown in the S&P Global’s analysis, in the normal condition of market on the weekdays, USDT showed a slightly higher depegging frequency and magnitude than USDC the 24-month data through mid-2023. The increasing holding of high-risk assets is also one of the reasons for this volatility.

1.2/ Regulatory Compliance

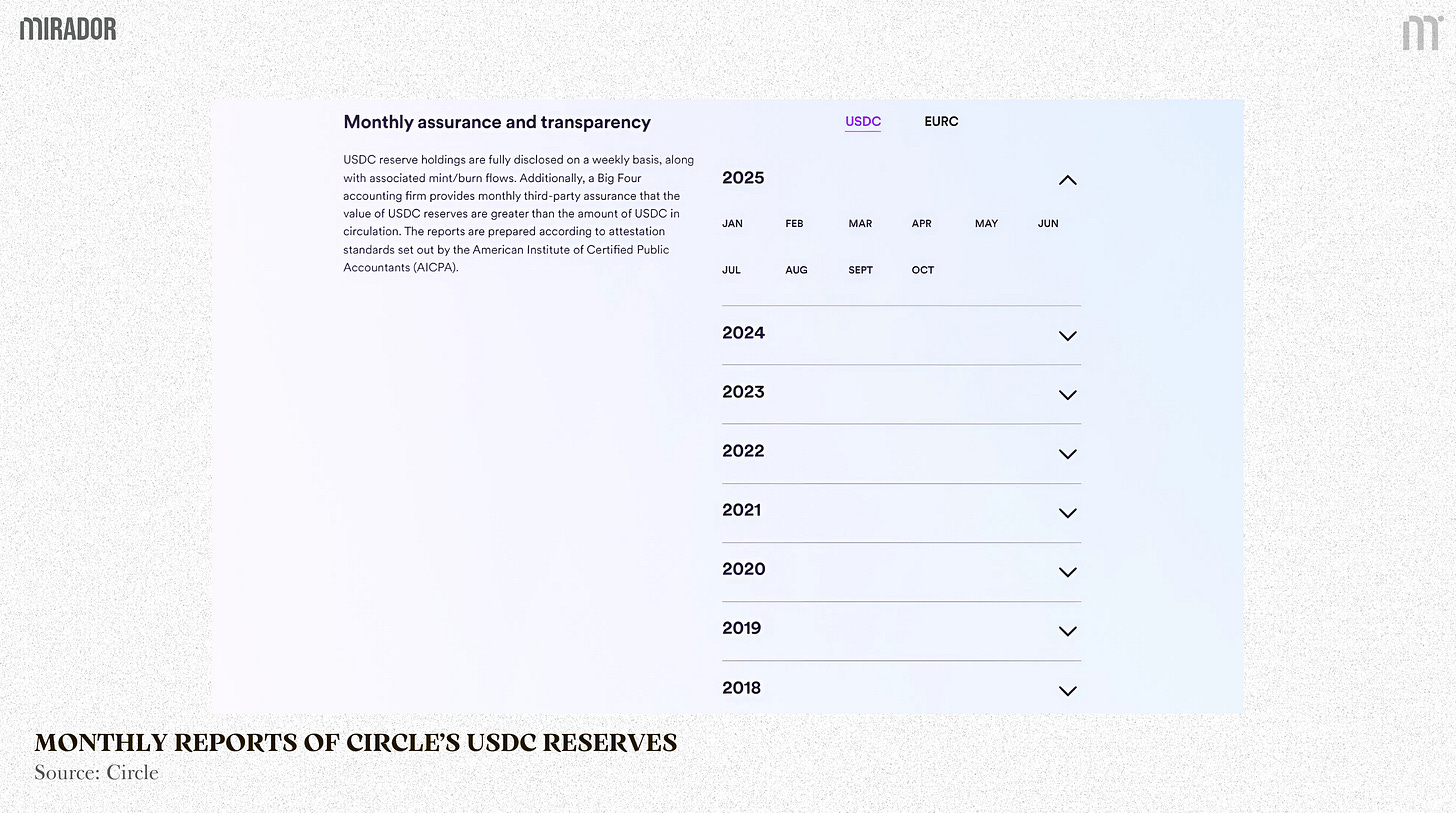

Circle is widely known as a regulation-first company. Registered and operating under the financial regulatory framework of the US, Circle has been publishing audits per month to prove that their reserves are always sufficient to fully back USDC. Currently, these attestations are being performed by Deloitte, the largest Big Four accounting firm in the world.

About Tether, operating in El Salvador - a regulatory environment that differs from US and EU frameworks – leads to fewer mandatory disclosure and reporting obligations than regulated stablecoin issuers like Circle. Despite being launched in 2014, Tether has long faced skepticism due to the lack of sufficient financial attestations regarding its reserves.

To address these concerns, Tether has begun publishing its Reserves reports since 2017 and quarterly since 2021, but the reporting frequency remains lower than Circle’s, and so far, Tether has not yet completed a full audit of its reserves, in fact.

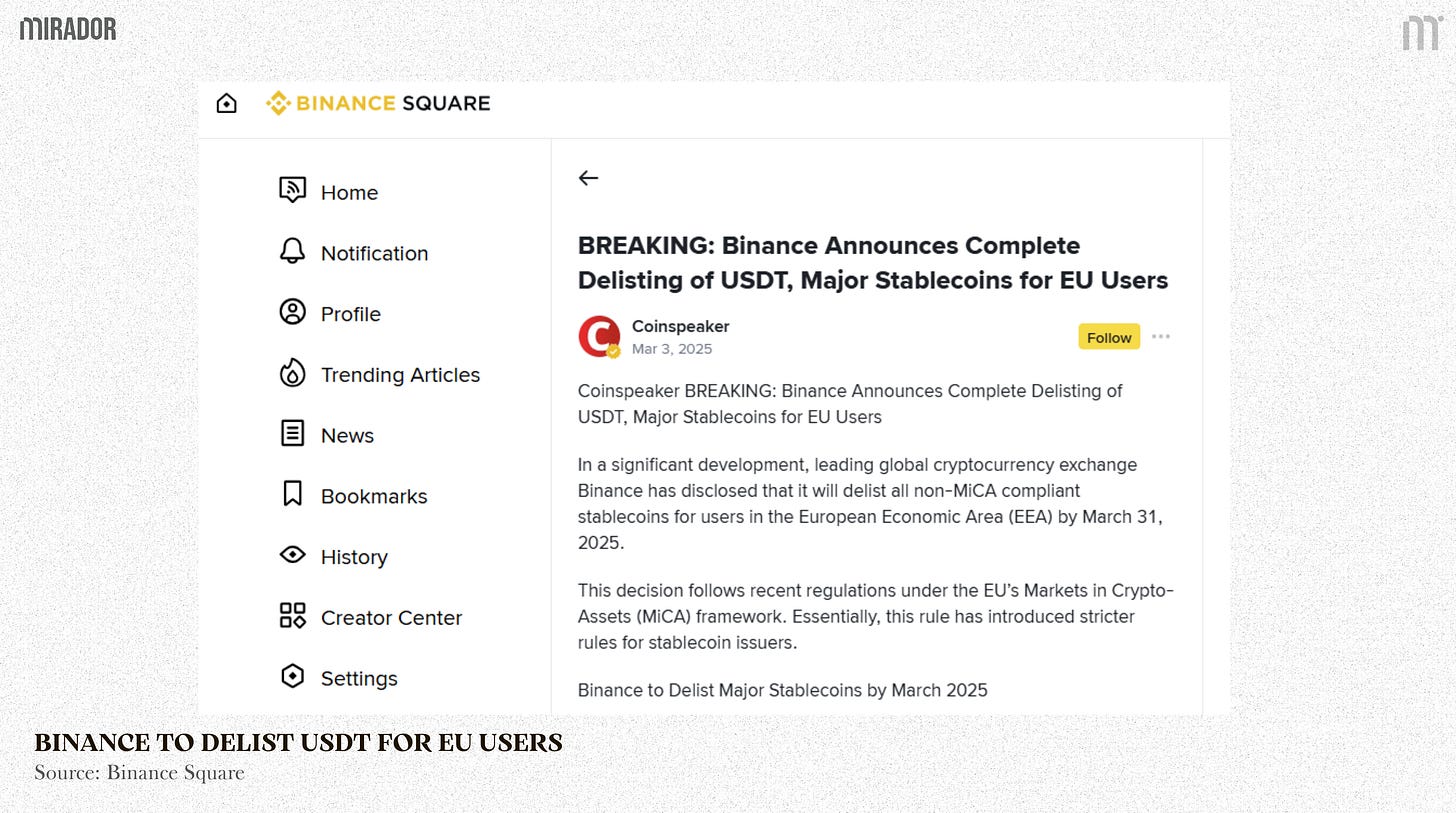

In the past, this was also one of the reasons why USDT failed to meet several requirements for E-money tokens under the European Union’s Markets in Crypto-Assets Regulation (MiCA) framework, including reserve composition, redemption rights, and regulatory supervision within the EU. As such, exchanges in Europe had to delist USDT, effectively limiting its use within certain European markets. Even Binance, Kraken and Crypto.com planned to delist USDT in the EU market.

The delisting means EU users can’t trade USDT anymore. Though the EU region represents a relatively small volume of USDT trading, regulatory compliance is important for a stablecoin to prove their transparency and get wider adoption. If e-money law like this applied in the Asia, where USDT accounts for 45% of global volume, this would impact Tether’s and users’ overall business.

On the other hand, USDC is MiCA compliant and continues to improve its credibility among users and regulators.

Hyperliquid is a DEX; they may not need to care about these complex laws, but their users can. From a risk management perspective, regulatory compliance helps mitigate the uncertainty about reserve treatment and information disclosure frequency. For large-scale LPs and market makers, these factors determine whether a stablecoin is accepted as collateral and affect how risk assumptions are designed when using it as margin, regardless of on CEXs or DEXs.

Hence, from a legal standpoint, Circle manages to prove its transparency and accountability, whereas Tether remains rather opaque.

In addition to the transparency, another factor to consider is the USDC adoption rate in DeFi (network effect).

2/ Network Effect: USDC Adoption in DeFi

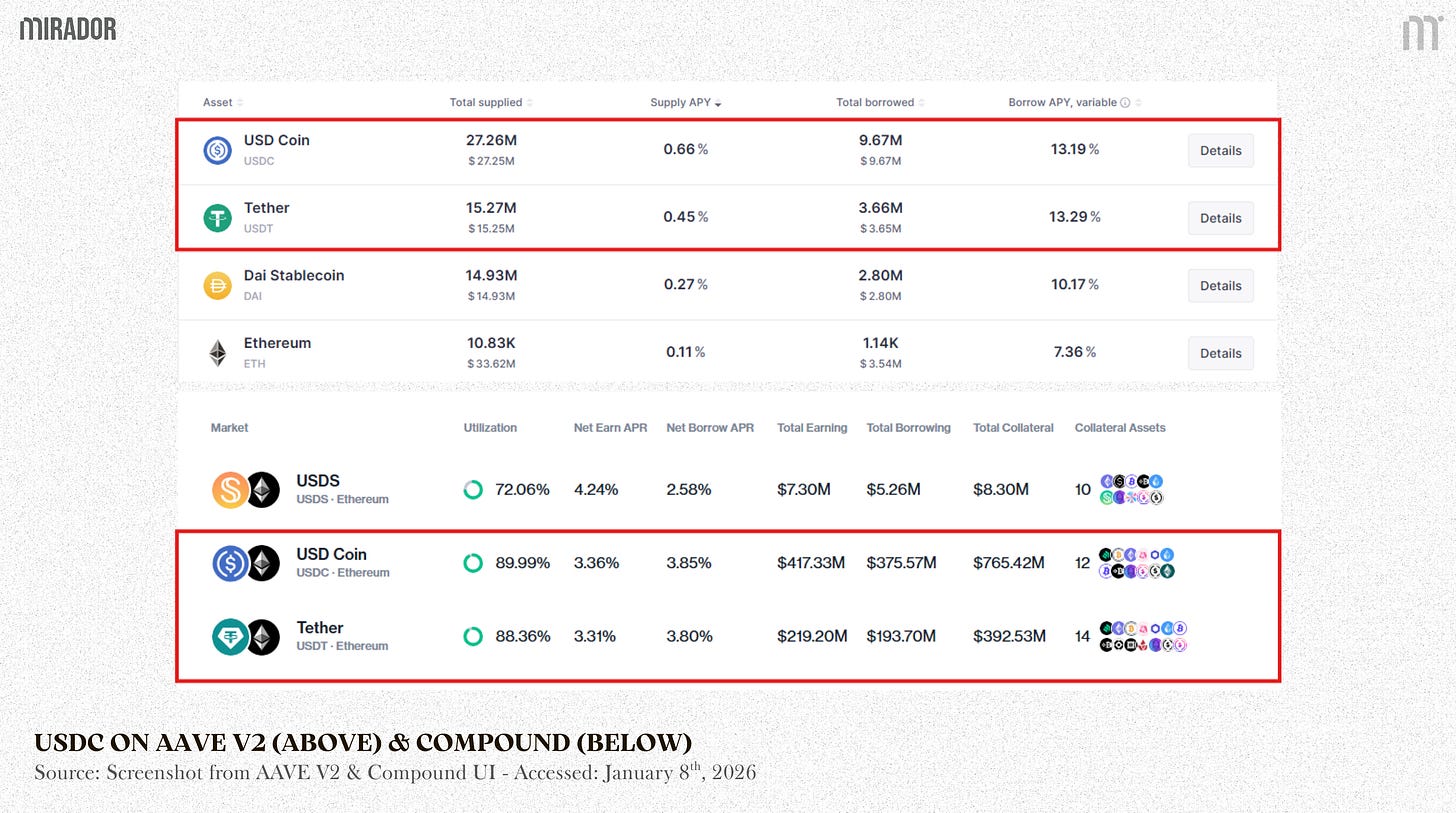

Since 2020, the heart of DeFi summer, USDC has appeared more frequently on DeFi protocols like AAVE or Compound (the most deposited and borrowed stablecoin) and offered greater APR for LPs. USDC was considered the leading stablecoin for collateralization demands, even surpassing USDT and DAI.

When it comes to Hyperliquid or other DEXs, USDC continues to become the main character in their DeFi game. AAVE and Compound prioritizes USDC, GMX and dYdX also opts for USDC, and so does Hyperliquid. It’s just a network effect because every protocol must be optimized for large liquidity ecosystems.

IF USDC IS SUCH TRANSPARENT, WHY CEXS PREFER USDT?

It’s easy to notice a clear pattern in the market: DEXs tend to prefer USDC, while CEXs lean heavily toward USDT. Even though USDC is generally viewed as more transparent and MiCA-compliant, major CEXs like Binance and Bybit still favor listing trading pairs quoted in USDT rather than USDC.

According to Cryptorank, Binance’s spot market features more than 400 USDT-quoted pairs - roughly double the number of USDC pairs. Similarly, on Bybit, nearly 500 spot trading pairs use USDT as the quote asset, while USDC-quoted pairs remain relatively limited at around 100.

Why is this the case?

To answer this question, we need to look back at history.

USDT (2014) has a longer history, born earlier than USDC (2018). CEXs were also born earlier than DEXs. Since the initial launch, USDT has partnered with many pioneer CEXs in the world like Bitfinex to expand their influence and adoption. Time passes by, users on CEXs are accustomed to trading USDT, especially via OTC or P2P mechanism.

And so, gradually, USDT becomes a fiat-backed stablecoin with a higher liquidity and market share.

To be specific, USDT’s total supply is roughly double that of USDC, giving it over 60% of the entire stablecoin market. CEXs prefer USDT since its global liquidity is the biggest, which is important to maintain a rich order book and support high trading volume.

So, with the first-mover advantage, USDT remains the preferred choice of CEXs to this day.

SECTION 2: IS USDC STILL THE BEST CHOICE?

However, with all these above advantages, USDC also comes with a certain potential risk that could affect the performance of Hyperliquid and other DEXs. The most critical risk is related to depegging.

Depegging risk

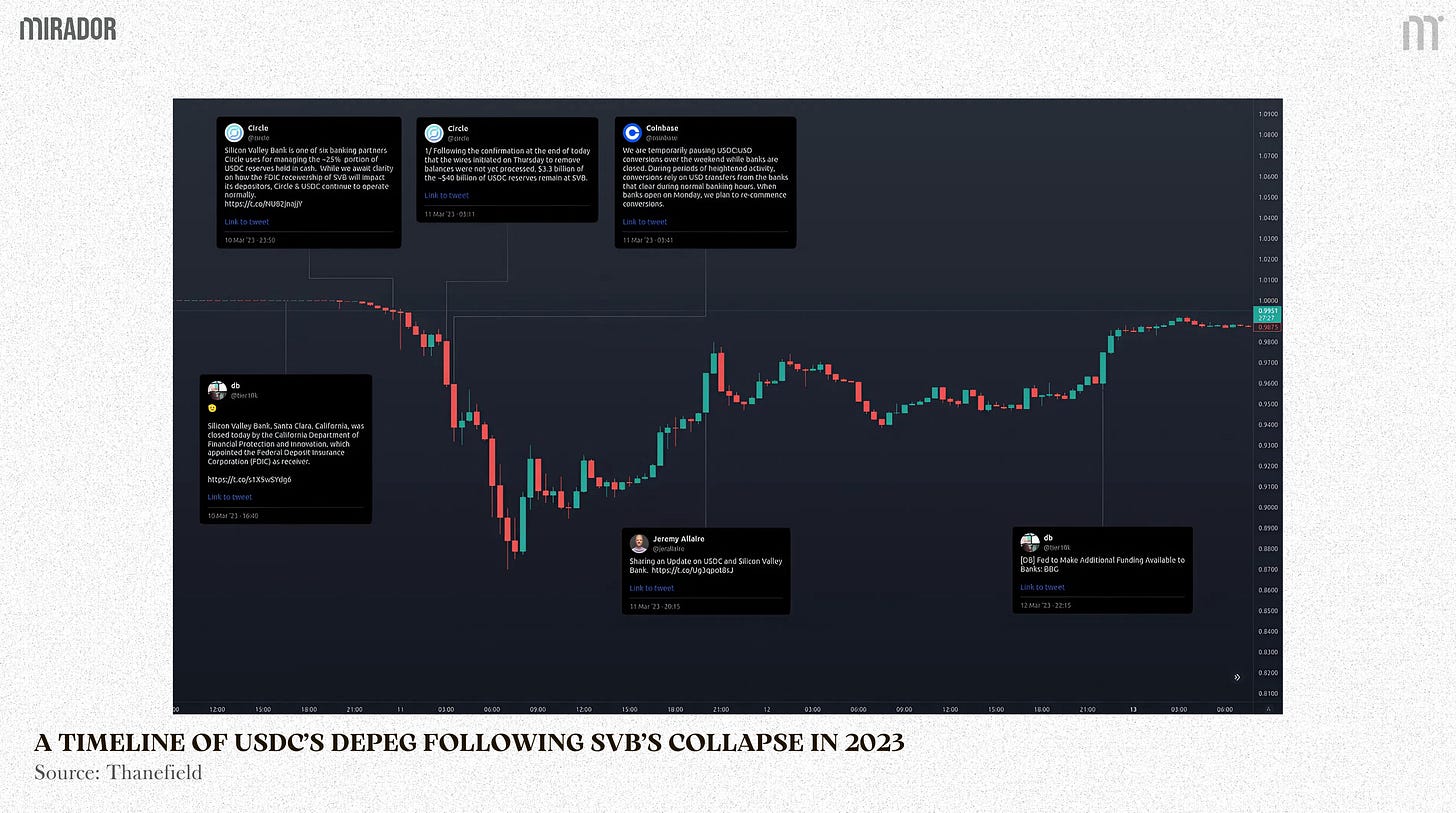

Deviating significantly from the pegged value is what people in the crypto world fear most when it comes to stablecoin. In the past, USDC used to be depegged and drop to $0.87 in 2023.

The collapse of Silicon Valley Bank (SVB) is the largest bank failure in the US since the global financial crisis in 2008. Prior to this incident, Circle had a portion of its reserve kept in SVB, accounting for about $3.3B. On March 10th, 2023, SVB was suddenly closed and the news that Circle deposits were temporarily stuck and could not be withdrawn spread widely in the crypto world. At once, investors withdrew their USDC’s holdings, transferring to USDT or fiat currency, causing the price of USDC on most exchanges bottom at $0.87 (~13%), recording a severe depegging event of a stablecoin.

Fortunately, on March 12th, US Treasury Department announced that all SVB deposits will be 100% protected, and provide assurances for Circle. It means that $3.3B deposit of Circle could be refunded. This announcement immediately saved USDC and made it bounce back to the pegged value.

Despite being trusted for its transparency and strong compliance standards, USDC still experienced a depegging event, a serious one indeed.

Also, if we look at the price levels of these two stablecoins in 2 years since June 2021, it shows that USDT is more stable than USDC in terms of overall volatility range. USDT often deviates by about 0.05% from its threshold, while USDC, in reality, once faced the most severe depegging event caused by the SVB collapse.

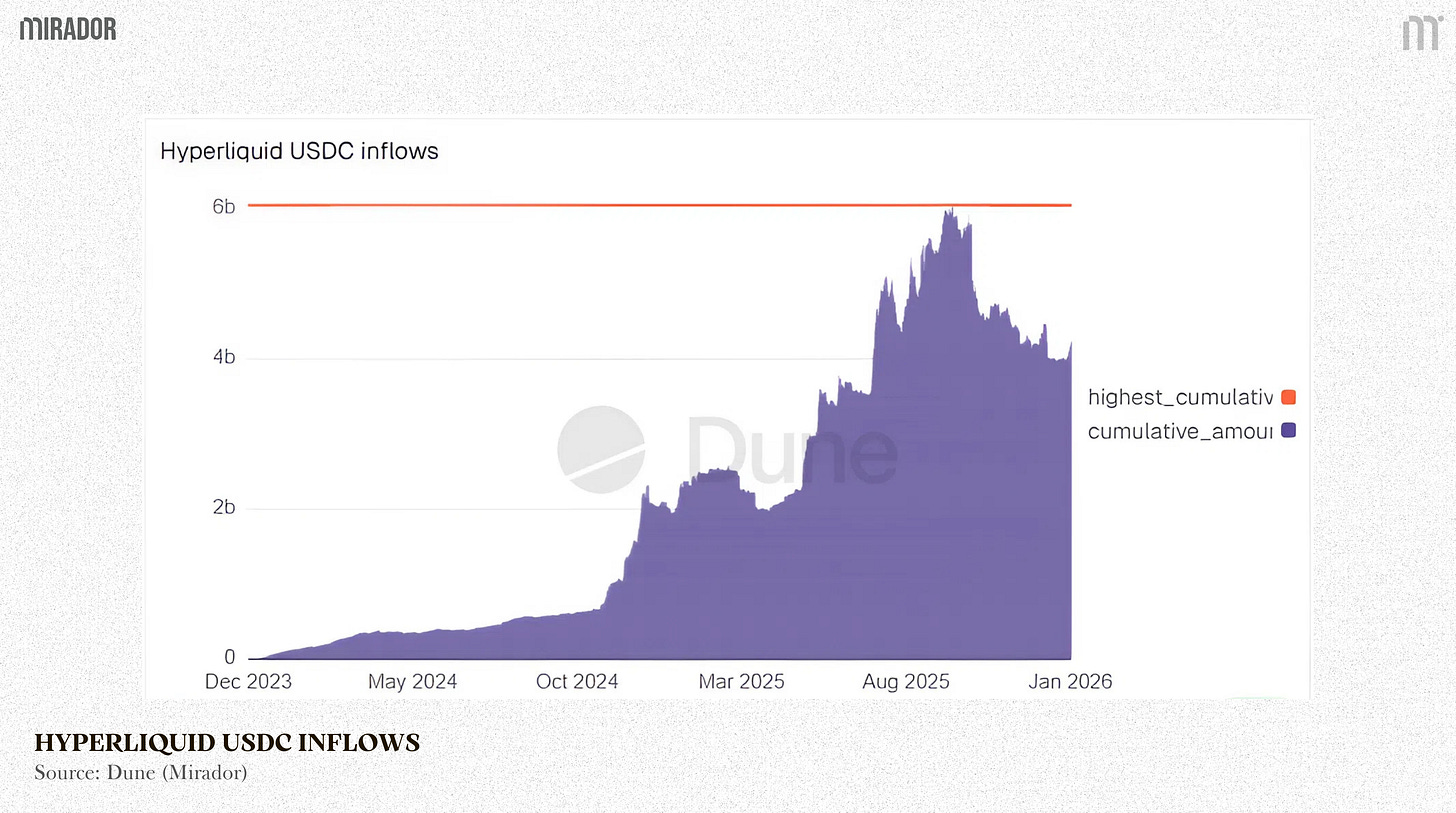

As can be seen in the picture above, Hyperliquid’s inflow of USDC (via Arbitrum bridge only - also the main network on Hyperliquid) has been increasing rapidly from its initial launch despite some ups and downs, notably with the peak of about $6B in September 2025.

If such a depegging event were to recur, it would have a substantial impact on Hyperliquid.

Overall, this incident raised concerns about the stability of stablecoins in general and USDC in particular, as well as requires certain approaches from DEXs.

SECTION 3: CAN HYPERLIQUID REDUCE ITS DEPENDENCY ON USDC?

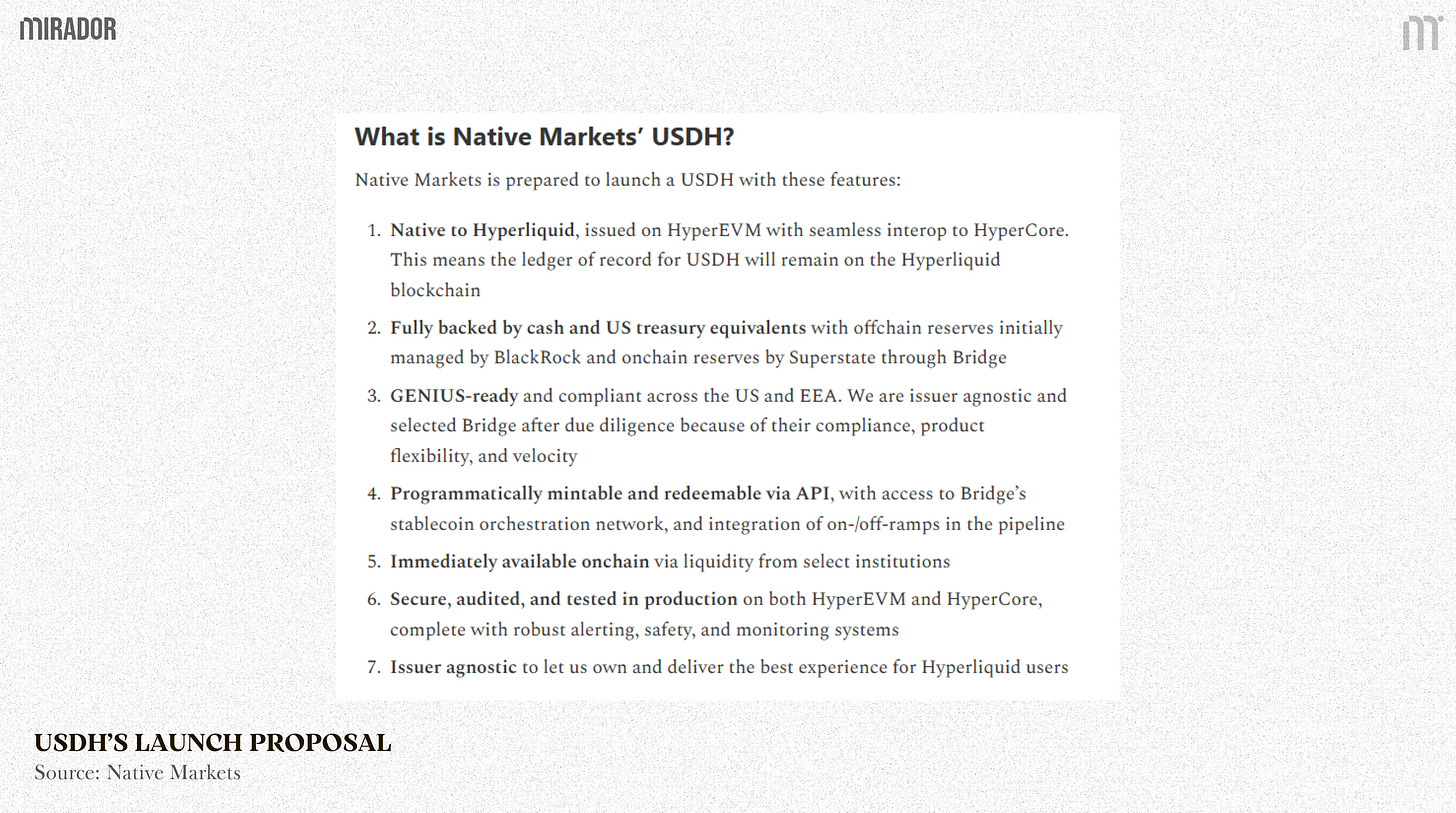

With its ambition to become the “House of All Finance,” Hyperliquid has been steadily rolling out new pillars of this ecosystem, including lending, yield products, staking, bridging, and most recently, its native stablecoin (USDH) launched in September 2025. This stablecoin’s introduction also serves as a strategic hedge against the depegging risk of USDC, which accounts for 95% stablecoin deposits on this platform.

USDH is also a fiat-backed stablecoin but issued on HyperEVM. Similar to USDC, this native stablecoin is fully backed by cash and US Treasury equivalents. Unlike USDC whose yield flow goes to its issuer (Circle), USDH directs 50% of earnings to $HYPE buybacks and 50% to ecosystem development funds.

Since the launch of USDH, the dominance of USDC on HyperEVM has significantly declined. At its peak in the beginning of December 2025, USDH supply ($60M) ranked second with nearly 18%. However, this number soon decreased to about 8%, leaving USDC as the dominant stablecoin over HyperEVM, currently holding over 55%.

Note: This figure only considers stablecoin supply on HyperEVM as USDH is launched on HyperEVM. Meanwhile, the amount of USDC ($4B) still lies on HyperCore Arbitrum bridge now.

Moreover, in the medium term, the dominance of USDC on HyperEVM is predicted to increase further in the future as more and more USDC on HyperCore is being bridged to HyperEVM due to the link between them. But in the long term, USDH still shows positive prospects for wider adoption as we look at the increasing USDH HyperEVM supply in the metric below.

In general, as just launched recently, the stability and transparency of this token still need more time to test. Hyperliquid still needs a long time to prove the security of its native stablecoin in order to gain wider adoption and reduce its dependence on USDC.

CONCLUSION

To sum up, DEXs like Hyperliquid prefer USDC as collateral and quote asset for trading pairs because of its greater transparency and stronger regulatory compliance compared to USDT. Additionally, due to a network-effect dynamic, Hyperliquid continues to adopt USDC as its primary stablecoin after early DeFi partners helped establish it as the standard.

However, the past depegging event revealed that USDC is not entirely risk-free for DEXs to rely on. Hyperliquid’s native stablecoin, USDH, was introduced to reduce this dependency, but it will still require time and real-world stress-testing before proving its resilience.

Disclaimer

This article is an independent educational analysis of stablecoin selection on decentralized exchanges, with a focus on why protocols like Hyperliquid currently prefer USDC over USDT as a quote asset and collateral. Our goal is to help readers understand the underlying design considerations - including transparency and network effect - and from there, form their own view on the trade-offs in stablecoin selection.

All concepts will be explained clearly and understandably, without requiring in-depth knowledge of stablecoin mechanics or exchange infrastructure.